Investing strategies for bear markets

Nationwide Financial

OCTOBER 12, 2022

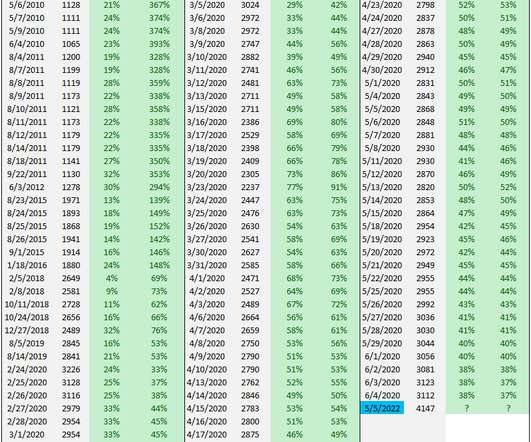

Of course, earnings and profits are dependent to a large extent on economic performance (although not for all companies and not all in the same manner.). The economic cycle of expansion and recession does affect the stock market by affecting company earnings. This can help temper some fluctuations in overall portfolios.

Let's personalize your content