The WealthStack Podcast: Unpacking The State of CRM with Doug Fritz

Wealth Management

SEPTEMBER 6, 2024

F2 Strategy's Doug Fritz discusses how the role of the CRM has evolved.

Wealth Management

SEPTEMBER 6, 2024

F2 Strategy's Doug Fritz discusses how the role of the CRM has evolved.

Calculated Risk

SEPTEMBER 6, 2024

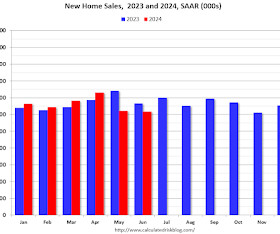

Today, in the Calculated Risk Real Estate Newsletter: Catching Up: New Home Sales Increased to 739,000 Annual Rate in July Brief excerpt: I'm back from Africa! I’ll be catching up on recent data over the next few days, and I’ll post some photos / videos from my trip. Last week the Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 739 thousand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 6, 2024

The lead enrichment provider also won a Wealthie award, CAIS has a new CTO and feature updates at interVal.

Abnormal Returns

SEPTEMBER 6, 2024

Strategy Three reasons why the stock market declines. (awealthofcommonsense.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That." (ritholtz.com) Semiconductors Trying to put a valuation on Nvidia ($NVDA). (aswathdamodaran.blogspot.com) TSMC's ($TSM) Arizona plant is on track for 2025 production. (bloomberg.com) Export controls are not keeping Nvidia ($NVDA) chips out of China.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

SEPTEMBER 6, 2024

Morgan Stanley will pay the fine to settle the investigation by the Massachusetts Securities Division.

Calculated Risk

SEPTEMBER 6, 2024

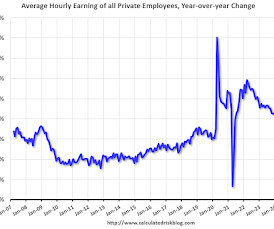

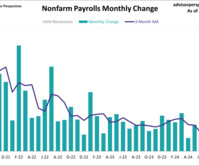

The headline jobs number in the August employment report was below expectations, and June and July payrolls were revised down by 82,000 combined. The participation rate and the employment population ratio were unchanged, and the unemployment rate decreased to 4.2%. Construction employment increased 34 thousand and is now 665 thousand above the pre-pandemic level.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious activity to Treasury's Financial Crimes Enforcement Network, with firms having until January 1, 2026 to comply with the rule.

Calculated Risk

SEPTEMBER 6, 2024

From the BLS: Employment Situation Total nonfarm payroll employment increased by 142,000 in August, and the unemployment rate changed little at 4.2 percent , the U.S. Bureau of Labor Statistics reported today. Job gains occurred in construction and health care. The change in total nonfarm payroll employment for June was revised down by 61,000, from +179,000 to +118,000, and the change for July was revised down by 25,000, from +114,000 to +89,000.

A Wealth of Common Sense

SEPTEMBER 6, 2024

I bought a Peloton exercise bike during the early days of the pandemic. It’s convenient and the technology is pretty neat.1 But I never would have purchased shares in the company. I have a rule of thumb that anything new that’s fitness-related is a fad. I’ve seen far too many fad diets and fancy exercise equipment or videos come and go over the years.

Calculated Risk

SEPTEMBER 6, 2024

From BofA: Since our last weekly publication, the 3Q GDP tracking estimate went down three tenths to 2.3% q/q saar while our 2Q GDP tracking estimate remains unchanged at 3.0% q/q saar since the second official estimate. [Sept 6th estimate] emphasis added From Goldman: The details of the trade balance report were somewhat softer than our previous assumptions while the details of the factory orders report were roughly in line with our expectations.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Million Dollar Round Table (MDRT)

SEPTEMBER 6, 2024

By Dave Crenshaw I’m going to share with you what I call “switch busters,” which are ways to reduce the number of times you switch activities in your day. If you can do that, you can radically decrease the amount of time it takes to complete pretty much everything. Most- and least-valuable activities The one thing that really hits the heart is all the hats you wear, and they create a lot of switches.

Alpha Architect

SEPTEMBER 6, 2024

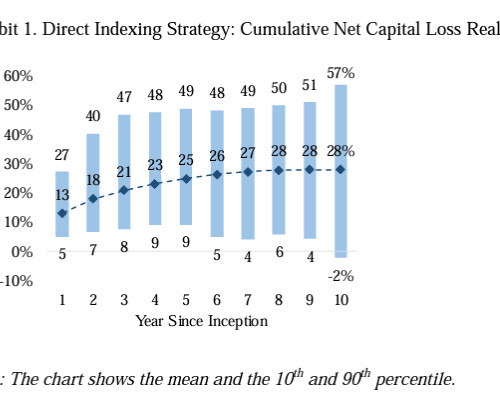

Joseph Liberman, Stanley Krasner, Nathan Sosner, and Pedro Freitas, authors of the September 2023 study “Beyond Direct Indexing: Dynamic Direct Long-Short Investing,” examined if the utilization of leverage and long-short strategies motivated by the literature on factor-based investing could improve on the tax benefits of direct indexing and tax-loss harvesting.

