Accelerating Growth By Marketing How Your Advisory Firm Is Different (Instead Of Better)

Nerd's Eye View

OCTOBER 16, 2023

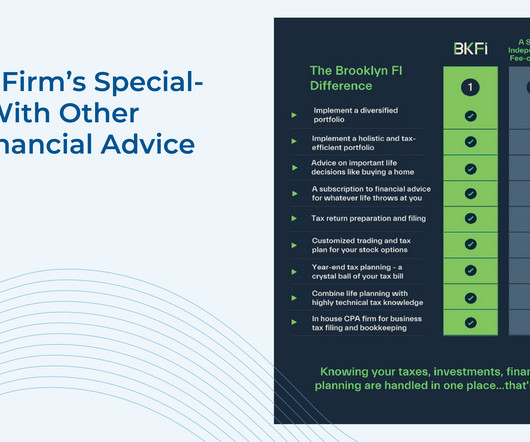

Consumers have a wide range of options when it comes to choosing a provider of financial advice, from larger wirehouses and asset managers to smaller Registered Investment Advisers (RIAs). Given that larger firms tend to have more substantial marketing budgets to attract clients, smaller firms and their advisors have had to look for alternative ways to differentiate themselves from the competition.

Let's personalize your content