Join The Bond Market Resistance!

Random Roger's Retirement Planning

APRIL 22, 2024

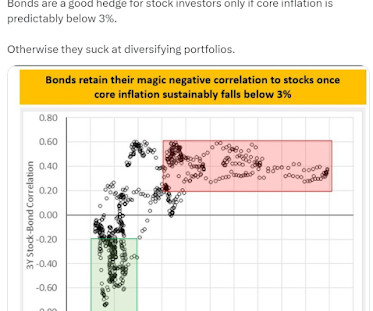

This blog has pretty much evolved into 100 ways to build a portfolio without bonds. An individual 20 year treasury bond bought when yields were at their lowest will return 100 cents on the dollar when it matures in 2040. Jason Zweig wrote an article titled How Not to Invest in the Bond Market. The title of course piqued my interest.

Let's personalize your content