The Great Wealth Treadmill

Wealth Management

JULY 11, 2024

What is horizontal wealth transfer?

Calculated Risk

JULY 11, 2024

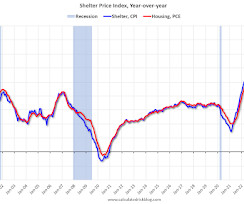

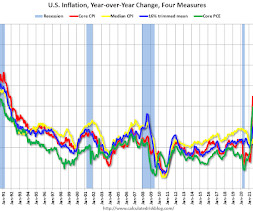

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 4.8% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through May 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 11, 2024

FINRA accused D. Allen Blankenship of unsuitable mutual fund trading. Still, the broker is looking to SEC v. Jarkesy and claiming the disciplinary proceedings violate his right to a jury trial.

Abnormal Returns

JULY 11, 2024

Defense How Russia has adapted to Western weapons in Ukraine. (wsj.com) Advances in drone warfare has happened outside the purview of the defense giants. (on.ft.com) GPS is increasingly under attack. (nytimes.com) Gambling Stock trading continues to migrate onto smartphones and apps. (bloomberg.com) Smartphones and ubiquitous gambling go hand-in-hand.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 11, 2024

Rock House Financial, which works with business owners, women and social media influencers, manages $272 million in assets.

Abnormal Returns

JULY 11, 2024

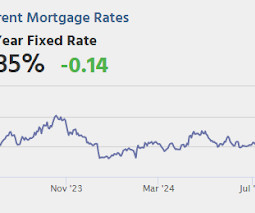

Markets Today's constructive CPI report rang a bell for financial markets. (sherwood.news) Falling interest rates helped push 30-year mortgage rates well below 7.0%. (mortgagenewsdaily.com) Finance Private equity firms just can't quit dividend recaps. (finance.yahoo.com) The market for leveraged loans is open for business, especially refinancings. (wsj.com) Weight loss drugs Patients with Type 2 diabetes are struggling to get GLP-1 drugs.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 11, 2024

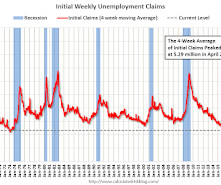

The DOL reported : In the week ending July 6, the advance figure for seasonally adjusted initial claims was 222,000 , a decrease of 17,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 238,000 to 239,000. The 4-week moving average was 233,500, a decrease of 5,250 from the previous week's revised average.

Wealth Management

JULY 11, 2024

C&J Wealth represents Modern Wealth’s ninth acquisition in the last 14 months and provides a foothold in the South.

Nerd's Eye View

JULY 11, 2024

Meaningful communication is crucial to building strong, durable relationships, and asking effective questions is an essential part of facilitating impactful conversations. Being able to initiate and lead those conversations has become an important aspect of any financial advicer's skill set , but for many, it's one that isn't always as straightforward or easy to learn … particularly for advicers who might be happiest when nerding out with spreadsheets and flowcharts!

Wealth Management

JULY 11, 2024

Stratos Private Wealth President Jeff Brown details his journey.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JULY 11, 2024

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For June, Realtor.com reported inventory was up 36.7% YoY, but still down 32.4% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 34.5% YoY. Realtor.com has monthly and weekly data on the existing home market.

Wealth Management

JULY 11, 2024

Jonathan Connolly, previously a managing director and head of trust at Wealthspire, will serve as president of the new trust company.

Calculated Risk

JULY 11, 2024

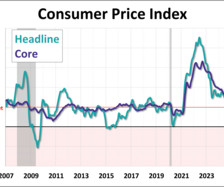

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent on a seasonally adjusted basis , after being unchanged in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment. The index for gasoline fell 3.8 percent in June, after declining 3.6 percent in May, more than offsetting an increase in shelter.

Wealth Management

JULY 11, 2024

Stifel had the highest satisfaction score among employee advisors, while Commonwealth took the top spot among independents, according to J.D. Power’s latest ranking.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 11, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, The Producer Price Index for June from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI. 10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

Wealth Management

JULY 11, 2024

Valued at $4.5 billion, the technology behemoth to advisors will be taken private with minority stakes from key strategic partners.

Calculated Risk

JULY 11, 2024

The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.2%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

A Wealth of Common Sense

JULY 11, 2024

A reader asks: On this week’s episode, you guys mention that nobody uses the 4% rule. I have been tracking my annual expenses for the last few years and multiplying it by 25 as a ballpark figure of what I need to retire. Is this not a good way to estimate? If not, what do you suggest? Sorry if this is a dumb question, but yes, I have read this in a lot of blogs.

