Compliance Consultant Launches Video Marketing Business

Wealth Management

JANUARY 9, 2024

Sander Ressler's Vidiance aims to deliver client testimonials compliant with SEC marketing rules.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 9, 2024

Sander Ressler's Vidiance aims to deliver client testimonials compliant with SEC marketing rules.

Wealth Management

SEPTEMBER 13, 2022

Speakers at the Future Proof wealth festival on how compliance can move a cost of doing business to a valuable business function to be marketed—and monetized.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

OCTOBER 11, 2023

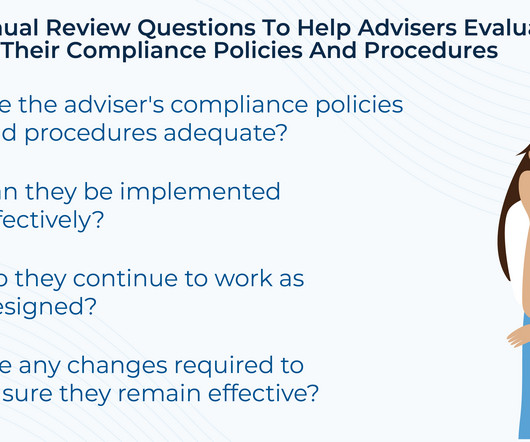

However, this "Compliance Rule" did not technically require that the annual compliance review of policies and procedures be conducted in writing, even though advisers were required to maintain records if they did document such reviews in writing! the SEC's new marketing rule). the SEC's new marketing rule).

Wealth Management

DECEMBER 22, 2022

While the marketing rule went into effect last year, advisors had until November 2022 to get into compliance.

Advertiser: G-P

Build and refine your global compliance program to boost speed-to-hire and minimize international growth risks. If your company wants to test new markets and hire top-tier global talent, remember that the first steps are the most crucial. Every global growth to-do list should begin with compliance.

Nerd's Eye View

OCTOBER 29, 2024

So, whether you're interested in learning about developing a profitable client niche, how to effectively raise fees to match the planning value being provided, or marketing strategies that can be used to rapidly gain clients within a niche, then we hope you enjoy this episode of the Financial Advisor Success podcast, with Travis Hornsby.

Wealth Management

JUNE 6, 2024

Fintello's Deepak Patel discusses advisor concerns about how to use social media and dealing with compliance.

Nerd's Eye View

OCTOBER 30, 2024

But the downside to using the "conflict-free" label was put into sharp focus recently, when the SEC announced that it had fined several RIA firms for violating its Marketing Rule.

Nerd's Eye View

JUNE 5, 2024

If they want to continue to grow and increase their capacity, they'll need to make several important decisions and address a plethora of legal and compliance requirements not only to avoid potential legal issues but also to ensure that their business will continue to operate smoothly.

Advertisement

Learn the seven must-have features that you can press vendors to showcase, and discover the secrets to accelerate your time to market while maintaining compliance controls and risk management standards.

Wealth Management

MAY 2, 2023

The company’s website, automation and text messaging platforms will now be connected in one unified system, with new pricing and a single compliance platform.

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

Nerd's Eye View

FEBRUARY 1, 2023

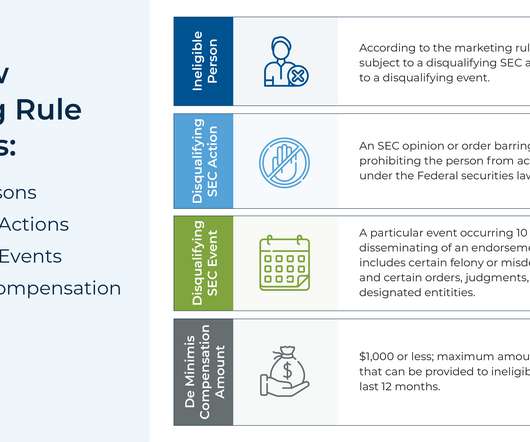

In recent years, though, the growing use of lead-generation services, advisor networks, and ‘advisor-matching’ tools, referred to as “operators” in the Marketing Rule’s Adopting Release, has given rise to third-party solicitation activity that often looks more like advertising directly to prospective clients.

Nerd's Eye View

JANUARY 3, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with a recent survey indicating that a majority of advisors are viewing new client acquisition as their primary challenge in the current competitive environment for financial advice (followed by compliance and technology management) and suggests (..)

