Constructing a More Efficient Investment Portfolio with Alternatives

Wealth Management

MARCH 25, 2024

Adding private real estate boosts returns and quells volatility.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

alternative-investments constructing-more-efficient-investment-portfolio-alternatives

alternative-investments constructing-more-efficient-investment-portfolio-alternatives

Wealth Management

MARCH 25, 2024

Adding private real estate boosts returns and quells volatility.

Random Roger's Retirement Planning

MARCH 29, 2024

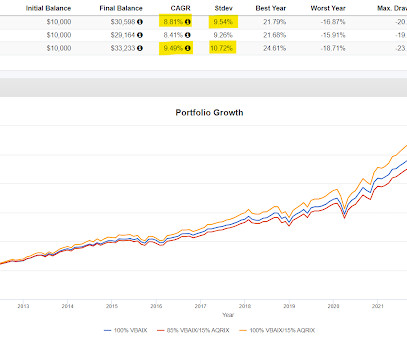

Return Stacked ETFs wrote a short paper in support of their ETF suite about how to incorporate return stacking into a portfolio. For anyone new, return stacking, also known as capital efficient, involves leverage to build a diversified portfolio. The idea is not that you would put 100% of a portfolio into that fund.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Random Roger's Retirement Planning

NOVEMBER 22, 2023

As a quick explainer, return stacking is the use of leverage in a portfolio to add an alternative asset class/strategy on top of the more typical mix of stocks and bonds. This is usually done with the intention of adding an uncorrelated asset class to a portfolio in an attempt to reduce portfolio volatility.

Brown Advisory

SEPTEMBER 6, 2022

Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations. We also document those objectives and preferences in an investment policy statement (IPS) because they represent the cornerstones of an organization’s investment strategy. Tue, 09/06/2022 - 10:30. 70–90% vs. 80%). RISK AND RETURN.

WiserAdvisor

MARCH 13, 2024

Below are 5 Pillars of retirement planning that should be a part of your retirement plan: Pillar 1: Investment planning Investment planning is one of the most vital pillars of retirement planning, as it offers a roadmap to align your financial resources with your risk appetite and long-term goals.

Random Roger's Retirement Planning

JANUARY 14, 2024

Long time readers might know my fascination with Nassim Taleb's idea about barbelling portfolios to concentrate risk into a small slice while having the vast majority in safe assets. It turns out Portfoliovisualizer can model actual Bitcoin which is more accurate than using Grayscale Bitcoin Trust. So this is interesting.

Random Roger's Retirement Planning

NOVEMBER 13, 2022

The TYA literature makes it clear that the fund is intended to be a tool for capital efficiency. We've been talking about the concept of capital efficiency here for ages, where you get the effect of a full portfolio with a smaller allocation to risk assets, long before the term capital efficiency became common.

Brown Advisory

APRIL 20, 2022

Good Preparation Leads to a Good Audit Experience: What to Expect from Your Investment Advisor mhannan Wed, 04/20/2022 - 06:03 After an extended period of strong returns that began in 2009, many not-for-profit (NFP) organizations find themselves increasingly challenged to earn the traditional target of an inflation-adjusted 5% annual spending rate.

Random Roger's Retirement Planning

OCTOBER 30, 2023

A little over a year ago I tweaked the name of this site to reference "portfolio lab" as market conditions have in my opinion evolved such that investors can't necessarily completely rely on how portfolios had been constructed in the past. Portfolio theory is also interesting and fun for me so there you go.

WiserAdvisor

DECEMBER 15, 2023

Consider consulting with a professional financial advisor who can help you understand and employ suitable retirement investment strategies based on your income, age, and retirement expectations. It also ensures that your portfolio caters to your risk appetite, irrespective of whether you are risk-averse or risk-tolerant.

Trade Brains

NOVEMBER 22, 2023

1996 it constructed its first 0.27 Over the years, the Company has expanded its presence in over 17 countries, having constructed over 12,700+ WTGs with 20.1 They are also 40-43% more efficient than the mid-variant offered by the Company. The private players include the likes of ACC, Bajaj, Hero, ITC, and a lot more.

Random Roger's Retirement Planning

DECEMBER 5, 2023

Early in October we looked at a portfolio concept from Bob Elliott who runs the Unlimited HFND Multi-Strategy Return Tracker ETF (HFND). I'm not sure if the Simple Game Plan portfolio that I am referring to is what HFND is but here is how I recreated it two months ago. Portfolio 1 is 80% VOO, 10% ASFYX, 10% BTAL.

