Gifting Complex Assets

Wealth Management

AUGUST 22, 2023

A simple approach to helping clients maximize charitable impact and reduce taxable income.

Wealth Management

AUGUST 22, 2023

A simple approach to helping clients maximize charitable impact and reduce taxable income.

Abnormal Returns

AUGUST 22, 2023

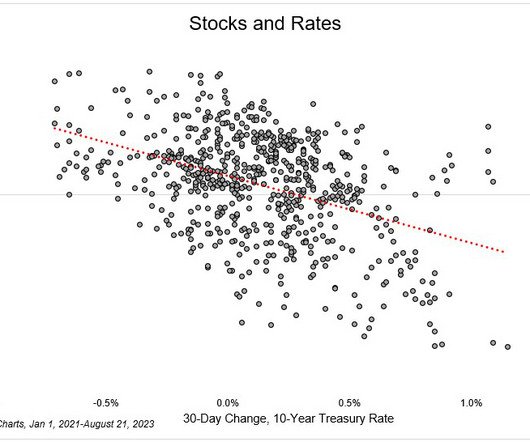

Markets The stock market is laser focused on interest rates. (theirrelevantinvestor.com) Do market valuations mean revert over time? (thediff.co) Why there's never a shortage of pundits willing to make a big market call. (wsj.com) Finance A look at recent Blackstone ($BX) fund performance. (morningstar.com) Retail investors love trading Nvidia ($NVDA) options.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 22, 2023

The new tool uses an API integration from OpenAI, the creator of text-based chatbot ChatGPT and image generator DALL-E.

Nerd's Eye View

AUGUST 22, 2023

Welcome back to the 347th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Cary Carbonaro. Cary is the Senior Vice President & Director of Women and Wealth Services for Advisor Capital Management, an independent RIA with offices around the country and headquartered in Charlotte, North Carolina, that oversees more than $6 billion in assets under management for 1,700 client families.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 22, 2023

A recent study by NAREIM and Ferguson Partners assessed the state of management practices among real estate investment managers and private equity real estate firms.

Calculated Risk

AUGUST 22, 2023

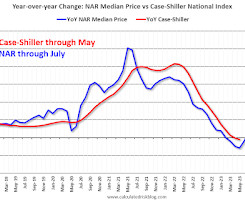

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.07 million SAAR in July; Median Prices Increased 1.9% YoY in July Excerpt: On prices, the NAR reported : The median existing-home price for all housing types in July was $406,700, an increase of 1.9% from July 2022 ($399,000). Prices rose in the Northeast, Midwest and South but were unchanged in the West.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 22, 2023

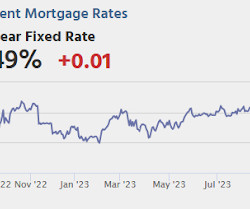

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 701 thousand SAAR, up from 697 thousand in June. • Also at 10:00 AM, the Bureau of Labor Statistics (BLS) will release the 2023 Preliminary Benchmark Revision to Establishment Survey Data. • Dur

Wealth Management

AUGUST 22, 2023

The financial services firm brought a benchmark-sized deal of senior unsecured notes Tuesday.

The Reformed Broker

AUGUST 22, 2023

Final Trades: NextEra Energy, Stryker & Zimmer Holdings from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

AUGUST 22, 2023

Rent growth is holding up much better for mid-market apartments vs. luxury units, reported CoStar. The Wall Street Journal looks at disappearing U.S. nursing homes. These are among today’s must reads from around the commercial real estate industry.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 22, 2023

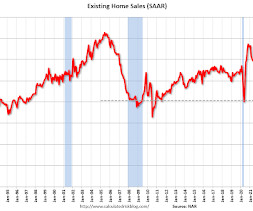

From the NAR: Existing-Home Sales Slipped 2.2% in July Existing-home sales receded in July, according to the National Association of Realtors®. Among the four major U.S. regions, sales grew in the West but faded in the Northeast, Midwest and South. All four regions registered year-over-year sales declines. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 2.2% from June to a seasonally adjusted annual rate of 4.07 mill

Wealth Management

AUGUST 22, 2023

Ethical considerations for this modern approach to working.

Abnormal Returns

AUGUST 22, 2023

Venture capital Venture capital fund performance is mid. (ft.com) Good luck calculating the returns to venture capital. (morningstar.com) Private equity Listed private equity performance is nothing special. (alphaarchitect.com) An introduction to private credit. (ft.com) Behavior Longer trading hours are not a good thing for retail traders. (papers.ssrn.com) How shopping in the grocery store is different than shopping online.

