AI Meeting Notes Tools For Financial Advisors: Solo Productivity Vs Associate Advisor Development?

Nerd's Eye View

MARCH 17, 2025

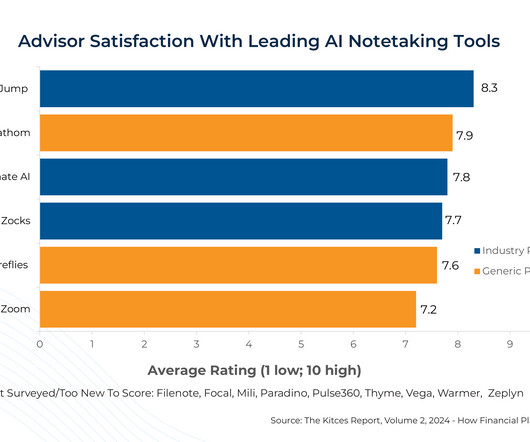

Instead, it's being allocated to far more specific – but still very relevant and helpful – use cases that don't replace professional service providers and instead simply leverage their time to be even more efficient. For which industry-specific providers are building the entire advisor-CRM-integrated workflow.

Let's personalize your content