Sales of Cannabis Real Estate Run into Some Challenges

Wealth Management

NOVEMBER 29, 2022

More states are legalizing marijuana. But so far, that hasn’t translated into much greater opportunities for real estate investment.

Wealth Management

NOVEMBER 29, 2022

More states are legalizing marijuana. But so far, that hasn’t translated into much greater opportunities for real estate investment.

Mish Talk

NOVEMBER 29, 2022

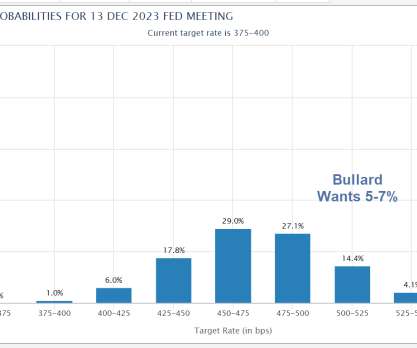

Monthly average Fed Funds Rate via St. Louis Fed. Chart Notes I use monthly averages because the Fed now targets a range. Also the Fed Funds Target Rate is discontinued and only dates to 1982. This is the steepest, most aggressive hiking cycle ever. You can see the impact especially in mortgage rates and thus housing. 30-Year Fixed Mortgage Rates 1975-Present. 30-year fixed mortgage rates courtesy of Mortgage News Daily. 30-Year Fixed Mortgage Rates - One Year. 30-year fixed mortgage rates court

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 29, 2022

DAFs and crypto have caught the attention of Capitol Hill.

Nerd's Eye View

NOVEMBER 29, 2022

Welcome back to the 309th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Anh Tran. Anh is the Founder and Managing Partner for SageMint Wealth, a corporate LPL-affiliated RIA based in Orange, California, that oversees nearly $325 million for 195 client households. What's unique about Anh, though, is how, as a solo advisor, she differentiates her firm by leveraging the combination of a high-touch concierge approach to client service with a unique investment mana

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 29, 2022

Though selling your business may sound simple in theory, what that looks like in practice is as unique as the people involved and can be completely different from one sale to another.

Abnormal Returns

NOVEMBER 29, 2022

Markets The yield curve is only getting more inverted. (morningstar.com) Oil prices are back to pre-Ukraine war levels. (axios.com) Strategy What is a reasonable return expectation for the next few decades? (ofdollarsanddata.com) Why indexing works. (evidenceinvestor.com) Crypto SBF was telling people about his plans in plain sight. (elmwealth.com) City of Miami Mayor Francis Suarez said that he’s still taking his paycheck in bitcoin.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

NOVEMBER 29, 2022

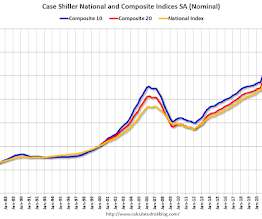

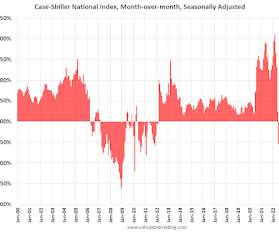

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3-month average of July, August and September closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P: S&P Corelogic Case-Shiller Index Continued to Decline in September The S&P CoreLogic Case-Shiller U.S.

Wealth Management

NOVEMBER 29, 2022

James Couture pleaded to charges of wire fraud, aggravated identity theft and witness tampering in September.

The Big Picture

NOVEMBER 29, 2022

My Two-for-Tuesday morning train WFH reads: • It’s not your imagination: Shopping on Amazon has gotten worse : The first page of Amazon results includes an average of about nine sponsored listings, according to a study of 70 search terms conducted in 2020 and 2021 by data firm Profitero. That was twice as many ads as Walmart displayed, and four times as many as Target. ( Washington Post ) See also How Amazon Become Ordinary : Amazon was never going to maintain a 50% market share of the growth i

Wealth Management

NOVEMBER 29, 2022

The newly integrated business intelligence engine is meant to streamline Reg BI and DOL compliance.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

A Wealth of Common Sense

NOVEMBER 29, 2022

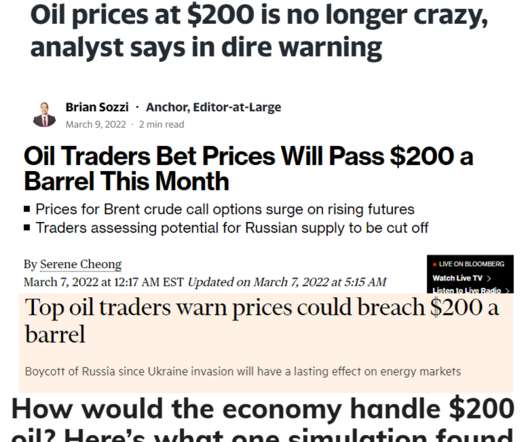

When Russia invaded Ukraine in late-February, the price of oil was a little more than $90 a barrel. It basically went straight up from there to well over $120 a barrel in about a week and a half. Gas prices quickly moved up as well, getting as high as more than $5 a gallon by early summertime. The energy picture felt bleak at the time and it seemed like it was only a matter of time until we broke through all-time highs in.

Wealth Management

NOVEMBER 29, 2022

Grau reflects on the evolution of succession planning in this industry over the last eight years and where it’s headed in the future, as his own transition plays out.

Advisor Perspectives

NOVEMBER 29, 2022

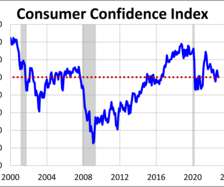

The headline number of 100.2 was a decrease of 2.0 from the final reading of 102.2 for October.

