Animal Spirits: Bear Market Math

The Irrelevant Investor

OCTOBER 25, 2022

The post Animal Spirits: Bear Market Math appeared first on The Irrelevant Investor.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Irrelevant Investor

OCTOBER 25, 2022

The post Animal Spirits: Bear Market Math appeared first on The Irrelevant Investor.

The Big Picture

MAY 25, 2023

Journal of Personality and Social Psychology, 1999 Yes, The Dunning-Kruger Effect Really Is Real Stuart Vyse Rational Skeptic, April 7, 2022 The Dunning-Kruger effect revisited Matan Mazor & Stephen M. Gaze, The Conversation, May 23, 2023 Math Professor Debunks the Dunning-Kruger Effect By Eric C.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

The Big Picture

APRIL 17, 2025

I have made some fortuitously timed buys, including Nasdaq 100 (QQQ) calls purchased during the October 2022 lows. These two possibilities a 10-fold increase versus a 90% drop are roughly symmetrical in terms of math (but probably not probabilities). I was up so much on that trade that my trading demons were emboldened.

The Big Picture

NOVEMBER 27, 2023

Staying long through the 60-day 34% drop during the 2020 pandemic; getting out of the market ahead of the 2022 rate hiking cycle; and getting back in October 2022 for the next bull leg. The dotcom top, the double bottom in Oct 02-March 03; the highs in 2007, the lows 2009. By Jeff Sommer New York Times, Nov. More on this later.

The Big Picture

AUGUST 12, 2024

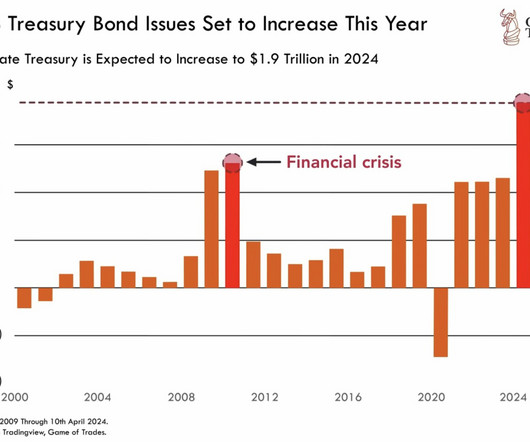

Economy in 2022 was $25,439.70B; in 2009, it was $14,478.06B; ignore that also? Do we simply ignore the growth in the size of the economy and the U.S. population? The US population today is 341,814,420; in 2009 it was 308,512,035. Do we just ignore that? Do we pretend that there has been no inflation? By the way, inflation-adjust that $1.3T

Random Roger's Retirement Planning

OCTOBER 26, 2024

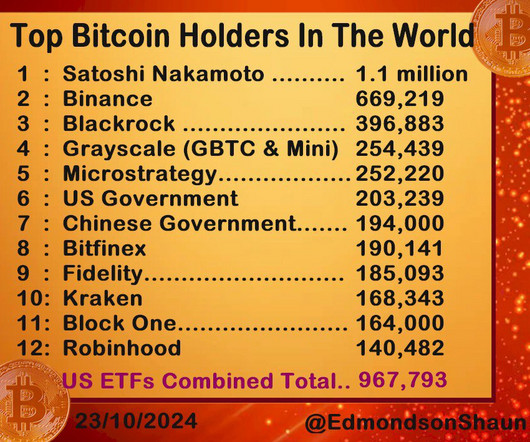

There were 127 million US households as of 2022. First, is the math right based on my numbers? That 40% could own Bitcoin makes no intuitive sense to me, I guess 20% is possible but that too seems a little high but who knows? So 25 million of them own a little Bitcoin worth a couple of hundred dollars?

Random Roger's Retirement Planning

NOVEMBER 6, 2023

The fund owns a lot of puts and should go up a lot in the face of a crash but not necessarily a slow protracted decline like there was in 2022. According to Portfoliovisualizer, CYA dropped 46.10% in 2022. The fund in question is the Simplify Tail Risk Strategy ETF (CYA). Here's what caught my eye that it might have blown up.

Random Roger's Retirement Planning

FEBRUARY 23, 2025

The "endowment" result is very close to red line VBAIX every year except 2020 when it lagged by almost 600 basis point and 2022 when it outperformed by about 500 basis points. The portfolio did just fine, it captured most of the upside and avoided the full brunt in 2022's large decline.

Diamond Consultants

OCTOBER 10, 2023

Advisors continue to break away from captive environments for independence, with some 6,873 making the leap in 2022 according to the Diamond Consultants Advisor Transition Report. Advisors breaking away for independence know what they are giving up, so how can they justify making this leap? The answer starts and ends with growth.

