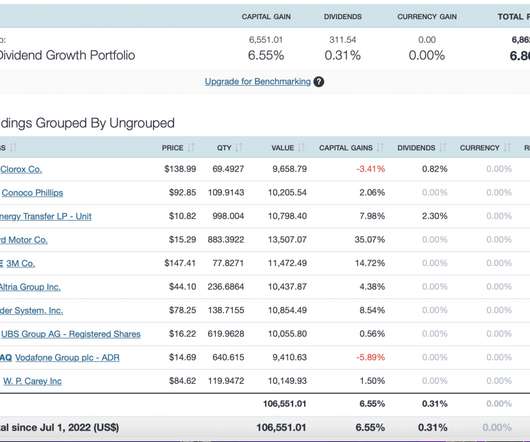

Top 10 Dividend Growth Portfolio

Dear Mr. Market

AUGUST 5, 2022

Inflation is currently at 40 year highs with increasing signs of slowing economic growth. Not only are we sharing the importance of dividends in this article, but it’s also the official roll-out of the Top 10 Dividend Growth Portfolio strategy managed by My Portfolio Guide, LLC.

Let's personalize your content