Nerd's Eye View

JUNE 17, 2024

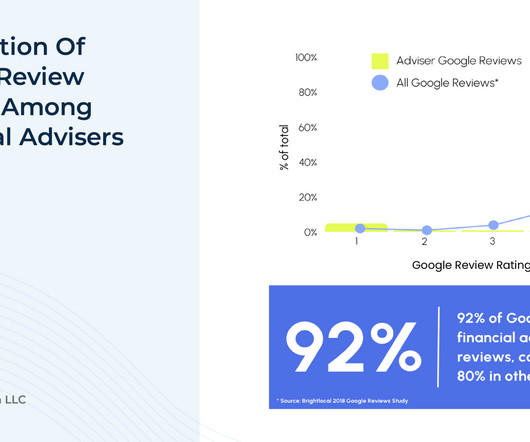

Nonetheless, fewer than 10% of SEC-registered investment advisers report using them, even though the SEC’s updated investment adviser marketing rule allows financial advisors to proactively encourage testimonials (from clients), use endorsements (from non-clients), and highlight their own ratings on various third-party review sites.

Wealth Management

JUNE 10, 2025

RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth Jalina Kerr of Charles Schwab shares how the most adaptive firms are expanding beyond portfolio management, into areas like estate and tax planning.

Nerd's Eye View

MARCH 14, 2025

Which, if implemented under the new administration, could provide relief for investment advisers, particularly smaller firms that already have to balance compliance with client service, marketing, and the other duties that go into running a firm.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Wealth Management

SEPTEMBER 19, 2022

4 compliance date. In a newly-released risk alert, the commission’s Department of Examinations highlighted potential areas of focus for the rule, which has a Nov.

Wealth Management

FEBRUARY 5, 2024

Some compliance experts took issue with a recent Michael Kitces podcast that appeared to endorse a marketing strategy that includes soliciting and reposting clients’ Google reviews.

Advisor Perspectives

SEPTEMBER 10, 2024

How do you convey your value and convince qualified prospects that hiring you will be a worthwhile investment without breaching your compliance obligations as an advisor?

Wealth Management

NOVEMBER 3, 2022

The commission’s rule update on advertising and marketing reaches its compliance date on Friday, and experts are warning firms to make sure they’re ready.

Abnormal Returns

NOVEMBER 4, 2024

citywire.com) Compliance The SEC is taking a closer look at AI use by RIAs. wealthmanagement.com) Some financial advisers are pushing the limits on marketing with their 'media' appearances. (businesswire.com) Niches If everyone is your prospect (or client), then no one is.

Wealth Management

JUNE 17, 2025

Mariner launched its independent channel in 2020, offering back-office support, practice management, marketing, investment and compliance to affiliated advisors. He has also held senior roles at LPL Financial and Edelman Financial Engines. The Overland Park, Kan.-based

Abnormal Returns

NOVEMBER 7, 2022

Podcast Michael Kitces talks with Mindy Crary, owner of Creative Money, about making it clear about fiduciary marketing. wsj.com) Advisers are scrambling to get into compliance with new advertising rules. kitces.com) Daniel Crosby talks with Kurt Brown, CEO and CIO, of TownSquare Capital.

Wealth Management

JUNE 10, 2025

Number 8860726. Registered in England & Wales with number 01835199, registered office 5 Howick Place, London, SW1P 1WG.

Wealth Management

DECEMBER 15, 2022

Former Entreda CEO Sid Yenamandra has co-founded a venture studio to drive data governance and compliance tech innovation and help startups in the field reach market more efficiently.

Midstream Marketing

NOVEMBER 26, 2024

Key Highlights Find out why marketing is important for RIAs in the current hard market. Learn smart ways to connect with RIAs, such as content marketing and digital strategies. Understand why following the rules is important in RIA marketing and read the best practices. Good marketing is important for growth.

XY Planning Network

AUGUST 5, 2024

In today's digital age, marketing—especially digital marketing—is crucial to any business strategy. As marketing evolves, so do the regulations designed to prevent fraud and ensure fair practices. So, what does this mean for RIAs regarding their marketing efforts and staying compliant?

Abnormal Returns

JUNE 10, 2024

bloomberg.com) Daniel Crosby talks advisor marketing with Robert Sofia who is the CEO of Snappy Kraken. fa-mag.com) The latest in financial advisortech including the launch of compliance archiving startup Archive Intel. kitces.com) Practice management What you need to know compliance-wise before you hire your first advisory employee.