Random Roger's Retirement Planning

MARCH 18, 2025

And checking in on the GraniteShares YieldBoost SPY ETF (YSPY) that sells put spreads on a levered S&P 500 ETF; Yes, that is a rough start, clearly, but interestingly the math checks out. Then it made it back in 2022 when it was only down 1.1%. YSPY sells put spreads on a 3x fund.

Random Roger's Retirement Planning

JUNE 22, 2023

And then just a little math, the "guarantee" based on the 50/50 allocation would be 2.5% Down less clearly worked in 2022 and YTD HEQT is lagging the S&P 500 by 400 basis points. Keep it to something broad like a total market fund or a market cap weighted large cap index.

Brown Advisory

JUNE 16, 2022

Global Leaders Investment Letter: June 2022 mhannan Thu, 06/16/2022 - 11:30 Just want the PDF? We discount each year at our 10% minimum weighted average cost of capital (WACC) and some infinite series maths gives us the basis for some rough approximations 2.

Integrity Financial Planning

JANUARY 23, 2023

In fact, as of September 2022, over 70 million Americans were collecting benefits. [1] 3] So, it’s easy math: the less you work, the less you’ll earn. For most, Social Security provides a solid foundation for retirement income. 1] However, not everyone knows exactly how or when to start tapping into this resource.

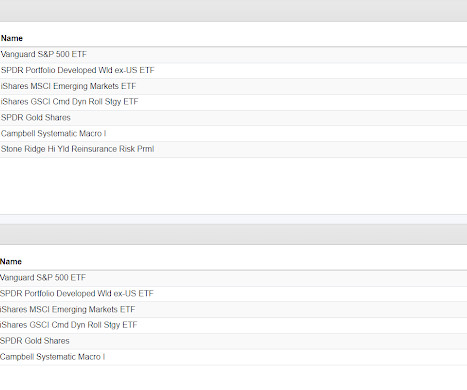

Random Roger's Retirement Planning

NOVEMBER 22, 2024

The way Portfolios 1 and 2 are weighted, the math works for being a 60/40 portfolio and then from there we add portable alpha/capital efficiency/return stacking. It certainly had a relatively good 2022 when CPI jumped 8%. The idea here is to look to see if any value can be added. So does it work? Well yeah, maybe it does.

Sara Grillo

JUNE 24, 2024

The math behind Universal Life Insurance Interest Rates is a twisted web and most consumers are deceived. Know how the math works so you can see the potential risks that may exist with your policy. Money market rates crashed to zero (0%) in 2022 due to Covid-19. Don’t be fooled! That is a mathematical impossibility.

Discipline Funds

MARCH 6, 2024

So, if you owned $100 worth of bonds yielding 2% in 2022 you now own $90 worth of bonds yielding 5%. Since the Fed started raising rates in 2022 the annual interest burden on the national debt went from $635B to $1,025B. This is the basic math behind what’s happened to every consumer who owns these bonds.

The Big Picture

NOVEMBER 14, 2023

She has a really fascinating background, very eclectic, a combination of math and law. You, you get a, a BS in Mathematics and a JD from Boston University Math and Law. It is something, math has always come easy to me since a child. I didn’t get an advanced degree in math. Not the usual combination. What happened?

Validea

JUNE 14, 2023

The Math Behind the Growth Let’s take a step back and think about what it would take for a company like Apple to reach a $10 trillion market cap. trillion, and by the end of 2022, it had soared to $40.5 With a current market cap of $2.8 trillion as of today, this would require an approximate increase of 3.6 trillion.

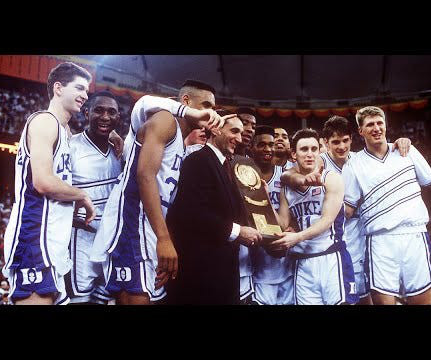

Darrow Wealth Management

MAY 22, 2023

In fact, the Federal Reserve has raised the upper limit federal funds rate by 5% since the beginning of 2022. Again just using simple math, this presumes the par value will roll over each month and reinvest at the same rate to get to the annual yield. Hold cash or invest? Interest rates have skyrocketed since the end of 2021.

Trade Brains

DECEMBER 16, 2022

And when used for ROE, as per the basic rule of math, if the denominator decreases, the fraction as whole increases i.e, On a yearly basis, from 2018 to 2022, the company has a return on equity of 36.56%, 45.3%, 70.39%, 105.76%, and 104.53% respectively. The ROE numbers from 2018 to 2022 are 57.17%, 49.79%, 42.74%, 71.64%, and 83.3%

The Better Letter

MAY 13, 2022

For math, she teaches the advanced class — the top students in the school. The class had a party recently as a reward for winning a national math competition. – to stay in and play math games at the party instead of more traditionally “fun” activities, inside or out. It is a very bright group.

