Why Certified Financial planners are the 1st choice Globally for Personal Assets Management

International College of Financial Planning

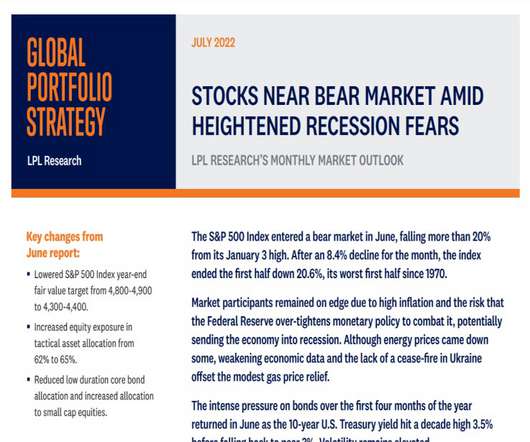

JULY 30, 2022

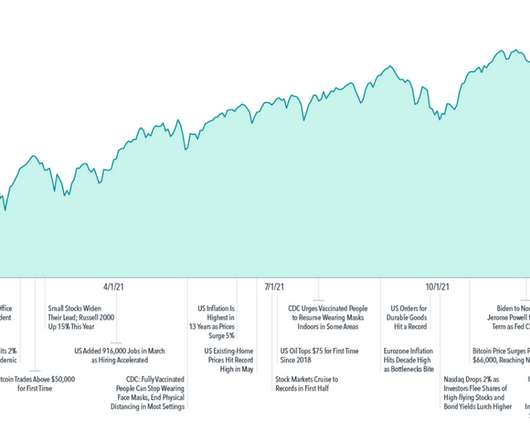

They can help you better prepare for future economic challenges and prevent you from going into debt. The key to building wealth is diversification and asset allocation. And the ability to adjust your asset allocation as your financial goals change strategically.

Let's personalize your content