Wealthspire to Acquire Sage Financial Advisors

Wealth Management

NOVEMBER 30, 2022

$194M acquisition expands the NFP-owned RIA’s presence in the West.

Wealth Management

NOVEMBER 30, 2022

$194M acquisition expands the NFP-owned RIA’s presence in the West.

The Big Picture

NOVEMBER 30, 2022

Last day of the 11th month! Enjoy the end of November with our mid-week morning train reads: • How Much Growth Can You Expect? Imagine I present to you a magical box that can turn your money into more money. The only problem is that you don’t know exactly how much more money you’ll get from this box. You could put $100 into the box and get back $200, $400, or maybe only $150 when all is said and done.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 30, 2022

A music catalog is a complex asset for both the buyer and the seller.

Calculated Risk

NOVEMBER 30, 2022

From Fed Chair Powell: Inflation and the Labor Market. Excerpts: Today I will offer a progress report on the Federal Open Market Committee's (FOMC) efforts to restore price stability to the U.S. economy for the benefit of the American people. The report must begin by acknowledging the reality that inflation remains far too high. My colleagues and I are acutely aware that high inflation is imposing significant hardship, straining budgets and shrinking what paychecks will buy.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 30, 2022

It will likely result in more headaches than benefits.

The Reformed Broker

NOVEMBER 30, 2022

Let’s assume we’re going to have a recession in 2023. I don’t know if we will, but everyone seems to think so, so let’s just say. So what. What can you do to stop it? Not much. Can you change your own spending and psych yourself up to survive it? Absolutely. Are there changes you could make to a portfolio in order to gird yourself for a worsening economy?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

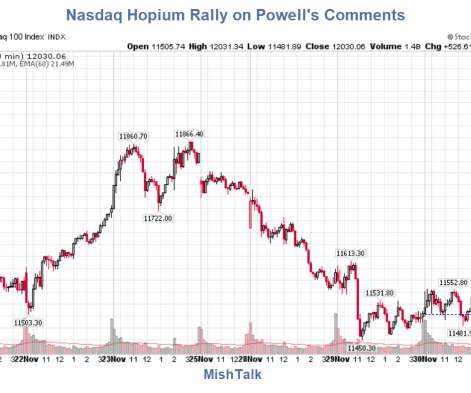

Mish Talk

NOVEMBER 30, 2022

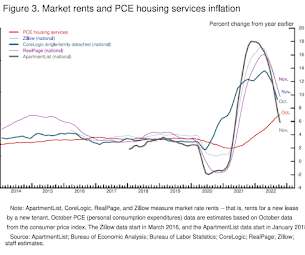

Image courtesy of StockCharts.Com. The Federal Reserve posts a Transcript of Powell's Speech on Inflation and the Labor Market. Powell put a spotlight on core Personal Consumption Expenditures (PCE) inflation, noting that it is stubbornly high despite the Fed's rate hikes. Key Powell Comments (Emphasis Mine) Twelve-month core PCE inflation stands at 5.0 percent in our October estimate, approximately where it stood last December when policy tightening was in its early stages.

Wealth Management

NOVEMBER 30, 2022

Seniors are prime targets for scammers looking to cheat them out of their money—often to the tune of tens of thousands of dollars.

Nerd's Eye View

NOVEMBER 30, 2022

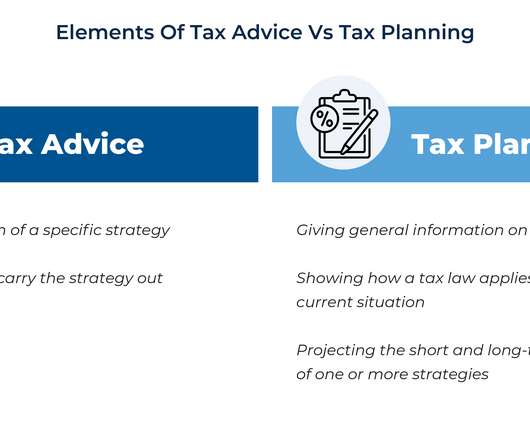

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden. And yet, despite the prominent role of taxes in financial planning, advisors are often prohibited by their compliance departments from making recommendations for a specific course of action on

Wealth Management

NOVEMBER 30, 2022

Data reflects effects of the COVID-19 pandemic and recent tax law changes.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

NOVEMBER 30, 2022

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Boston based on information collected on or before November 23rd, 2022." Economic activity was about flat or up slightly since the previous report , down from the modest average pace of growth in the prior Beige Book period. Five Districts reported slight or modest gains in activity, and the rest experienced either no change or slight-to-modest declines.

Wealth Management

NOVEMBER 30, 2022

Matthew Tuttle's ETF lineup was acquired by AXS Investments. He'll no longer serve as portfolio manager of SARK and more than two dozen other funds.

Abnormal Returns

NOVEMBER 30, 2022

Podcasts Kenny Malone and Greg Rosalsky talk with Yale economist James Choi about his paper "Popular Personal Financial Advice Versus The Professors." (npr.org) Michael Klein talks with Laura Gee at Tufts University about the state of charitable giving in the U.S. (econofact.org) Aging More Americans are living alone as they reach retirement age. (nytimes.com) Why you should talk to your parents about their money.

