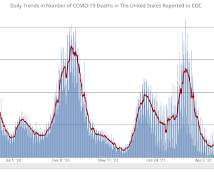

Tough to Beat the Market

The Big Picture

SEPTEMBER 8, 2022

Barry Ritholtz, Ritholtz Wealth Management Chairman & CIO and “Masters in Business” Bloomberg Radio & Podcast Host, discusses global shocks impacting market volatility (Source: Bloomberg). Hard for an Individual to Beat the Collective. Source: Bloomberg. The post Tough to Beat the Market appeared first on The Big Picture.

Let's personalize your content