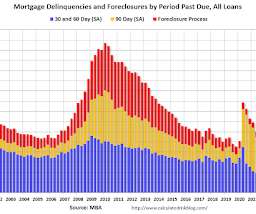

MBA: "Mortgage Delinquencies Decrease in the Second Quarter of 2022"

Calculated Risk

AUGUST 11, 2022

From the MBA: Mortgage Delinquencies Decrease in the Second Quarter of 2022 The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.64 unemployment rate seems to be the best gauge of loan performance. emphasis added Click on graph for larger image.

Let's personalize your content