CRE Conduit Lending Sector Braces for Challenges in 2023

Wealth Management

JANUARY 11, 2023

Industry experts expect a difficult economic environment to keep CMBS issuance volume down while existing loans may see higher delinquency rates.

Wealth Management

JANUARY 11, 2023

Industry experts expect a difficult economic environment to keep CMBS issuance volume down while existing loans may see higher delinquency rates.

The Reformed Broker

JANUARY 11, 2023

After December’s trash fire, markets are optimistic, says Ritholtz’s Josh Brown from CNBC. The post Clips From Today’s Closing Bell appeared first on The Reformed Broker.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JANUARY 11, 2023

Charles Richard Burgess will go to prison for more than six years for fleecing investors of more than $4 million, while pretending to be a registered investment advisor.

Abnormal Returns

JANUARY 11, 2023

Podcasts Christine Benz and Jeff Ptak talk with Mark Miller, author of "Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track." (the-long-view.simplecast.com) A discussion about when it is time to adjust your retirement plans. (mullooly.net) Banking High yield bank savings accounts are now actually high yield. (awealthofcommonsense.com) The BNPL bubble is set to burst.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JANUARY 11, 2023

Take these "advisor must-dos" with a grain of salt.

Abnormal Returns

JANUARY 11, 2023

Markets How does the 60/40 portfolio perform after big down years? (awealthofcommonsense.com) GMO loves deep value stocks. (ft.com) FTX Bankruptcy courts were not built to unwind crypto messes like FTX. (economist.com) Alameda Research made a big investment in miner Genesis Digital Assets soon before the FTX unwind. (wsj.com) BITO Bitcoin tanked in 2022 but Bitcoin futures ETPs held in there.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JANUARY 11, 2023

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog). I'm adding some thoughts, and maybe some predictions for each question. 3) Unemployment Rate: The unemployment rate was at 3.5% in December, down 0.4 percentage points year-over-year.

Wealth Management

JANUARY 11, 2023

A judge's role is not writing the laws but applying them as written to the facts.

Calculated Risk

JANUARY 11, 2023

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 6, 2023. The Refinance Index increased 5 percent from the previous week and was 86 percent lower than the same week one year ago.

Wealth Management

JANUARY 11, 2023

The company plans to build a family-focused resort aimed specifically at younger kids on 97 acres of land it’s acquired in the Dallas suburb of Frisco, Texas. It will include rides, shows and a hotel, as well as character meet and greets tied to the company’s library of film and TV properties, which include Minions and Shrek. The company also announced plans for a year-round, horror-focused destination in Las Vegas.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JANUARY 11, 2023

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Freddie Mac “National” Home Price Index Down Again in November; Rents Continued to Slide A brief excerpt: Freddie Mac recently reported that its “National” Home Price Index (FMNHPI) declined for the fifth straight month on a seasonally adjusted basis in November, putting the FNNHPI down 2.06% from its June 2022 peak.

Wealth Management

JANUARY 11, 2023

What attorneys can and can’t do.

Calculated Risk

JANUARY 11, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 204 thousand last week. • Also, at 8:30 AM, The Consumer Price Index for December from the BLS. The consensus is for 0.1% increase in CPI, and a 0.3% increase in core CPI.

Wealth Management

JANUARY 11, 2023

Four steps clients should take before they even consider the possibility of a sale.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Nerd's Eye View

JANUARY 11, 2023

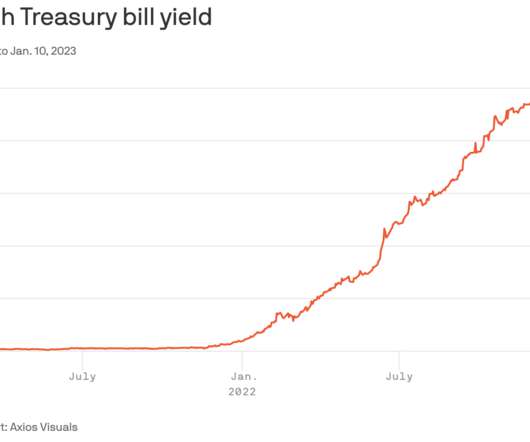

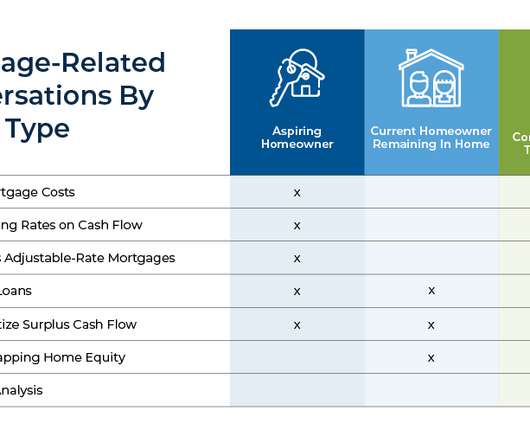

Leading up to 2022, financial advisors and their clients had grown accustomed to a relatively low mortgage rate environment. In fact, until earlier this year, the average 30-year fixed mortgage rate had stayed below 5% since 2010 (and below 7% since 2001). But as the Federal Reserve has sought to raise interest rates this year to combat inflation, mortgage rates have reached higher levels not seen in more than 20 years, with 30-year fixed mortgages reaching an average of 6.9% in October 2022, tw

Wealth Management

JANUARY 11, 2023

The giant asset manager had nearly 20,000 employees at the end of September.