Random Roger's Retirement Planning

JULY 27, 2022

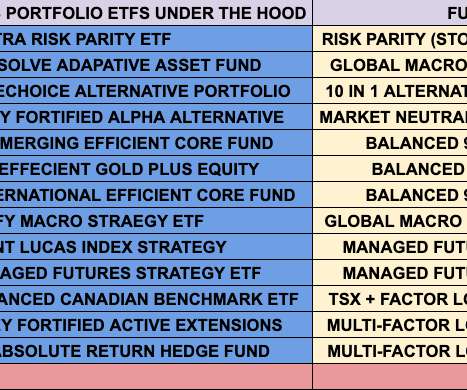

It has had a great 2022 but doesn't appear to have captured much upside coming into 2022. In terms of complexity, several of the funds blend together multiple complex strategies and the blend itself is complex in terms of the math applied and the outcomes sought, they are complex-complexity. It's multi-asset and multi-strategy.

Random Roger's Retirement Planning

FEBRUARY 24, 2024

In the case of real estate a 2.29% weighting and for "private equity" companies it's about 17 basis points (looked at XLF holdings and then did a little math), that's just not going to move the needle. You may agree with Jack about not needing those things, that's valid, my point is that owning an index fund isn't a proxy for them.

Random Roger's Retirement Planning

JULY 14, 2022

Here's how QYLD has done for the last 5 years coming into 2022, so before the market was underway, versus the NASDAQ. And here is 2022, the bear market. Similar to PUTW, it didn't offer protection during the pandemic crash of 2020 but only dropping half of what the S&P 500 index has dropped in 2022 is impressive and surprises me.

Random Roger's Retirement Planning

MARCH 20, 2023

The way the math works, a 67% allocation to NTSX (Portfolio 2 with 33% in the T-bill ETF) equals 100% in Vanguard Balanced Index Fund (VBAIX) which is a proxy for 60/40 and Portfolio 3. Portfolio 1 is 100% in NTSX which in 2022 was down 25.84% versus down 16.85% for Portfolio 2 and 16.87% for Portfolio 3.

Investing Caffeine

FEBRUARY 1, 2022

After this meteoric multi-year rise, stock values started to come back to earth in 2022, and the rocket ship turned into a roller coaster during January. Math Matters. I did okay in school and was educated on many different topics, including the basic principle that math matters. Source: Calafia Beach Pundit. www.Sidoxia.com.

Random Roger's Retirement Planning

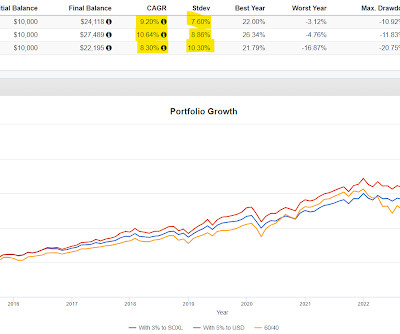

AUGUST 1, 2024

Despite the leveraged semiconductor ETFs, when blended with USMV, the portfolio is underweight technology versus the S&P 500 using simple math, it works out to about 26% versus closer to 40% for the S&P 500. They even did much better than 60/40 in 2022 dropping only low to mid single digits.

The Better Letter

DECEMBER 15, 2022

Those of us called upon professionally to write about market performance in 2022 as the year ends are necessarily struggling for the right verbiage. That’s because, in language as plain as I can make it, pretty much every market and sector has had a very bad 2022. percent and 6-month T-bills are yielding almost 4.75

Your Richest Life

NOVEMBER 9, 2023

months in January of 2022, and has since bumped up to 3.3 You should also do the math to make sure you have a clear idea of what you can afford. Appliances, for example, have seen a price decrease of 10 percent since 2022. And finally, inventory is still lower than usual. That number fell to 1.6 months in August of 2023.

Steve Sanduski

AUGUST 4, 2022

Charles Schwab just released their 2022 RIA Benchmarking Study and I decided to crunch the numbers and see what the data shows. Now, let’s take two cuts at the growth performance of advisory firms in the 2022 RIA Benchmarking Study from Charles Schwab relative to what the markets did. Simple math says the CAGR of NET NEW ASSETS (i.e.,

The Big Picture

SEPTEMBER 19, 2023

One, one is true and I’ve always said is that I wanted people to stop, ask if I could doing math. And no one asked me if I can do math anymore with a degree from Booth, particularly in econometrics and statistics. So people really ask you, you take French and can you do math. Two reasons.

