The Contrarian Predictive Power of Retail Option Trading

Wealth Management

MAY 30, 2023

Retail options traders are gambling, driven by sentiment and narratives. That often leads to future price declines on the overbought stocks, research shows.

Wealth Management

MAY 30, 2023

Retail options traders are gambling, driven by sentiment and narratives. That often leads to future price declines on the overbought stocks, research shows.

Nerd's Eye View

MAY 30, 2023

Welcome back to the 335th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Tim Wyman. Tim is a Managing Partner for the Center for Financial Planning, a hybrid advisory firm based in Southfield, Michigan, that oversees $1.5 billion in assets under management for 1,000 client households. What's unique about Tim, though, is how, as a second-generation partner, he helped redesign the firm’s organizational structure from siloed advisors to an ensemble practice,

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 30, 2023

Clients rarely have well-defined ideas about what they want their portfolios to look like. That’s why they seek out advisors in the first place.

The Big Picture

MAY 30, 2023

My back-to-work morning train reads: • Why Are Markets So Calm? It’s Revenge of the Quant Funds : Firms that use computers to determine buy and sell signals have been loading up while other investors sit back. ( Wall Street Journal ) • Crypto Is Staging a Major Rebound. How It Survived a $3 Trillion Crash. Bitcoin and other tokens have rebounded while big companies and funds continue to plow capital into cryptocurrencies. ( Barron’s ) • Five Things That Could Knock Nvidia Down : Which is

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MAY 30, 2023

With the sector facing headwinds, HNWI enthusiasm for commercial real estate has dampened and what type of investments they prefer has shifted, according to WMRE exclusive research.

Calculated Risk

MAY 30, 2023

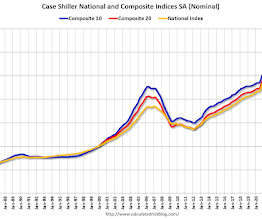

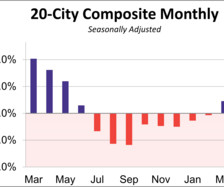

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From CNBC Home price declines may be over, S&P Case-Shiller says Nationally, home prices in March were 0.7% higher than March 2022 , the S&P CoreLogic Case-Shiller Indices said Tuesday.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 30, 2023

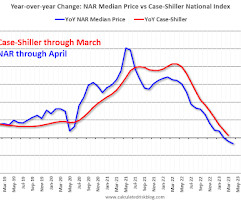

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Increased 0.7% year-over-year in March Excerpt: The recent increase in mortgage rates to over 7% will not impact the Case-Shiller index until reports released in the Fall. Here is a comparison of year-over-year change in median house prices from the NAR and the year-over-year change in the Case-Shiller index.

Wealth Management

MAY 30, 2023

The four provisions that require changes revolve around RMDs, employer contribution to pension plans, SIMPLE and SEP plans, and catch-up contribution allowances.

Calculated Risk

MAY 30, 2023

Two key points: 1) There is a clear seasonal pattern for house prices. 2) The surge in distressed sales during the housing bust distorted the seasonal pattern. For in depth description of these issues, see Jed Kolko's article from 2014 "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data" Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009 ) - and this led to S&P Case-Shiller questioning the seasonal factor too ( from April 2010

Wealth Management

MAY 30, 2023

The latest Urban Land Institute forecast looks into when investment sales might rebound. Office owners are starting to dispose of lower quality office buildings, reported The Wall Street Journal. These are among today’s must reads from around the commercial real estate industry.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

MAY 30, 2023

ChargePoint upgraded to buy at Bank of America from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

MAY 30, 2023

DLOM can significantly impact the value of a privately held company.

Advisor Perspectives

MAY 30, 2023

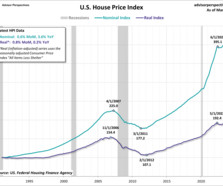

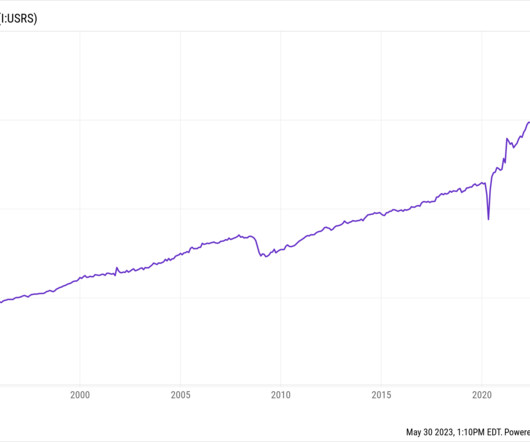

The Federal Housing Finance Agency (FHFA) has released its U.S. house price index (HPI) for March. The index reached a record high last month, coming in at 398.0. U.S. house prices increased by 0.6% from the previous month. Year-over-year the index is up 3.6%. After adjusting for inflation, the real index is up 0.8% in March and up 0.2% year-over-year.