Wealth Management

AUGUST 22, 2023

This era in wealth management has seen unparalleled growth opportunity. Lido Advisors has embraced this golden age of shifting demographics and technological advancements to be one of the fastest growing and successful firms in the industry.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

AUGUST 22, 2023

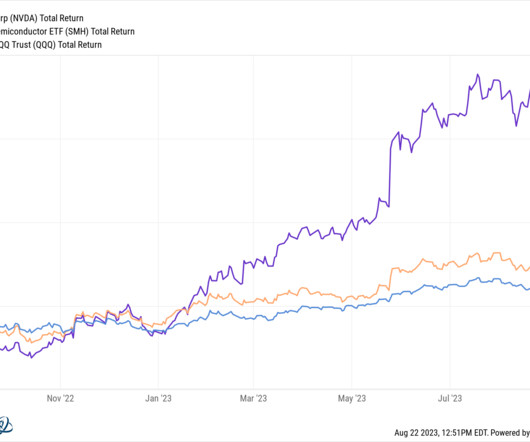

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Tech Stock Roundup – Nvidia goes into earnings as the best performing stock this year, plus 221%. ►Beats Get Smoked – “The reward for EPS beats has been close to 10Y lows.” ►Musk’s Shado.

Wealth Management

AUGUST 22, 2023

The evidence demonstrates that we should have a healthy skepticism about the accuracy of forecasts.

Calculated Risk

AUGUST 22, 2023

Last week, housing economist Tom Lawler wrote: Is The “Natural” Rate of Interest Back to Pre-Financial Crisis Levels? Here are some additional comments from Lawler: While NY Fed President Williams recently argued that “there is no evidence that the era of low natural rates of interest has ended,” (which many including myself would say is not accurate), other analysts at the NY Fed who oversee its “Dynamic Stochastic General Equilibrium” (DSGE) model suggest otherwise, at least for the “short-run

Wealth Management

AUGUST 22, 2023

The company has faced scrutiny from investors in recent months, particularly regarding unrealized losses from securities held on bank balance sheets.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

A Wealth of Common Sense

AUGUST 22, 2023

Rounding third base to middle age and having kids has caused me to think a lot about how different their lives are going to be than mine. I suppose this is a rite of passage every generation goes through. A lot of it has to do with the technological progress we’ve experienced over my lifetime. I graduated high school in the year 2000 which is weird because I grew up in the pre-internet age but have witnessed all of.

Wealth Management

AUGUST 22, 2023

When done correctly, joint representation can have many benefits.

Million Dollar Round Table (MDRT)

AUGUST 22, 2023

By Sim Gakhar, CHS, CEA If you only work for money, you become selfish. Selfish advisors are not professionals. When you run after money, you are only running. Yes, making money is an objective. If, however, you run a solid business, build strong relationships and help people, you will achieve financial success that grows and lasts. That’s what I want to do.

Wealth Management

AUGUST 22, 2023

A paramount concern is the attorney-client privilege.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Irrelevant Investor

AUGUST 22, 2023

It’s hard to take advantage of what everyone already knows. This is one of many reasons that index returns cannot be explained by valuations, especially in the short term. If everybody is aware of something, it’s hard to derive an edge from it. It’s what you can’t predict that drives excess returns. One of the most important things to the stock market right now is interest rates.

Wealth Management

AUGUST 22, 2023

Legal editor Anna Sulkin discusses this month's cover.

The Irrelevant Investor

AUGUST 22, 2023

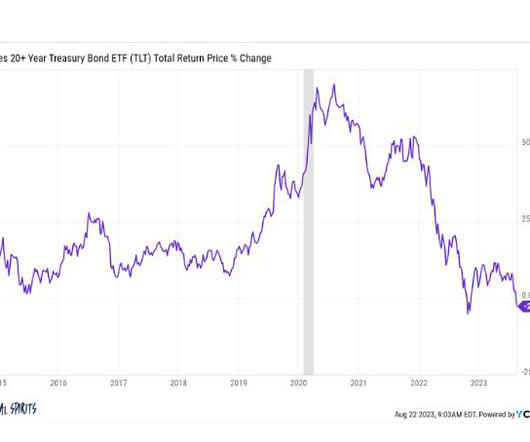

Today’s Animal Spirits is brought to you by YCharts: Submit your email here to receive 20% off a YCharts subscription for new clients and here for YCharts Value vs. Growth Trends Report On today’s show, we discuss: Why the era of historically low-interest rates could be over Real interest rates hit 2% Misconceptions about individual bonds vs bond funds How to get rich and famous from a stock market crash Federal.

Wealth Management

AUGUST 22, 2023

ABA Formal Opinion 507 addresses some of these issues.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

SEI

AUGUST 22, 2023

The future of wealth management is rooted in a personalized, connected experience.

Trade Brains

AUGUST 22, 2023

Fundamental Analysis of Polycab India : From the rapid exchange of digital information to the seamless distribution of energy, the cables and wires sector plays a vital role in the development of the country. Within this critical sector, one company stands out as a market leader: ‘Polycab India’ Since its lows during covid, the stock has given a multi-bagger of 629% to its investors.

SEI

AUGUST 22, 2023

Adapting their offerings is key to remaining relevant.

Harness Wealth

AUGUST 22, 2023

Starting an accounting firm, like any new business, requires a certain amount of start-up capital. From incorporation fees to purchasing tax and accounting software to optimizing your human capital (time), we’ll explore the many costs associated with starting an accounting firm and the operational expenses you should anticipate as you grow your new business.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content