CFP Board Chooses Elizabeth Miller as 2024 Chair-elect

Wealth Management

JULY 19, 2023

Elizabeth Miller, the founder and president of Summit Place Financial Advisors is the 2024 CFP Board Chair-elect, set to take leadership for a year in 2025.

Wealth Management

JULY 19, 2023

Elizabeth Miller, the founder and president of Summit Place Financial Advisors is the 2024 CFP Board Chair-elect, set to take leadership for a year in 2025.

Nerd's Eye View

JULY 19, 2023

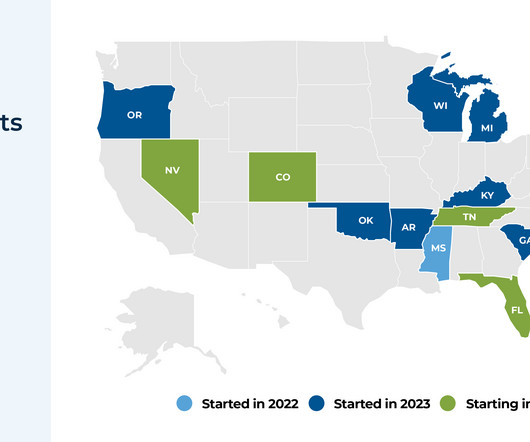

Continuing Education (CE) requirements are common for many professions, but historically there has been no minimum CE requirement for individual Investment Adviser Representatives (IARs) of advisory firms. While holders of certain credentials (e.g., CFP certificants and CFA charterholders) have CE requirements to retain their credentials, IARs without such credentials haven’t traditionally had any ongoing CE requirements.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 19, 2023

A rundown of recent court decisions.

Abnormal Returns

JULY 19, 2023

Podcasts Peter Lazaroff talks with Jill Schlesinger about her latest book "The Great Money Reset." (peterlazaroff.com) Tim Ranzetta talks with Jonathan Clements, editor of the new book "My Money Journey, How 30 People Found Financial Freedom And You Can Too." (ngpf.org) Retirement FAT Fire. How to retire at any age with confidence. (ofdollarsanddata.com) Take retirement surveys with a big grain of salt.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 19, 2023

DAFs may be used to enhance existing philanthropic strategies.

Calculated Risk

JULY 19, 2023

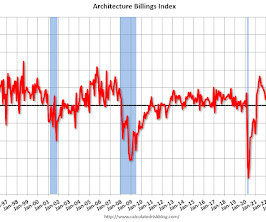

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: AIA/Deltek Architecture Billings Index Stable in June Architecture firms reported flat billings in June, according to the latest Architecture Billings Index (ABI) from the American Institute of Architects (AIA) and Deltek. The ABI score of 50.1 for the month indicates that billings at architecture firms remained steady as design activity continues to slowly recover from roiled economi

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 19, 2023

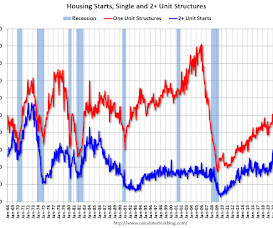

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,434,000. This is 8.0 percent below the revised May estimate of 1,559,000 and is 8.1 percent below the June 2022 rate of 1,561,000. Single‐family housing starts in June were at a rate of 935,000; this is 7.0 percent below the revised May figure of 1,005,000.

Wealth Management

JULY 19, 2023

“Unwinding” of PHE Medicaid rules exposes deeper flaws in the system.

Abnormal Returns

JULY 19, 2023

Markets A look at all the signs of risk-on behavior. (wsj.com) Some clues that showed the way to a better 2023 for the stock market. (carsongroup.com) Microsoft's ($MSFT) stock is at an all-time high. (cnbc.com) The VIX is at it lowest post-Covid level. (axios.com) Cash Cash often looks best, when it is the worst investment. (thisisthetop.substack.com) Reinvestment risk is real.

Wealth Management

JULY 19, 2023

Moore v. United States involves a challenge to new tax code regarding untaxed foreign earnings.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 19, 2023

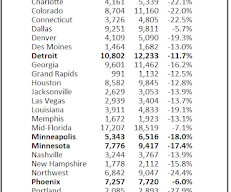

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in June & 4th Look at Local Markets A brief excerpt: An early read from housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.26 million in June , down 0.9% from May’s preliminary pace and down

Wealth Management

JULY 19, 2023

This demographic views charitable giving as a top priority.

