Tuesday links: the likelihood of FOMO

Abnormal Returns

MARCH 5, 2024

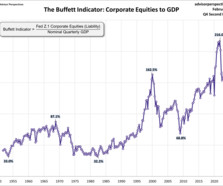

Markets Industrials are leading. (allstarcharts.com) Congratulations, goldbugs. (seeitmarket.com) Strategy Being right is more important than being first. (microcapclub.com) Being fearful is no way to invest. (dariusforoux.com) Why you should write more. (investmenttalk.co) Crypto Spot Bitcoin ETFs are raking in the assets. (wsj.com) Microstrategy ($MSTR) is trading at a big premium to its Bitcoin holdings.

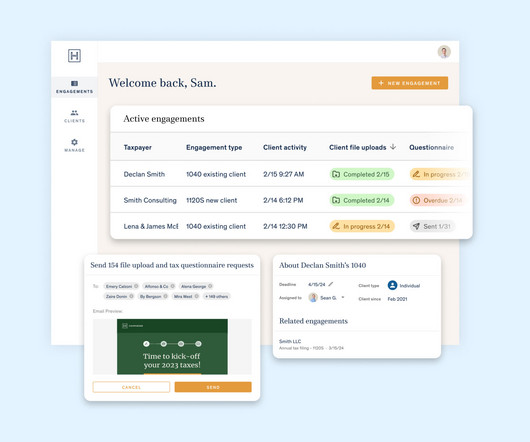

Let's personalize your content