Tuesday links: higher rates as competition

Abnormal Returns

SEPTEMBER 5, 2023

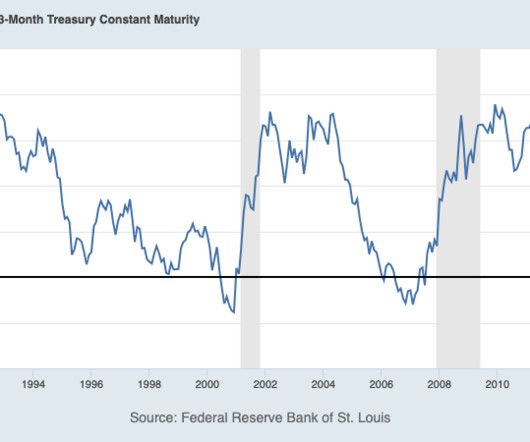

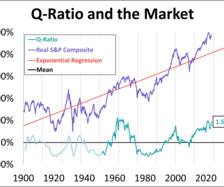

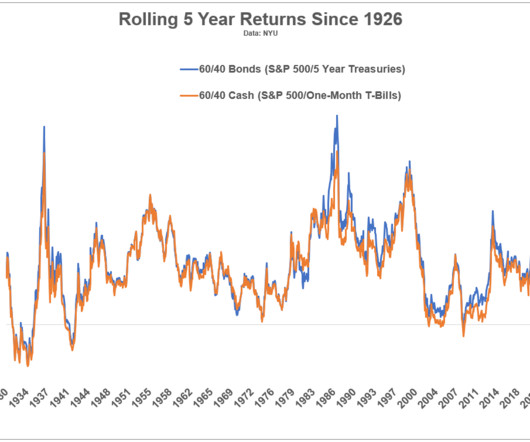

Rates How an inverted yield curve affects stock and bond market returns. (mrzepczynski.blogspot.com) Utility stocks are battling higher fixed income yields. (wsj.com) High real yields are hurting the Federal budget deficit. (axios.com) Strategy Dollar-cost averaging makes downturns less painful. (awealthofcommonsense.com) On the mismatch between our investment horizons and our actual behavior.

Let's personalize your content