Avoid the Unforced Investment Errors Even Billionaires Make

The Big Picture

APRIL 17, 2025

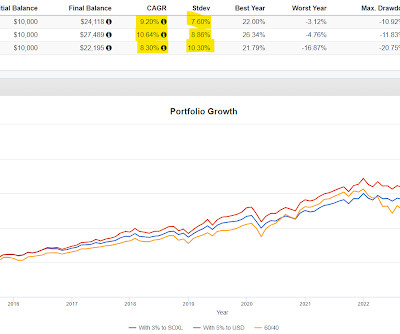

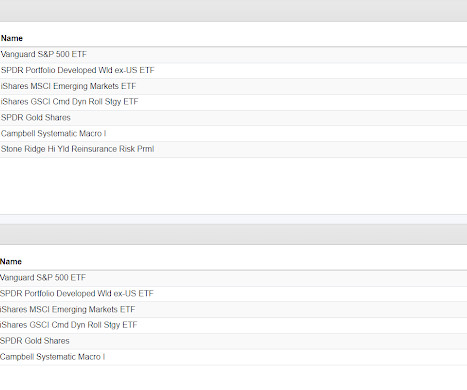

All costs impact your returns, but high or excessive fees have an enormous impact as they compound or, more accurately, lessen your portfolios compounding over time. I have made some fortuitously timed buys, including Nasdaq 100 (QQQ) calls purchased during the October 2022 lows. The latter turned out to be what occurred.

Let's personalize your content