Carson Wealth

MAY 7, 2025

If you give property to a qualified organization, you can generally deduct the fair market value of the property at the time of the contribution. Disclosures: If you receive any goods or services in return for your donation, you can only deduct the amount of your donation that exceeds the fair market value of what you received.

Carson Wealth

NOVEMBER 4, 2024

We will say this about the election — we could see some market volatility this week, although the extra days it took to determine the winner in 2020 actually saw market strength. Bottom line, investors have been quite spoiled with a historic year for markets and it is important to remember that stocks indeed can go down.

Carson Wealth

DECEMBER 2, 2024

Fortunately, all we have to do is look at the data to see they once again could be on the wrong end of this amazing bull market. The past few weeks we’ve discussed why we think this bull market is alive and well, but we also see no major reasons to expect the economy to fall into a recession in 2025. on average. on average.

Carson Wealth

MARCH 17, 2025

Understanding Market Corrections The S&P 500 moved into a correction on Thursday of last week, defined as a close at least 10% below the indexs recent closing high. Historically, the S&P 500 has come fully out of the correction about three times as often as it has entered a bear market. corrections per year since 1928.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors (..)

Midstream Marketing

OCTOBER 30, 2024

RIAs need to update their marketing plans to stay ahead. A strong brand identity is key to getting and keeping clients in this tough market. RIAs must understand and follow SEC marketing rules to meet their ethical and legal needs. Understanding the Marketing Landscape for RIAs The world of financial advice is changing fast.

Nerd's Eye View

AUGUST 5, 2022

From there, we have several articles on advisor content marketing: How advisors can generate topic ideas for content to engage their target audience. Why campaigns that combine “sunk marketing” with “momentum marketing” can lead to greater results for advisors.

Abnormal Returns

JULY 22, 2024

fastcompany.com) Advisers Off-channel communications surpassed marketing as the leading compliance concern for RIAs. (citywire.com) Retirement A Q&A with Wade Pfau about the challenges of spending in retirement. thinkadvisor.com) Why staggered retirements make a lot of sense.

The Big Picture

APRIL 22, 2023

This week, we speak with Brian Hamburger , founder and chief executive officer of the business / regulatory compliance consultancy MarketCounsel , as well as the founder and chief counsel of the Hamburger Law Firm, a boutique law firm that focuses on investment and securities industry matters.

Midstream Marketing

DECEMBER 26, 2024

Forefield Advisor Marketing is a powerful suite of tools for financial professionals, aimed at enhancing client engagement and driving business growth. This blog post will explore the importance of advisor marketing in todays evolving financial services industry, focusing on strategies for success.

Indigo Marketing Agency

FEBRUARY 19, 2025

Why Hiring a Digital Marketing Agency for Financial Services Is the Key to Growing Your Business In the mid-2000s, digital marketing was just one of many mediums local businesses were starting to utilize to growalong with newspaper ads, phone book ads, direct mail ads, radio and TV ads, billboards, door-to-door sales, and more.

Nerd's Eye View

MAY 2, 2025

Also in industry news this week: A majority of financial advisory clients feel reassured by their advisor in the current market environment, according to a recent survey, with advisors pursuing a mix of 'high touch' and 'low touch' communication methods A FINRA proposal that purports to streamline regulatory obligations regarding outside business activities (..)

Carson Wealth

APRIL 21, 2025

One potential positive is market breadth has held up quite well in the face of the near-bear market. Powell’s prepared remarks started off by saying the economy was/is in good shape, including labor markets and the inflation picture. The labor market is not a source of inflationary pressure.

Nerd's Eye View

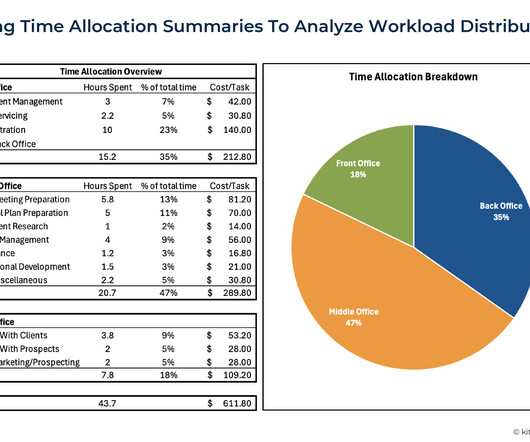

FEBRUARY 17, 2025

In order to deliver the best service to their clients, financial advisors often take on responsibilities beyond giving financial advice, including compliance, marketing, team management, and other operational duties.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content