Four Strategies for Donating a Home to Charity

Wealth Management

OCTOBER 16, 2023

It's often a better option, both in terms of dollars and cents and family stress, than passing on a residence to heirs.

Wealth Management

OCTOBER 16, 2023

It's often a better option, both in terms of dollars and cents and family stress, than passing on a residence to heirs.

Calculated Risk

OCTOBER 16, 2023

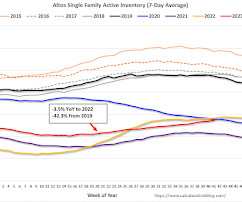

Altos reports that active single-family inventory was up 1.8% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of October 13th, inventory was at 546 thousand (7-day average), compared to 537 thousand the prior week. Year-to-date, inventory is up 11.3%. And inventory is up 34.8% from the seasonal bottom 26 weeks ago.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 16, 2023

Cadre's CEO discusses how the firm uses predictive models and workflow tools to change the real estate investment experience.

Calculated Risk

OCTOBER 16, 2023

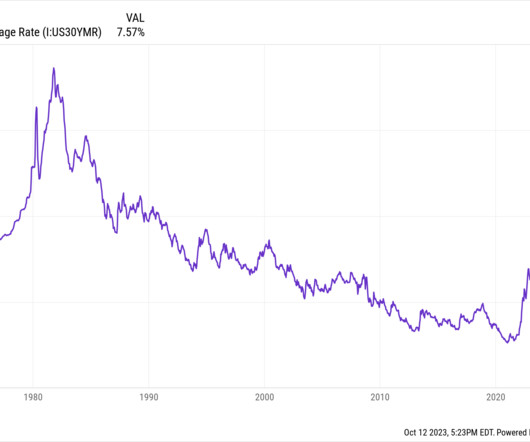

Today, in the Calculated Risk Real Estate Newsletter: Preliminary 2024 Housing Forecasts A brief excerpt: Towards the end of each year, I collect some housing forecasts for the following year - and also provide my own outlook. Several more forecast will be available in early December. A few key points from these early forecasts: 1) Forecasters expect house prices in increase next year. 2) Everyone expects multi-family starts to be down sharply in 2024. 3) 30-year fixed rate mortgages rates are e

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 16, 2023

Paul Kwak conspired with others to fraudulently apply for business assistance from the Economic Impact Disaster Loan program.

Abnormal Returns

OCTOBER 16, 2023

Podcasts Brendan Frazier talks with Meghaan Lurtz about re-engaging with existing clients. (wiredplanning.com) Daniel Crosby talks with Matt Reiner partner at Capital Investment Advisors about the future of financial advice. (standarddeviationspod.com) M&A Are smaller RIAs at risk because of national, full-service firms? (citywire.com) RIA M&A volume has picked up of late.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

OCTOBER 16, 2023

Consumers have a wide range of options when it comes to choosing a provider of financial advice, from larger wirehouses and asset managers to smaller Registered Investment Advisers (RIAs). Given that larger firms tend to have more substantial marketing budgets to attract clients, smaller firms and their advisors have had to look for alternative ways to differentiate themselves from the competition.

Wealth Management

OCTOBER 16, 2023

Using archane language without defining it is demeaning and will alienate clients and prospects, not impress them.

Calculated Risk

OCTOBER 16, 2023

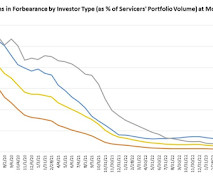

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.31% in September The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.33% of servicers’ portfolio volume in the prior month to 0.31% as of September 30, 2023. According to MBA’s estimate, 155,000 homeowners are in forbearance plans.

Wealth Management

OCTOBER 16, 2023

Panel discussion focuses on fostering deeper relationships with clients by making them feel seen and heard.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

OCTOBER 16, 2023

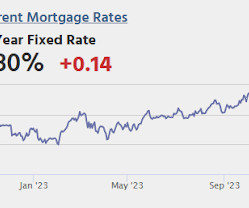

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump Back Near Long-Term Highs Last week was mostly good for mortgage rates, even if the goodness was made possible in large part by the badness of the previous week. By Friday, rates were 0.15% lower than the previous Friday, on average. As the new week begins, virtually all of that progress has been erased.

Wealth Management

OCTOBER 16, 2023

Joe Duran has named Terri Kallsen, former WEG and Schwab executive, as managing partner and senior operating advisor at Rise Growth Partners.

Alpha Architect

OCTOBER 16, 2023

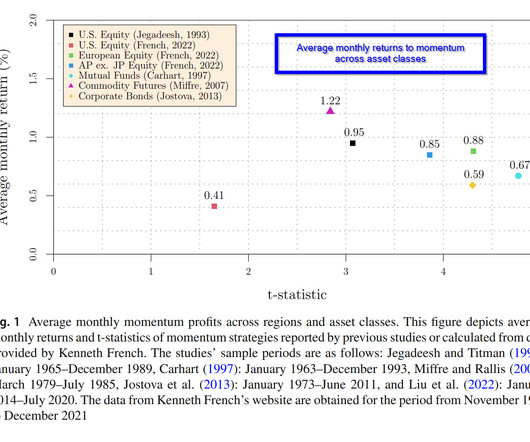

The Jegadeesh and Titman (1993) paper on momentum established that an equity trading strategy consisting of buying past winners and selling past losers, reliably produced risk-adjusted excess returns. The Jegadeesh results have been replicated in international markets and across asset classes. As this evidence challenged and contradicted widely accepted notions of weak-form market efficiency, the academic community took notice and started churning out research.

