What Does the Market “Know” ?

The Big Picture

AUGUST 19, 2022

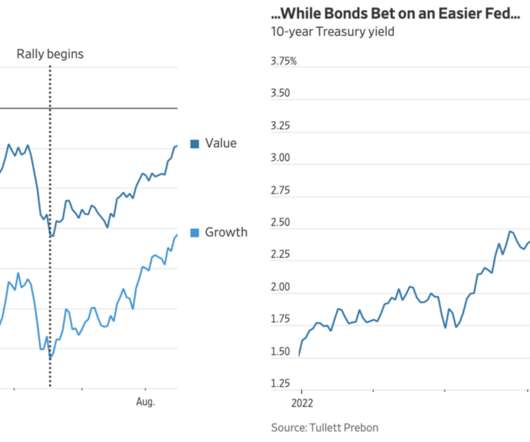

I am not a fan of that framing; my preference is to note that different investors in equity and fixed income have very different risk tolerances stocks, time horizons, and investment goals. But rational people can reasonably disagree on anything market-related — after all, someone has to be on the other side of your trade.

Let's personalize your content