ATM: Investing Skill vs. Luck

The Big Picture

DECEMBER 6, 2023

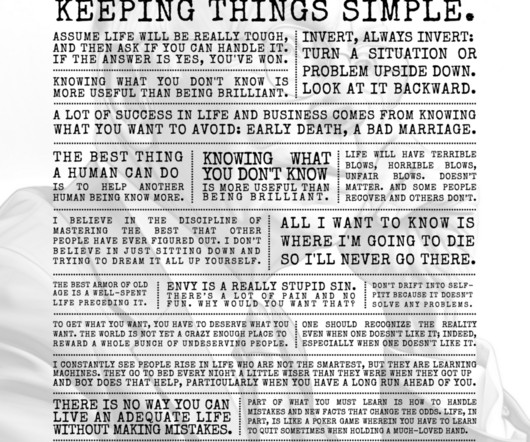

Investing Skill vs. Luck with Michael J. Mauboussin, Counterpoint Global (Dec 6, 2023) Is it better to be lucky or good? How much of a role does luck pay in investing? And how can you tell the difference between chance and skill? In this episode of At the Money, I speak with Michael Mauboussin. ~~~ About Michael J. Mauboussin: Michael Mauboussin is head of Consilient Research at Counterpoint Global, Morgan Stanley Investment Management.

Let's personalize your content