Weekend Reading For Financial Planners (July 5–6)

Nerd's Eye View

JULY 4, 2025

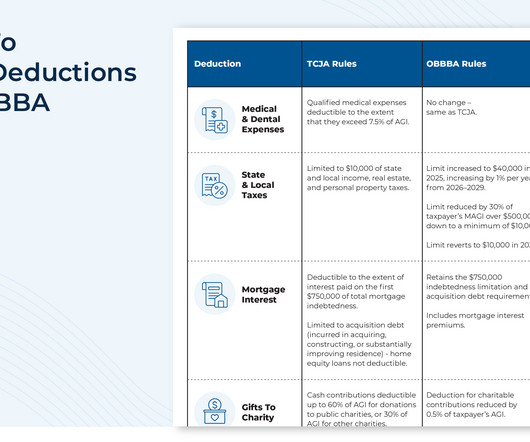

million next year) to $15 million in 2026, and raising the limit on the deductibility of State And Local Taxes (SALT) to $40,000 (though this measure is scheduled to revert to the current $10,000 in 2030 and begins to phase out for consumers with more than $500,000 of income), among many other measures.

Let's personalize your content