How Listing Fees On Advisory Firm Websites Can Clearly Communicate The Cost (And Value) Of Planning

Nerd's Eye View

MARCH 20, 2023

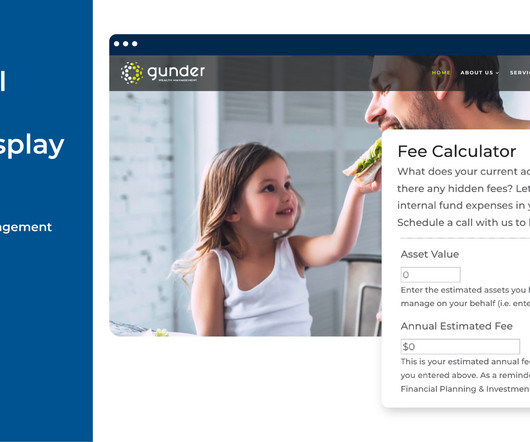

But even as fee-only financial planning has gained in popularity and advisory firm websites have become ubiquitous, it can still sometimes be hard for prospective clients to determine how much they would pay for advice before actually reaching out to the firm.

Let's personalize your content