Wealth Management

JULY 11, 2024

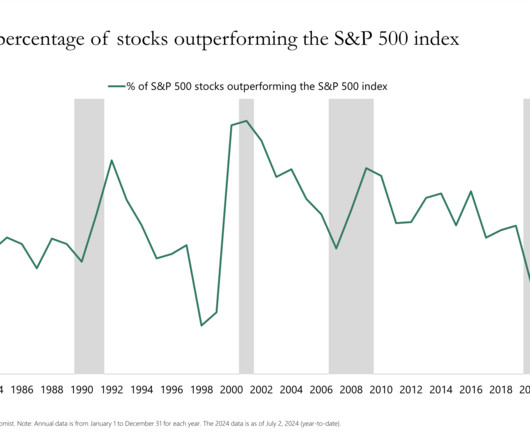

Four years after their debut, actively managed strategies that only periodically reveal their holdings are enduring a slow demise.

Advisor Perspectives

JULY 11, 2024

No investor wants to miss the wave of a massive, transformational technology. Spot these big shifts early, and you have a chance at Nvidia-like returns.

Trade Brains

JULY 11, 2024

Ambuja Cements: We all know that the Indian construction industry is a vast canvas which constantly undergoes development. Ambuja Cement being a brand which has been a trusted supplier of building blocks for this progress has entered into a new chapter. Their recent acquisition has lightened things up and promises to redefine the company’s position.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JULY 11, 2024

As Pete Stavros addressed the private equity industry’s yearly shindig in Berlin last month, the KKR & Co. executive’s words were slightly less headline grabbing than those of Apollo Global Management’s co-president Scott Kleinman. But they were just as troubling.

MainStreet Financial Planning

JULY 11, 2024

As a parent and financial planner, ensuring that we make the smartest financial decisions for our families is crucial. In this article, we will explore three popular savings and investment options: 529 Plans, Roth IRAs, and Real Estate. Each has unique benefits and drawbacks, and understanding these can help you decide which fits best with your financial situation, risk tolerance, and goals. 529 Plans 529 Plans are specialized savings accounts designed to help families save for future education

Carson Wealth

JULY 11, 2024

Financial planning for a small business gets more complicated every day. Business owners must navigate tax efficiency (and life under the new Tax Cuts and Jobs Act), retirement preparations for yourself and your employees, and succession planning. Get your financial plan in place today and prepare for what tomorrow brings with our guide to financial planning for small business owners.

Advisor Perspectives

JULY 11, 2024

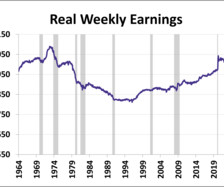

This series has been updated to include the June release of the consumer price index as the deflator and the monthly employment update. The latest hypothetical real (inflation-adjusted) annual earnings are at $50,634, down 7.1% from over 50 years ago. After adjusting for inflation, hourly earnings are below their all-time high from April 2020.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Wealthfront

JULY 11, 2024

Bond ladders may be a buzzy investment strategy at the moment, but they’re more than just a passing trend. Bond ladders are also a time-tested approach for investors who want to protect and grow a windfall or save for a future purchase. But what are bond ladders, and who can potentially benefit from using them? […] The post Bond Ladders: What You Need To Know appeared first on Wealthfront Blog.

Advisor Perspectives

JULY 11, 2024

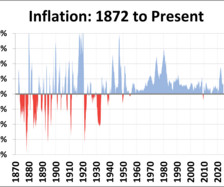

The Consumer Price Index for Urban Consumers (CPI-U) released for June puts the year-over-year inflation rate at 2.97%. The latest reading keeps inflation below the 3.74% average since the end of the Second World War for the 13th straight month. However, inflation remains above the 10-year moving average which is now at 2.82%.

Random Roger's Retirement Planning

JULY 11, 2024

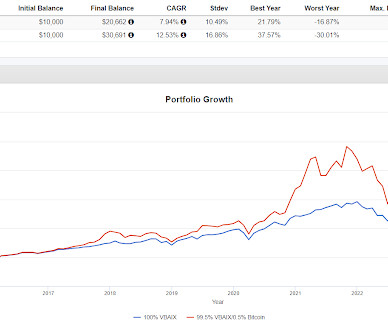

Bloomberg reported that the Skybridge Capital hedge fund that focuses on crypto has gated withdrawals despite the crypto space having generally done quite well. I'm not too interested in the story but toward the end of the article there was a breakdown of the asset allocation as of the end of Q1 and I am fascinated. If reported correctly, the fund is certainly crypto-heavy but it doesn't just invest in cryptocurrencies.

Advisor Perspectives

JULY 11, 2024

Inflation cooled for a third straight month in June, dropping to its lowest level in a year. According to the Bureau of Labor Statistics, the headline figure for the Consumer Price Index fell to 3.0% year-over-year while core CPI cooled to 3.3%. Both readings were lower than their respective forecasts.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content