Wealth Management

NOVEMBER 30, 2022

Innovative technology, by design, is built around people to bridge the workflow between those inside and outside sponsor firms.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

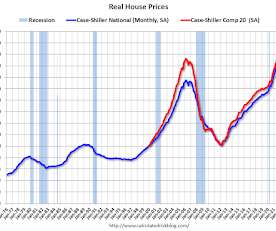

Calculated Risk

NOVEMBER 30, 2022

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.3% Below Peak Excerpt: It has been over 16 years since the bubble peak. In the Case-Shiller release yesterday, the seasonally adjusted National Index (SA), was reported as being 62% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 12% above the bubble peak (and historically there has been an upward slope to real house prices).

Wealth Management

NOVEMBER 30, 2022

Like with other property types, investment sales volume on lodging properties has taken a hit as uncertainties mount.

Mish Talk

NOVEMBER 30, 2022

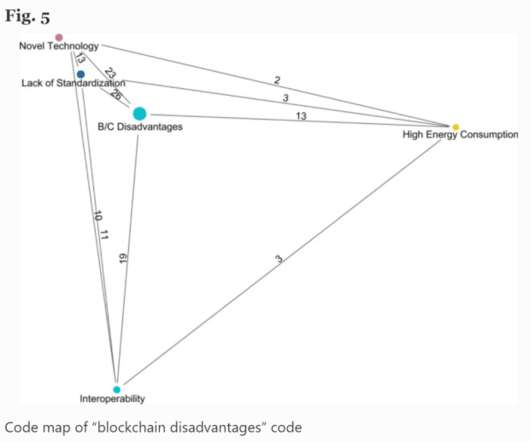

Blockchain Scrapheap The Tech Monitor reports IBM and Maersk Scrap Blockchain Trade Platform TradeLens IBM and logistics company Maersk have called time on TradeLens, the blockchain-backed supply chain platform that came online for the first time in 2018, citing a “lack of global industry collaboration” for its demise. It is due to cease operations early next year, and the second IBM-backed blockchain trade platform to get the chop this year.

Wealth Management

NOVEMBER 30, 2022

The Wall Street Journal looks at the history of pyramid in Memphis, Tenn., that now houses a massive Bass Pro Shop. The U.S. has seen $71.9 billion in industrial property sales so far in 2022, according to CommercialEdge. These are among today’s must reads from around the commercial real estate industry.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Mish Talk

NOVEMBER 30, 2022

Really Worried about IRA Eurointelligence writes Industry is Really Worried about IRA. Whether you talk to European industrialists in Brussels or German industrialists in Berlin, you get the same message these days. They are really worried about the US inflation reduction act. At the BDI conference in Berlin, it was the dominant subject. FAZ quotes the president of the German federation of industry as saying that more than a fifth of German medium-sized companies they had polled were considering

Wealth Management

NOVEMBER 30, 2022

These funds saw the most activity over the past 30 days.

Calculated Risk

NOVEMBER 30, 2022

From the BEA: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), Third Quarter 2022 Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the third quarter of 2022 , according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.

Wealth Management

NOVEMBER 30, 2022

The regulatory agency released an update Wednesday on its targeted sweep of firms’ supervision of options recommendations launched in August 2021, offering more pointed questions for registrants.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

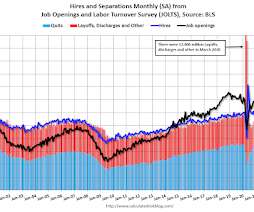

Calculated Risk

NOVEMBER 30, 2022

From the BLS: Job Openings and Labor Turnover Summary The number of job openings edged down to 10.3 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month the number of hires and total separations changed little at 6.0 million and 5.7 million, respectively. Within separations, quits (4.0 million) and layoffs and discharges (1.4 million) changed little. emphasis added The following graph shows job openings (black line), hires (dark blue), L

Wealth Management

NOVEMBER 30, 2022

Jackson Wood of Freedom Day Solutions discusses how how he and his firm have used podcasts, YouTube and Instagram to connect with NextGen investors.

Calculated Risk

NOVEMBER 30, 2022

From the NAR: Pending Home Sales Declined 4.6% in October Pending home sales slid for the fifth consecutive month in October, according to the National Association of REALTORS®. Three of four U.S. regions recorded month-over-month decreases, and all four regions recorded year-over-year declines in transactions. The Pending Home Sales Index (PHSI) , a forward-looking indicator of home sales based on contract signings, sank 4.6% to 77.1 in October.

Wealth Management

NOVEMBER 30, 2022

VanEck's Ed Lopez details recent trends in the capital markets, and how they can become opportunities for growth.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Reformed Broker

NOVEMBER 30, 2022

Big Tech may remain high through year end, says Ritholtz CEO Josh Brown from CNBC. The post Clips From Today’s Closing Bell appeared first on The Reformed Broker.

Wealth Management

NOVEMBER 30, 2022

The focus will return to high net worth and ultra high net worth clients.

Calculated Risk

NOVEMBER 30, 2022

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, down from 240 thousand last week. • Also, at 8:30 AM, Personal Income and Outlays, October 2022. The consensus is for a 0.4% increase in personal income, and for a 0.8% increase in personal spending.

Wealth Management

NOVEMBER 30, 2022

A long-overdue ethics reform would be a useful final step for outgoing House Speaker Nancy Pelosi.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content