Brown Advisory

MAY 3, 2023

In our last episode , Sid and Erika did a moderately deep dive on Artificial Intelligence, and with Mike they look more specifically at the business risks and opportunities stemming from AI, and in particular some of the emerging competitive dynamics between tech giants Google and Microsoft that are driving progress at a seemingly breakneck pace.

Brown Advisory

MAY 3, 2023

In our last episode , Sid and Erika did a moderately deep dive on Artificial Intelligence, and with Mike they look more specifically at the business risks and opportunities stemming from AI, and in particular some of the emerging competitive dynamics between tech giants Google and Microsoft that are driving progress at a seemingly breakneck pace.

Trade Brains

SEPTEMBER 22, 2022

Whether it be Virat Kohli’s next century, or more Indian billionaires crossing the $ 100 billion net worth mark; we all want that soon. How do you go about picking investment-worthy companies among this large pool? stake in the construction company. Top Stocks Under Rs 100: Figure 100 holds a separate fan base around the world.

Trade Brains

OCTOBER 25, 2023

Force Motors Vs Olectra Greentech : As the automotive industry accelerates its transition towards a more sustainable and eco-friendly future, two prominent companies in the commercial vehicle sector have been at the forefront of this transformation. This can help the firm increase its operational as well as marketing and sales efficiency.

Trade Brains

JUNE 17, 2023

These companies try to overcome capital adequacy problems, low productivity, regulation, shortages of raw materials, and other factors that make them more capital-intensive in nature to run their businesses. It offers a portfolio of products for heating, cooling, water and waste management, and specialty chemicals. billion) in FY21.

Trade Brains

JANUARY 2, 2024

Both Companies have a very diverse portfolio of products ranging from Vehicle Starter systems to Driver Information Systems. Now let’s learn more about these Companies & understand their market. Starter Motors & Alternators: The Company supplies Starter motors with Gear Reduction Technology (GRS). Minda in 1985.

Brown Advisory

JUNE 3, 2015

The boom in sustainable strategies has made it far easier than even five years ago to construct a sustainable portfolio across asset classes—from stocks to fixed income to compelling private equity alternatives. No question about it, sustainable investing is a growth industry. That’s up a staggering 88% from 2010.

Trade Brains

DECEMBER 18, 2023

With this belief and with the vision to be the most valuable company in the recycling space globally by 2026, Gravita India has been recycling and creating value for its stakeholders for more than 3 decades. The post Fundamental Analysis of Gravita India – Future Plans & More appeared first on Trade Brains.

The Big Picture

MARCH 5, 2024

David Snyderman has put together an incredible career in fixed income, alternative credit, and really just an amazing way of looking at risk and trade structure and how to figure out probabilistic potential outcomes rather than playing the usual forecasting and macro tourist game. . ~~~ This is not an official transcript. All four years.

Brown Advisory

JUNE 2, 2021

However, with the tremendous growth in the labeled bond market and the proliferation of new and innovative financing structures, it has become all the more critical to conduct in-depth due diligence in order to ensure that labeling does not lose its impact. IS IT TOO EASY TO BE GREEN, SOCIAL OR SUSTAINABLE? DO DUE DILIGENCE!

Brown Advisory

JUNE 2, 2021

However, with the tremendous growth in the labeled bond market and the proliferation of new and innovative financing structures, it has become all the more critical to conduct in-depth due diligence in order to ensure that labeling does not lose its impact. IS IT TOO EASY TO BE GREEN, SOCIAL OR SUSTAINABLE? DO DUE DILIGENCE!

The Big Picture

JANUARY 16, 2024

Cathy Marcus is co CEO and global COO of p GM Real Estate, a $208 billion investor in real estate, part of the giant real estate investment firm, PIM. There are few people in the world better situated to discuss commercial real estate investing from every perspective. Starting with your undergraduate work. I like architecture.

The Big Picture

AUGUST 15, 2023

Let’s talk a little bit about your alternative investments career. So that was my initial foray into the investment business. SEIDES: That was my true investment MBA. He said, “You’re not going to learn anything about investing. You just stay here for a couple more years.”

WiserAdvisor

FEBRUARY 12, 2024

Asset allocation is the primary building block of any investment strategy. It is the process of spreading investments across various asset classes to optimize the balance between risk and potential returns. This is the reason why some strategies are more successful than others. The primary asset classes include: a.

Random Roger's Retirement Planning

JANUARY 29, 2023

A common reason to have fixed income exposure, often 40% of a portfolio, is to help manage equity market volatility. Longer bonds were down just as much as the S&P 500 in 2022, the longest of bonds were down more. A 67% allocation to NTSX should equal 100% to VBAIX leaving 33% leftover in Portfolio 2 to put into something else.

