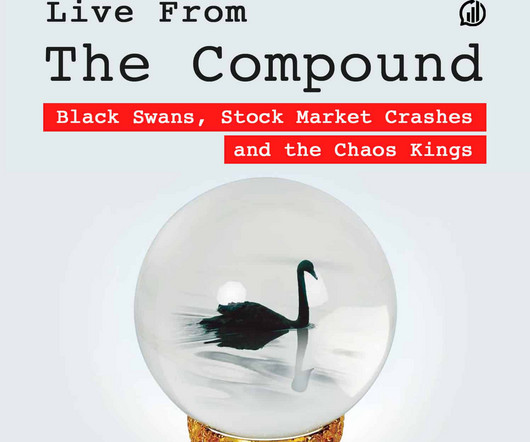

Black Swans, Stock Market Crashes and the Chaos Kings

The Reformed Broker

JUNE 5, 2023

On this special episode of Live from The Compound, Scott Patterson, Financial Journalist and Wall Street Journal Reporter, joins Michael Batnick and Josh Brown to discuss Scott’s new book, Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis. Follow Scott on: Twitter Book. The post Black Swans, Stock Market Crashes and the Chaos Kings appeared first on The Reformed Broker.

Let's personalize your content