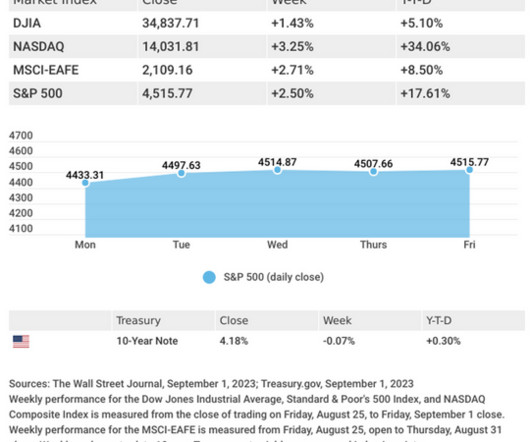

Weekly Market Insights – September 4, 2023

Cornerstone Financial Advisory

SEPTEMBER 5, 2023

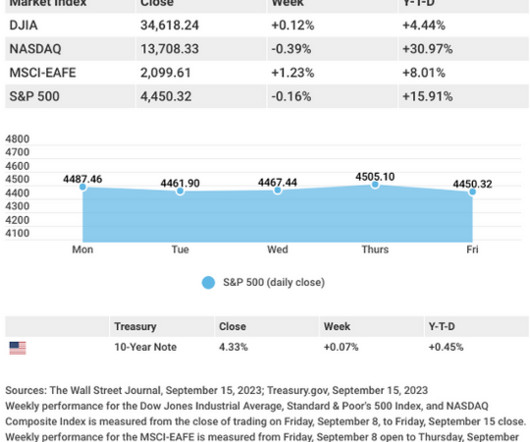

Weekly Market Insights: September Stocks Open In Positive Territory Presented by Cornerstone Financial Advisory, LLC Falling bond yields–spurred by weak economic data–helped lift stocks to weekly gains. A downward revision of Q2 economic growth and fresh signs of a cooling labor market reversed the recent rise in bond yield.

Let's personalize your content