Wealth Management

MAY 30, 2023

While fluctuating capital markets may have caused buyers to become more selective, the talk of slowing RIA M&A activity has been over-exaggerated, and valuations remain high for growing firms, said panelists at the RIA Edge conference last week.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

MAY 30, 2023

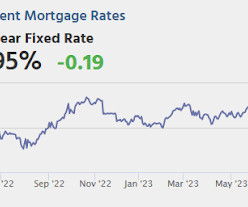

From Matthew Graham at Mortgage News Daily: Rates Drop Sharply to Start The New Week The past 2 weeks were fairly rough for fans of low mortgage rates. The average lender moved higher at the fastest pace since February over that time. By the end of last week, the average lender was back above 7% for a top tier 30yr fixed scenario (and "well above" on Friday).

Wealth Management

MAY 30, 2023

Clarion Partner's Rick Schaupp came on the podcast to talk about the firm's latest real estate investment fund and how it can fit into client's portfolios.

Abnormal Returns

MAY 30, 2023

Strategy How does the stock market perform after a period of sideways action? (ofdollarsanddata.com) Investment funds are a tool, not an investment philosophy. (fortunesandfrictions.com) International diversification never went out of style. (mrzepczynski.blogspot.com) Covered call writing is not free money. (caia.org) Crypto Crypto, and Bitcoin, are still here.

Wealth Management

MAY 30, 2023

The unit, called 23 Wall, focuses on about 700 families worth more than $4.5 trillion.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Abnormal Returns

MAY 30, 2023

Factors Joachim Klement, "The bottom line is that the academic definition of ‘growth investing’ isn’t really a proper growth investment style." (klementoninvesting.substack.com) What factors are representative of defensive equity. (advisorperspectives.com) Research Igor Tulchinsky, "Finance may not feel like the most obvious application of these [AI] tools, but we should recognize the importance of approaching early-stage technology like this in a spirit of radical openness.

Wealth Management

MAY 30, 2023

Discover why a succession strategy is more crucial than just a succession plan – and gain valuable insights on navigating the complexities of succession planning from the latest WMIQ research

A Wealth of Common Sense

MAY 30, 2023

Some random market thoughts after a nice long holiday weekend: Tech stocks don’t need lower rates to go up. Tech stocks got crushed last year with the Nasdaq 100 falling more than 30%. The Fed raised interest rates from 0% to more than 4% so that didn’t help long-duration assets like growth stocks. But there was this theory many people latched onto that tech stocks were only a rates play.

Wealth Management

MAY 30, 2023

She built her reputation on picking tech trends. Now she is having to defend bailing out of Nvidia.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Million Dollar Round Table (MDRT)

MAY 30, 2023

By Ford Saeks In today’s digital world, your online presence is crucial to the success of your business, as prospects often research you online before they even decide to meet with you. If it has been a while since you thought about your digital marketing strategy, it may be time to update your digital footprint and step up your online presence.

MarketWatch

MAY 30, 2023

Former Wells Fargo & Co. WFC executive Carrie L. Tolstedt has agreed to pay $3 million to settle charges connected with allegedly misleading investors about the success of the Community Bank, Wells Fargo’s core business, the U.S. Securities and Exchange Commission said late Tuesday. The SEC already has settled related charges against Wells Fargo’s former Chief Executive John Stumpf.

MainStreet Financial Planning

MAY 30, 2023

With all of the exponential advancements we are seeing in technology, it is important to proactively protect your identity, and these are a few easy ways to do that and save yourself the time and headache of trying to untangle the mess it can create! Freeze your credit Freezing your credit is a free and easy way to add a layer of protection to your identity.

MarketWatch

MAY 30, 2023

Shares of ad agency WPP UK:WPP rose 3% in early London trade after saying it’s making a content engine in partnership with AI chipmaker Nvidia NVDA. The companies said the engine will allow WPP to make large volumes of brand advertising content such as images or videos and experiences like 3D product configurators more tailored and immersive. Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they move.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

MAY 30, 2023

In March, S&P Case-Shiller Home Price Index revealed seasonally adjusted home prices for the benchmark 20-city index saw a 0.5% increase month-over-month (MoM) and a 1.2% decrease year-over-year (YoY). After adjusting for inflation, the MoM was reduced to 0.0% and the YoY was reduced to -8.5%.

Steve Sanduski

MAY 30, 2023

Guest: Kevin Kelly , Co-Founder and Senior Maverick of WIRED magazine. His new book is Excellent Advice for Living: Wisdom I Wish I’d Known Earlier. In a Nutshell: Back in 1969, one-hit wonders Zager and Evans reached the top of the Billboard Hot 100 with In the Year 2525. We use the provocative, playful, and, in some cases, quite prophetic questions raised in that song to dive into a wide-ranging conversation about technology, longevity, the future, and the meaning of life.

Integrity Financial Planning

MAY 30, 2023

Healthcare insurance is a crucial aspect of managing one’s health and finances. Understanding its basics can help individuals make informed decisions to help them stay healthy without running into unexpected costs. Here are some important points to keep in mind: Types of health insurance: There are different types of health insurance plans, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), point of service (POS) plans, and high-deductible health pl

Advisor Perspectives

MAY 30, 2023

A digital-marketing audit typically includes an analysis of the following elements.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content