Random Roger's Retirement Planning

SEPTEMBER 29, 2024

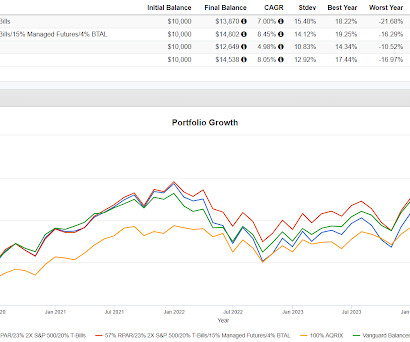

The authors noted that risk parity did very well for a long time but that "bond based risk-parity failed miserably in 2022." In fund form, it started doing badly long before 2022 which is corroborated by AQR's change to AQRIX in 2019. Both 2 and 3 were up in 2022 while the RPAR replication was down 11%.

Random Roger's Retirement Planning

DECEMBER 11, 2024

Imagine the Intel scenario of down 59% on top of VBAIX dropping 16% in 2022. Most of the improved return can be attributed to 2022. A 20% drop in managed futures that is leveraged to a 40% weight would have added another 800 basis points to the decline (simple math). In 2008, VBAIX was down 23%.

Sara Grillo

MAY 16, 2022

From the company’s website, as of May 16th, 2022: Single people. From the company’s ADV Part 2 brochure, as of May 16th, 2022: Fees are set as a fixed annual fee, paid quarterly, and based approximately on the total time required to service an account yearly. Pay attention, get it in writing, and do the math for yourself.

Random Roger's Retirement Planning

DECEMBER 1, 2023

Part of the math that determines options premiums is the risk free rate of return from T-bills. In 2022 it dropped 13% versus about 19% for the S&P 500. Covered call funds have many favorable attributes. Keeping up with the broad stock market is not one of them. Assuming an 11% payout in perpetuity is a very bad idea.

The Big Picture

FEBRUARY 6, 2024

I’d say management consulting is any of the other thing that least at that time was the other career trajectory, just my personality, more of a math oriented introvert. But then it didn’t in the, when the tech bubble burst, it didn’t last year in 2022. Quality strategies in 2022. Learn math, learn history.

Validea

JUNE 14, 2023

The Math Behind the Growth Let’s take a step back and think about what it would take for a company like Apple to reach a $10 trillion market cap. trillion, and by the end of 2022, it had soared to $40.5 With a current market cap of $2.8 trillion as of today, this would require an approximate increase of 3.6 trillion.

The Big Picture

SEPTEMBER 12, 2022

I — I loved math, but really, I was going to go down that literature route more than anything else and — and study Spanish literature. I — I — I think 50 plus 75 plus 75 plus whatever happened September 2022, that’s the end of the soft landing. So heading into 2022, there surely were pockets of froth.

The Better Letter

MARCH 18, 2025

Both 2021 and 2022 each had 14 upsets; there were 10 upsets in 2023 and nine in 2024, if only three in 2007. Duke math professor Jonathan Mattingly claimed the average college basketball fan has a far better chance of achieving bracket perfection than one in 9.2 Between 1985 and 2024, there were 8.5 upsets per tournament (4.7

Good Financial Cents

SEPTEMBER 29, 2022

However, by doing a little math, you can easily determine your hourly wage from your annual salary. Here’s a state-by-state list of after-tax salaries in 2022, based on a gross amount of $55,000. State By State $55,000 a Year Salary After Taxes in 2022. 55K a Year Is How Much an Hour?

The Better Letter

DECEMBER 30, 2022

We checked the maps, did the math, and determined that, if all went well, we could drive from BWI to San Diego in about 40 hours of driving time. Nobody’s financial plan had a good 2022. In years like 2022, or in situations like this week for me, the worrying is worse. Issue 135 (December 30, 2022) We wanted to go!

Random Roger's Retirement Planning

FEBRUARY 8, 2023

The way the math works, a 67% allocation to NTSX replicates 100% into a 60/40 portfolio which leaves 33% left over to do something. In 2022, VBAIX was down 16.87% while Portfolio 2 was only down 10.77%. In the 13 years between 2008 and 2022, VBAIX outperformed Portfolio 2 in six of those years with one year being a tie.

David Nelson

NOVEMBER 27, 2023

Do the math S&P 500 Top Performers Bloomberg Data 25% of the S&P 500 is up more than the index this year. As we closed out 2022 a lot of this year’s winners were for sale. There are always exceptions and of course some did outperform. That’s more than 125 companies with better than 20% returns. Remember last year.

The Big Picture

NOVEMBER 21, 2023

So, 00:25:52 [Speaker Changed] You know, as you know, 2022 was a tech recession. And what we were already hearing throughout 2022 was the voracious appetite people had for Nvidia GPUs. 00:30:51 [Speaker Changed] So we were shorting the components of those indexes that we thought had gotten too bold up as safety trades in 2022.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content