Wealth Management

NOVEMBER 29, 2022

The often-bearish US equity strategist talks about his career year, and why he likes steering clear of the herd.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

NOVEMBER 29, 2022

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 200,000 jobs added, down from 239,000 in October. • At 8:30 AM: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), 3rd

Wealth Management

NOVEMBER 29, 2022

Atria says Morrissey will be deeply involved in the firm's evolution and bring the firm into the next phase of growth.

The Reformed Broker

NOVEMBER 29, 2022

Final Trades: Tradeweb, A.O. Smith, Morgan Stanley & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

NOVEMBER 29, 2022

Friday, December 09, 2022 | 11:00 AM ET

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

NOVEMBER 29, 2022

High-Cost Areas increase to $1,089,300. Here is the official announcement from the FHFA: FHFA Announces Conforming Loan Limit Values for 2023 The Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages to be acquired by Fannie Mae and Freddie Mac (the Enterprises) in 2023. In most of the United States, the 2023 CLL value for one-unit properties will be $726,200 , an increase of $79,000 from $647,200 in 2022.

Wealth Management

NOVEMBER 29, 2022

Retailers discounted generously on Black Friday and Cyber Monday this year in an effort to clear excess inventory and lure consumers who are increasingly strained by inflation. Those efforts drove foot traffic up.

Calculated Risk

NOVEMBER 29, 2022

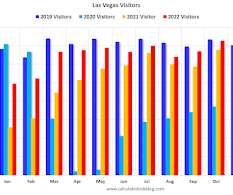

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions). From the Las Vegas Visitor Authority: October 2022 Las Vegas Visitor Statistics With an improving conventions segment combined with several events including the dual weekend When We Were Young music festival, two Raiders home games and the NASCAR South Point 400 race, the month saw the destination host over 3.6M visitors, nearly matching the tally of October 2019.

Abnormal Returns

NOVEMBER 29, 2022

Behavior Why investors hang on to losing stocks. (onlinelibrary.wiley.com) Corporate boards are strongly inclined to bring on new members with existing connections. (alphaarchitect.com) On the psychology of giving people no strings attached money. (wsj.com) Research Trend following loves macro volatility. (mrzepczynski.blogspot.com) Don't fool yourself when it comes to picking a proper benchmark.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Reformed Broker

NOVEMBER 29, 2022

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ?Record Sales – “Shoppers are expected to spend between $9 billion and $9.2 billion online on Friday” ?Credit Suisse looks Lehman-y – FTX stuff temporarily took everyone’s focus off this story, The post Elon Goes to War With Apple appeared first on The Reformed Broker.

Calculated Risk

NOVEMBER 29, 2022

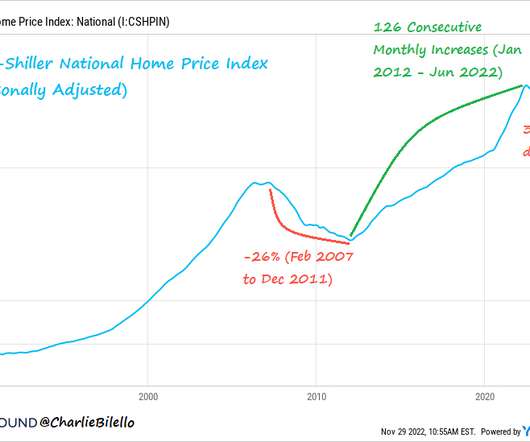

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Continued to Decline" to 10.6% year-over-year increase in September Excerpt: Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for September were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

Wealth Management

NOVEMBER 29, 2022

Ray Dalio and the Koch family have pioneered philanthropy through the 501(c)(4). More than just a charity, it can avoid punishing taxes, retain business control and even influence politics.

Mullooly Asset Management

NOVEMBER 29, 2022

The end of the year is a great time to consider charitable gifting. If you are feeling generous, want to make a difference in someone’s life, and want to reap potential tax benefits, this is the blog post for you! Before we go any further, when we talk about gifting strategies, we’re not talking about […].

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

NOVEMBER 29, 2022

Uniparts India IPO Review : Uniparts India Limited is coming up with its Initial Public Offering. The IPO will open for subscription on November 30th, 2022, and close on December 2nd, 2022. It is looking to raise Rs 835.61 crore whole of which will be an Offer for Sale. In this article, we will look at the Uniparts India IPO Review 2022 and analyze its strengths and weaknesses.

Million Dollar Round Table (MDRT)

NOVEMBER 29, 2022

By Matt Pais, MDRT Content Specialist Some leaders think they should look forward and remain firm at all times, even in the wake of a mistake. J.P. Pawliw-Fry, M.D., the co-founder of the Institute for Health and Human Potential, said his work with the NBA champion Chicago Bulls reflected the importance of acknowledging errors and demonstrating accountability in professional relationships.

Advisor Perspectives

NOVEMBER 29, 2022

The Federal Housing Finance Agency (FHFA) has released its U.S. House Price Index (HPI) for September. U.S. house prices were up 0.1% on a seasonally adjusted nominal basis from the previous month. Year-over-year the index is up 11.0% on a non-seasonally adjusted nominal basis. After adjusting for inflation and seasonality, the index is down 0.13% in September and up 1.8% year-over-year (seasonally adjusted).

The Irrelevant Investor

NOVEMBER 29, 2022

Today’s Animal Spirits is brought to you by AcreTrader and Nasdaq: See here for more information on AcreTrader and here for AcreTrader disclosures See here for Nasdaq’s stock screener On today’s show we discuss: U.S. crude turns positive, Brent pares losses on OPEC+ cut rumors Was the Nasdaq 100 in a bubble? Fed minutes show most officials favored slowing rate rises soon Miami nightclubs mourn the absence.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content