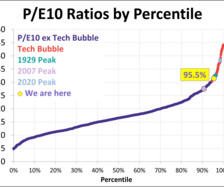

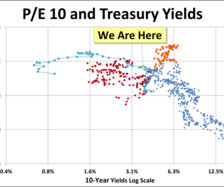

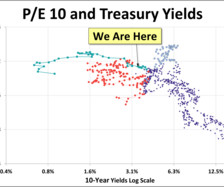

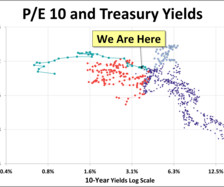

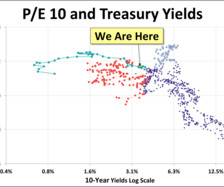

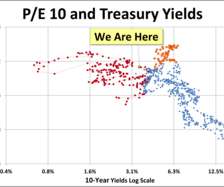

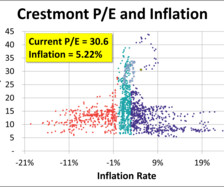

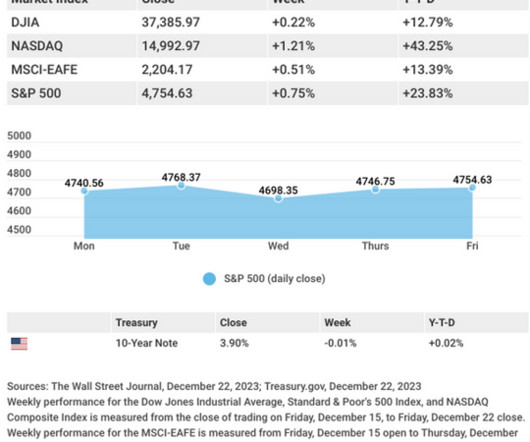

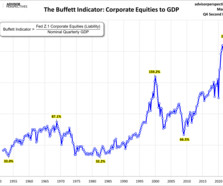

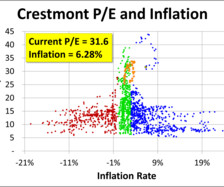

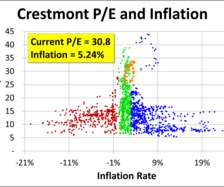

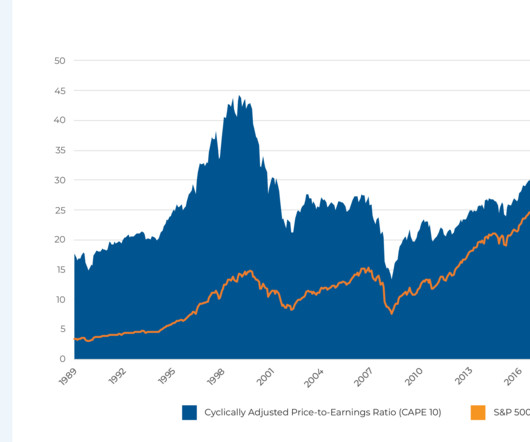

P/E10 and Market Valuation: December 2023

Advisor Perspectives

JANUARY 2, 2024

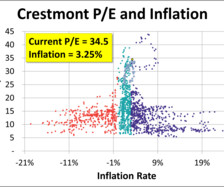

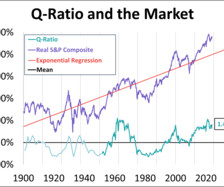

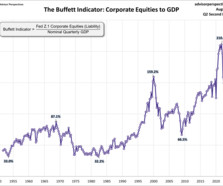

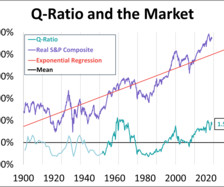

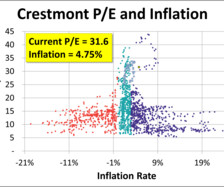

Here is the latest update of a popular market valuation method, Price-to-Earnings (P/E) ratio, using the most recent Standard & Poor's "as reported" earnings and earnings estimates, and the index monthly average of daily closes for the past month. The latest trailing twelve months (TTM) P/E ratio is 24.2

Let's personalize your content