Calculated Risk

JULY 19, 2023

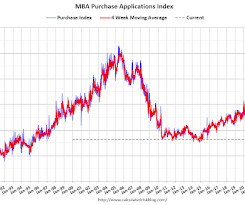

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 14, 2023. Last week’s results included an adjustment for Independence Day. The Market Composite Index, a measure of mortgage loan application volume, increased 1.1 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JULY 19, 2023

Stung in recent months by the regional banking crisis and downgraded credit rating, the company still beat industry projections Tuesday.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

JULY 19, 2023

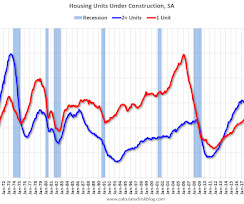

Today, in the CalculatedRisk Real Estate Newsletter: June Housing Starts: Record Number of Multi-Family Housing Units Under Construction Excerpt: The fourth graph shows housing starts under construction, Seasonally Adjusted (SA). Red is single family units. Currently there are 688 thousand single family units (red) under construction (SA). This was down in June compared to May, and 143 thousand below the recent peak in May 2022.

Wealth Management

JULY 19, 2023

Open, honest and candid discussions about the latest news in the RPA industry.

The Big Picture

JULY 19, 2023

My mid-week morning train WFH reads: • Is Rolex a Non-Profit? Answers to Your Burning Questions About the Rolex Watch Company. ( Teddy ) • Jerome Powell’s Prized Labor Market Is Back. Can He Keep It? The Federal Reserve chair spent the early pandemic bemoaning the loss of a strong job market. It roared back — and now its fate is in his hands. ( New York Times ) see also Powell Will Find Much to Love in Retail Sales Letdown : The latest report landed with a mixed reception.

Wealth Management

JULY 19, 2023

Abby Salameh explains how CAIS addresses two of advisors’ biggest problems with alternative investments.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

The Big Picture

JULY 19, 2023

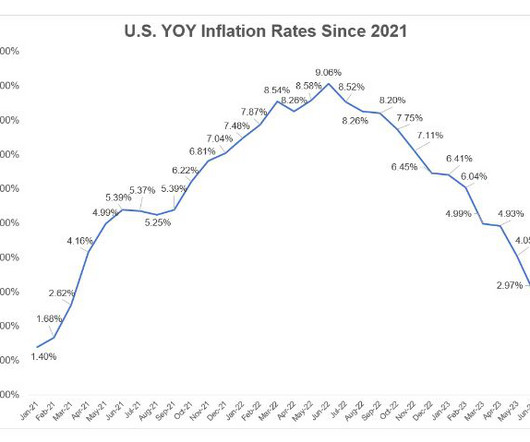

On today’s show I join Downtown Josh Brown to discuss my recent piece “ A Dozen Contrarian Thoughts About Inflation.” Source: YouTube Previously : A Dozen Contrarian Thoughts About Inflation (July 13, 2023) The post 12 Things Everyone Got Wrong About Inflation appeared first on The Big Picture.

Wealth Management

JULY 19, 2023

Understanding and explaining this option to your client.

Calculated Risk

JULY 19, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, up from 237 thousand last week. • Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of -10.0, up from -13.7. • At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR).

Wealth Management

JULY 19, 2023

Editor in Chief Susan R. Lipp discusses this month's issue.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Meb Faber Research

JULY 19, 2023

Episode #490: Bill Bernstein on Financial History, Star Managers & The 4 Pillars of Investing Guest: William (Bill) Bernstein is a financial theorist, a neurologist, and a financial adviser to high net worth individuals. Known for his website on asset allocation and portfolio theory, Efficient Frontier, Bill is also a co-principal in the money management […] The post Episode #490: Bill Bernstein on Financial History, Star Managers & The 4 Pillars of Investing appeared first on Meb

Wealth Management

JULY 19, 2023

Current options in planning with retirement benefits for the youngest beneficiaries.

Brown Advisory

JULY 19, 2023

The Equity Beat: Would ‘AI’ By Any Other Name Smell As Sweet? bgregorio Wed, 07/19/2023 - 13:41 The famous adage from arguably Shakespeare’s most popular play is the backdrop of our journey this month. Juliet, of the House of Capulet, falls in love with Romeo, a member of the House of Montague, with which the Capulets have a blood feud. Juliet’s profound proclamation that Romeo’s name is just a label suggests the importance of a person or thing is the way it is; not because of what it is called.

Wealth Management

JULY 19, 2023

Legal editor Anna Sulkin discusses this month's cover.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

JULY 19, 2023

Today’s Animal Spirits is brought to you by Argent Capital: See more information here for Argent Capitals Mid Cap Strategy On today’s show, we discuss: The stock market’s up big this year — but not because of earnings growth Investors Are Bailing on Cathie Wood’s Popular ARK Fund Pay Raises Are Finally Beating Inflation After Two Years of Falling Behind Europeans Are Becoming Poorer.

Wealth Management

JULY 19, 2023

A conceptual decision-making framework.

Advisor Perspectives

JULY 19, 2023

Should you be concerned? How can you compete with “free”?

Wealth Management

JULY 19, 2023

A new opinion addresses how attorneys should meet ethical requirements for client confidentiality.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content