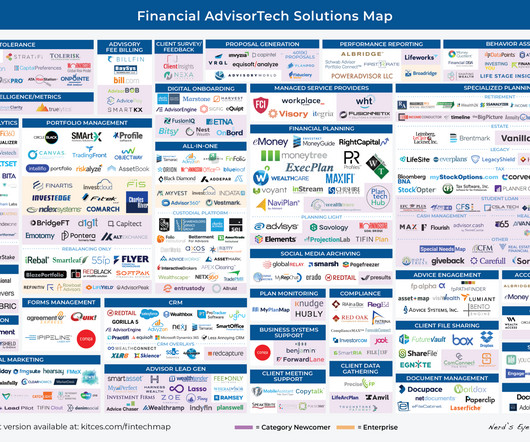

The Latest In Financial #AdvisorTech (May 2023)

Nerd's Eye View

MAY 1, 2023

only' checking client portfolios for tax-loss harvesting every other day, after having advertised daily checks) – a first for the SEC in scrutinizing an RIA not for failing to execute its investment promises to clients, but for failing to execute tax-loss harvesting promises instead.

Let's personalize your content