Weekly Market Insights – October 2, 2023

Cornerstone Financial Advisory

OCTOBER 2, 2023

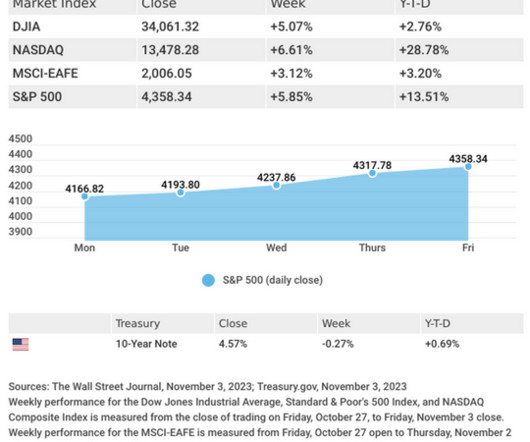

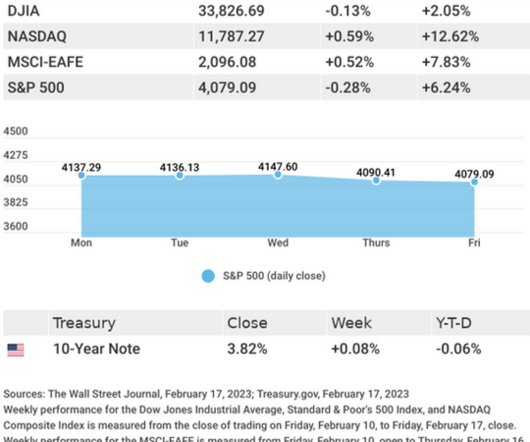

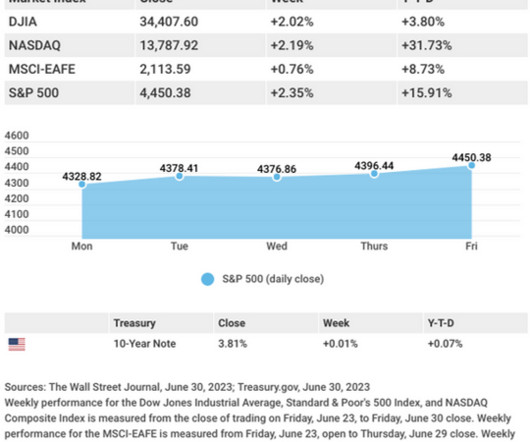

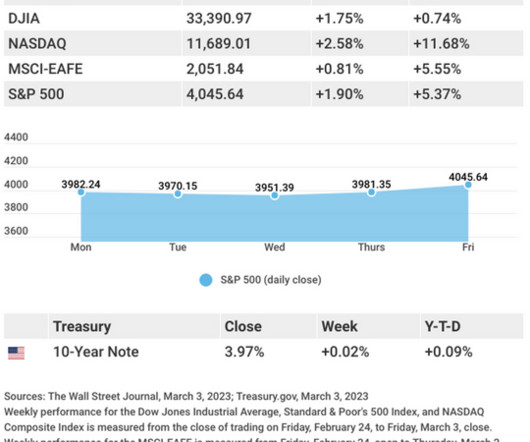

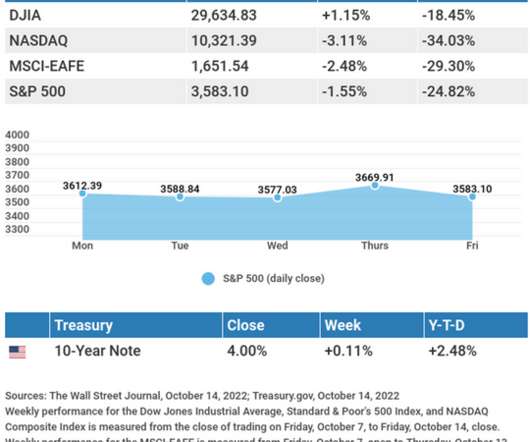

Weekly Market Insights: Bond Yields Rise; Government Shutdown Looms Presented by Cornerstone Financial Advisory, LLC Rising bond yields and government shutdown fears left stocks in mostly negative territory for the week. But the rally faded as traders fixated on a potential government shutdown. Answer: She bought house numbers.

Let's personalize your content