Advisor Perspectives

SEPTEMBER 6, 2024

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Truemind Capital

SEPTEMBER 6, 2024

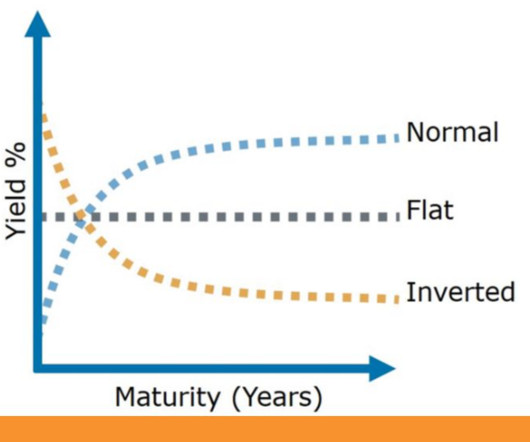

India’s 1-year G-Sec is trading at 6.75% and 10-year G-sec yields 6.85%. The difference is only 0.10%. 5-year G-sec is trading at 6.76%—almost at the same level as 1-year G-sec. This indicates that the yield curve is flat. There is a peculiar situation here. Usually, as the duration of any debt security increases (from the same issuer, in this case, it is GOI), the yield also goes up.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

SEPTEMBER 6, 2024

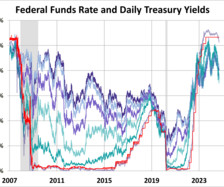

The yield on the 10-year note ended September 6, 2024 at 3.72%, the 2-year note ended at 3.66%, and the 30-year at 4.03%.

Trade Brains

SEPTEMBER 6, 2024

Reliance Industries Limited (RIL) recently outlined its future strategies at its Annual General Meeting (AGM). As a leading force in India’s business sector, RIL highlighted its plans for growth across retail, digital services, and energy. The company’s innovative approaches and strategic investments underscore its commitment to driving substantial value.

Advisor Perspectives

SEPTEMBER 6, 2024

The world’s biggest asset manager is taking some chips off the table as markets enter a “new phase” of turbulence ahead of a Federal Reserve interest rate cutting cycle and the US presidential election.

Validea

SEPTEMBER 6, 2024

In today’s unpredictable financial landscape, investors are increasingly seeking ways to help mitigate risk. One strategy that can make sense is focusing on low beta stocks that also demonstrate solid fundamentals. Let’s explore the benefits of this approach and highlight some standout companies that fit the bill. Understanding Beta and Its Importance Beta is a measure of a stock’s volatility in relation to the overall market.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

SEPTEMBER 6, 2024

Recent changes to the FAFSA form and process include a simpler form, fewer questions and a revised eligibility formula. Our Bill Cass highlights what you need to know to apply for federal financial aid for college.

Validea

SEPTEMBER 6, 2024

In the vast ocean of investment strategies, momentum investing stands out as a surfboard that catches the biggest waves. Unlike its more intuitive cousins such as value or quality investing, momentum doesn’t rely on fundamental analysis of a company’s financials. Instead, it’s all about riding the wave of market sentiment. What is Momentum Investing?

Advisor Perspectives

SEPTEMBER 6, 2024

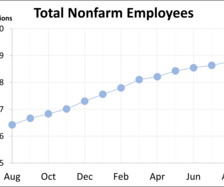

There is a general belief that there are four big indicators that the NBER Business Cycle Dating Committee weighs heavily in their cycle identification process. This commentary focuses on one of those indicators, nonfarm employment. August saw a 142,000 increase in total nonfarm payrolls and the unemployment fell to 4.2%.

Validea

SEPTEMBER 6, 2024

Here is the latest update for September from Validea’s market valuation tool. Rather than focusing on market-cap weighted indexes like the S&P 500, our tool focuses on the valuation of the average stock relative to history. We use the median of our investable universe of 2700 stocks to perform the calculation. The average stock got a little cheaper in August with the TTM PE Ratio falling to 21 from 21.5.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

SEPTEMBER 6, 2024

US Treasuries gained and traders ramped up their bets that the Federal Reserve will opt for a supersized interest-rate cut this month after a mixed report on the US labor market.

Random Roger's Retirement Planning

SEPTEMBER 6, 2024

Barron's dusted off the retirement bucket playbook in an article while also arguing that a 5% withdrawal rate in retirement can now be considered safe versus the more common 4%. Before I forget, read the comments on this one. Always read the comments. First to the buckets. They suggest two years worth of cash invested in cash proxies (my word, not theirs), 5-8 years in income producing securities like bonds and then put the rest in growth like the stock market.

Advisor Perspectives

SEPTEMBER 6, 2024

US hiring fell short of forecasts in August after downward revisions to the prior two months, a development likely to fuel ongoing debate over how much the Federal Reserve should cut interest rates.

Wealth Management

SEPTEMBER 6, 2024

From taxes to tariffs, several changes are being discussed on the campaign trail that would result in new benefits for some and new burdens for others.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

SEPTEMBER 6, 2024

Most people see “blockchain” and “funds” in the same sentence and immediately think of pools of money betting on cryptocurrencies like Bitcoin and Ether. That isn’t how Singapore sees the utility of distributed ledgers.

Advisor Perspectives

SEPTEMBER 6, 2024

OPEC+ is like a teabag – it only works in hot water. The late Robert Mabro, one of the savviest oil-market observers, liked to say the cartel only got the job done when it was under prolonged financial pain. To judge by its latest actions, OPEC+ has yet to realize it’s inside a warming kettle.

Advisor Perspectives

SEPTEMBER 6, 2024

The latest employment report showed 142,000 jobs were added in August, falling short of the expected addition of 164,000 new jobs. Meanwhile, the unemployment rate ticked lower to 4.2%.

Advisor Perspectives

SEPTEMBER 6, 2024

Candidate tax policies could affect municipal bonds, but the bigger picture is important too.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content