WiserAdvisor

JANUARY 23, 2024

Here are five steps you can take to gauge your financial advisor’s performance: Step 1: Evaluate the performance of your investment portfolio Assessing the performance of your investment portfolio is a critical aspect of managing your financial well-being and ensuring that your money is working effectively toward your goals.

Trade Brains

DECEMBER 20, 2023

About Amines and their uses Aliphatic amines are formed when an aliphatic molecule replaces one or more hydrogen atoms from ammonia. They have a product portfolio of 100+ products which they cater to 20+ countries across the globe through their 20 individual production plants over three manufacturing sites covering over 110 acres of land.

Brown Advisory

JULY 1, 2016

Investment Perspectives | Real Returns achen Fri, 07/01/2016 - 06:00 One of the most penetrating and recurring questions we receive from clients is, “what is a reasonable long-term expectation for U.S. Still, investors need to incorporate a reasonable long-term assumption into their portfolio projections. stock market returns?”

Brown Advisory

JULY 1, 2016

Investment Perspectives | Real Returns. Since equities typically comprise the largest single component of a balanced portfolio, they are the greatest single determinant of overall returns for institutional and private clients alike. Still, investors need to incorporate a reasonable long-term assumption into their portfolio projections.

The Big Picture

JUNE 13, 2023

Mathieu Chabran is the co-founder of TIKEHAU Capital, a Paris-based alternative asset manager. I found this to be really a fascinating conversation about approaching the world of investing from a different angle. The exposure you get in investment banking, I was a leveraged finance banker by background. I think we learned a lot.

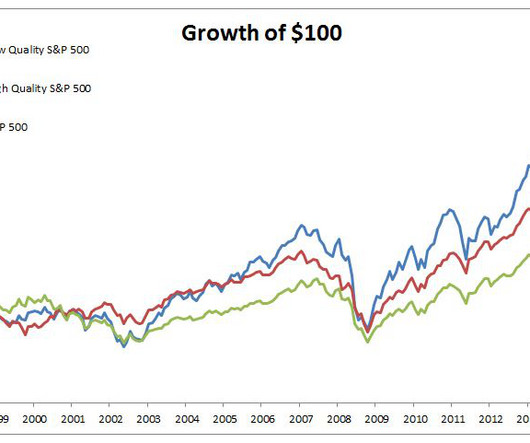

The Irrelevant Investor

MARCH 30, 2016

The buyer of a traditional cap-weighted index, like the S&P 500, puts a lot of faith in the Efficient Market Hypothesis. Is there a better way to construct an index? A way that puts less faith in the size of a company and more faith in its "economic footprint?" But is size all that matters?

Validea

NOVEMBER 15, 2023

Many equity investors, particularly in the small-cap space, are likely looking at their portfolio values and seeing very little growth, and possibly losses. But today’s investor, mostly due to structural efficiencies, technology, fees, optionality and tools, resources and investing education, is probably better off than ever before.

The Big Picture

AUGUST 16, 2022

If you’re all interested in macro investing, trend following, commodities, currencies, fixed income, various types of quantitative strategies, and most important of all, risk management, you’re going to find this conversation to be absolutely fascinating. John was one of our managers that we had, you know, our clients invest in.

The Big Picture

DECEMBER 20, 2022

His name is Robert Koenigsberger, and he has a fascinating career in emerging market, opportunistic and distressed debt investing. If you’re interested in what it’s like investing in emerging market debt, how that part of the investment firm has changed over the decades as the world itself has changed.

Good Financial Cents

FEBRUARY 15, 2023

Table of Contents Types of Investment Companies How to Choose an Investment Company 10 Best Investment Companies 1. Ally Invest 6. Investment management companies – firms that provide individual portfolio management and may work with other investment companies. Fidelity 3. Vanguard 4. Betterment 8.

The Big Picture

NOVEMBER 15, 2022

And so if it sounds like just two idiots talking about really interesting stuff in great detail, and me probably speaking more than I usually do during the podcast, well, that’s probably because it is. Blake Grossman was the chief investment officer there. You need to be more constructive because Dow 57% is a fantastic reset.”

The Big Picture

AUGUST 22, 2023

It was more about the people. And more than any justice at the time, and I think maybe more than any justice in history, that’s what he put his finger on. Now in some times, the Office of Legal Counsel is more politically, let’s say, what’s the right word? It felt more like stultifying.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content