Advisor Perspectives

JANUARY 11, 2023

The bond market is much cheaper than the stock market, according to Jeffrey Gundlach. Investors should abandon the traditional 60/40 stock/bond allocation in favor of a 40/60 split.

Wealth Management

JANUARY 11, 2023

Financial engineering has found a way to keep ailing SPACs afloat.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

A Wealth of Common Sense

JANUARY 11, 2023

Today’s Animal Spirits is brought to you by YCharts: Enter your information here to get 20% off YCharts (new clients only) On today’s show, we discuss: Jeff Bezos may return to helm Amazon, says forecaster of double-digit stock market losses last year Amazon workers joke about Jeff Bezos’s comeback amid Andy Jassy layoffs The 2023 Economy FAQ: Is recession inevitable?

Wealth Management

JANUARY 11, 2023

These funds lost the most money over the last 30 days.

Clever Girl Finance

JANUARY 11, 2023

Minimalism hasn't always been the trendy lifestyle portrayed on Pinterest. In fact, some black minimalists grew up with a different understanding of this concept. Minimalism, for many people who are part of black and brown communities, isn’t simply an enlightened lifestyle change. They grew up with it as a way of life. However, some black women have taken to the minimalist movement and are using it as a tool of empowerment.

Wealth Management

JANUARY 11, 2023

As of today, the queue is gone. So why did it take most of 2022 to clear the backlog of ocean freight and where are those containers now?

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

JANUARY 11, 2023

Here’s a worthy goal to contemplate for 2023: Reduce stress and anxiety in your life, especially from family. The benefits of achieving this goal are significant.

Good Financial Cents

JANUARY 11, 2023

A career in a major bank can be both rewarding and well-paying, with top positions garnering income of hundreds of thousands or even millions of dollars annually. For example, investment bankers are near the top of the list, often working for large investment banks like Goldman Sachs or Morgan Stanley. But what exactly do these high-earning professionals do?

Advisor Perspectives

JANUARY 11, 2023

Can you believe these grifters hawking indexed universal life (IUL) insurance on TikTok? Here’s the actions I’m taking to put an end to this predatory nonsense.

Nationwide Financial

JANUARY 11, 2023

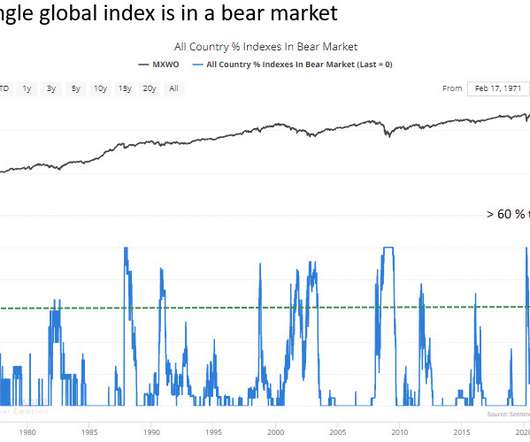

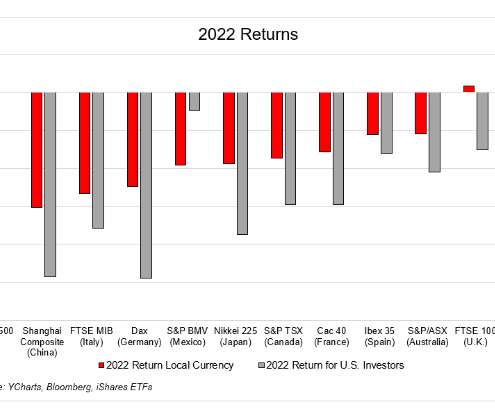

Two of the most significant developments in the financial markets during 2022 were the breakout of higher interest rates and the return of stock market volatility. For a glimpse of how volatile stocks were last year, consider the VIX Index, often used as a gauge of fear or stress in the stock market. In 2022, the VIX spent 91% of trading days above 20.0, which signals a high degree of market volatility.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

FMG

JANUARY 11, 2023

2022 has been a wild year, but with all the things that have happened, it’s hard not to look back at it with wonder. From NASA looking at distant galaxies to England giving beavers legal protection. In addition to that, FMG has its Fall 2022 Showcase Roundup to highlight our lovely clients who were kind enough to give us their time and attention.

Integrity Financial Planning

JANUARY 11, 2023

If inflation is the silent killer of retirement planning, what can you do about it? On today’s show, Brian talks through the rule of 72, how it relates to inflation, and how understanding this rule can impact your financial plan. Whether it’s real estate, the stock market, or business growth, apply the rule of 72 to see how long it takes to grow your money into what you need.

Trade Brains

JANUARY 11, 2023

Top IT Penny Stocks: Investors of large IT stocks got burnt recently due to the global slowdown. Newly listed tech companies like Paytm and Nykaa gave serious blows too, reaching lower lows every other day. Some investors came down a step for mid-cap IT stocks. A few, even considered penny IT stocks eying multi-bagger gains to offset recent losses. In this article, we talk about the top IT penny stocks in India that risk-taking investors can add to their watchlists.

NAIFA Advisor Today

JANUARY 11, 2023

Understanding whether you are an Extrovert, Introvert, Ambivert, or Omnivert will help you to get through Behavioral and Economic Highs And Lows. Behavioral research goes back to 400 B.C. when Empodocles stated that behaviors have four elements or roots; Fire, Air, Earth, and Water. The elements of Fire and Air are said to be Extroverted. The elements of Earth and Water are said to be Introverted.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content