Wealth Management

OCTOBER 16, 2023

“It’s not really a matter of if; it’s a matter of when Sanctuary is more acquisitive in the marketplace,” said Sanctuary CEO Adam Malamed.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

OCTOBER 16, 2023

How worried should we be about AI and what should we do about it? There is risk on both sides: of not taking warnings about AI seriously enough, and of taking them too seriously.

Wealth Management

OCTOBER 16, 2023

The majority of Bob Barker's estate was donated to 40 different animal and military charities.

Cornerstone Financial Advisory

OCTOBER 16, 2023

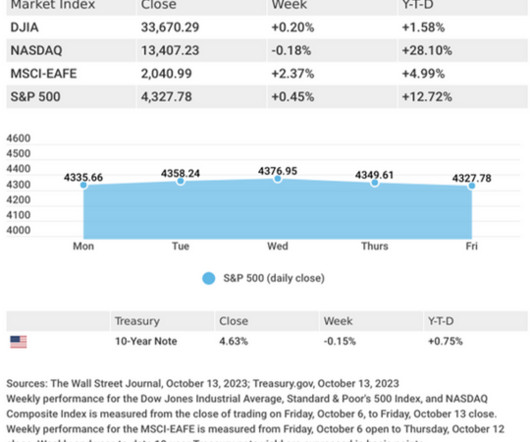

Weekly Market Insights: Markets React To Turmoil In Middle East, Inflation Concerns. Presented by Cornerstone Financial Advisory, LLC Stocks ended mixed last week amid the outbreak of hostilities in the Middle East and higher-than-expected inflation data. The Dow Jones Industrial Average gained 0.20%, while the Standard & Poor’s 500 rose 0.45%. But the Nasdaq Composite index slipped 0.18% for the five trading days.

Wealth Management

OCTOBER 16, 2023

Thursday, November 02, 2023 | 2:00 PM ET

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

A Wealth of Common Sense

OCTOBER 16, 2023

Today’s Talk Your Book is brought to you by Northpointe Bank: On today’s show, we spoke with Jason Anderson, Regional Vice President of Northpointe Bank to discuss all things housing market. On today’s show, we discuss: How the All In One loan is structured How interest rates affect home equity line of credits Why refinancing sometimes does not make sense Who this product is not for What Northpointe do.

Wealth Management

OCTOBER 16, 2023

Bridgeline Wealth Partners in Atlanta, Ga., specializes in providing bespoke investment strategies and ‘multi-dimensional’ wealth management.

Advisor Perspectives

OCTOBER 16, 2023

The choice to use an advisor in retirement is one that will cost clients and their beneficiaries millions of dollars in fees and opportunity costs as I show in this article.

Wealth Management

OCTOBER 16, 2023

Investors can’t pass up how valuable teams, leagues and game technology have become.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Clever Girl Finance

OCTOBER 16, 2023

With all the resources online, it can be easy to overlook financial literacy books. However, books allow you time to reflect as you read. Because they’re long-form, books are a great way to dive into topics you care about. That said, you can use some of the best finance books to achieve financial wellness. Check out this list! Table of contents Financial literacy basics Why reading financial literacy books is helpful 23 Top financial literacy books Expert tip: Read books related to your fi

Wealth Management

OCTOBER 16, 2023

On Friday, the US Securities and Exchange Commission declined to appeal on earlier positive court ruling for Grayscale.

Clever Girl Finance

OCTOBER 16, 2023

The words “frugal” and “thrifty” come loaded with quite a bit of baggage. A lot of people have strong feelings for or against those terms, but both can offer a lot to improve your lifestyle. Have you ever thought about what being frugal and thrifty really means and how they might differ? Let’s discuss this in more detail! Table of contents What does being frugal vs. being thrifty mean?

Random Roger's Retirement Planning

OCTOBER 16, 2023

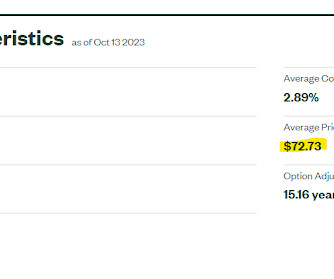

On Monday's ETF IQ on Bloomberg there was a segment that looked at weighing out whether adding bond market duration makes sense or not. They mentioned the SPDR Portfolio Long Term Treasury ETF (SPTL). Here are the portfolio characteristics. I highlighted that the bonds held are trading at an average price of 72 cents on the dollar. Here's a chart of the last couple of years compared to the S&P 500 and the iShares Aggregate Bond ETF (AGG) which has a much shorter duration.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Clever Girl Finance

OCTOBER 16, 2023

Most of us dedicate a significant portion of our lives to our jobs. While work can be fulfilling and rewarding, it can also be a source of stress and discomfort, especially when we find ourselves in a toxic workplace. In this article, we’ll delve into what constitutes a toxic working environment, how to recognize it, and what steps you can take to navigate within one and get yourself out of one.

Advisor Perspectives

OCTOBER 16, 2023

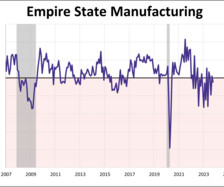

Manufacturing activity declined slightly in New York State, according to the Empire State Manufacturing October survey. The diffusion index for General Business Conditions fell 6.5 points from last month to -4.6. This morning's reading was better than the forecast of -7.0 and pushes the index back into contraction territory.

Financial Symmetry

OCTOBER 16, 2023

If you are a long-time listener you know that we like to go through the nuances of financial planning that may be valuable to you. In this episode, Allison and I take a look at net unrealized appreciation (NUA). Listen … Continued The post Could You Use Net Unrealized Appreciation? Ep #201 appeared first on Financial Symmetry, Inc.

Advisor Perspectives

OCTOBER 16, 2023

The outlook for earnings is weakening and could remain subdued, according to strategists from Morgan Stanley to JPMorgan Chase & Co.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content