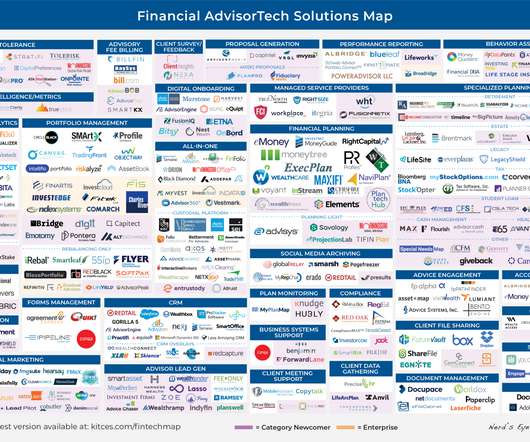

The Latest In Financial #AdvisorTech (November 2022)

Nerd's Eye View

NOVEMBER 7, 2022

Welcome to the November 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Let's personalize your content