Morningstar: Assets in Tax-Managed SMAs Now Total Over $500B

Wealth Management

OCTOBER 17, 2024

The amount of assets in tax-managed SMAs has jumped 67% from year-end 2022.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 17, 2024

The amount of assets in tax-managed SMAs has jumped 67% from year-end 2022.

Wealth Management

FEBRUARY 22, 2023

During the fourth quarter of 2022, 66 independent financial professionals affiliated with the tax-centric broker/dealer.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

JULY 25, 2023

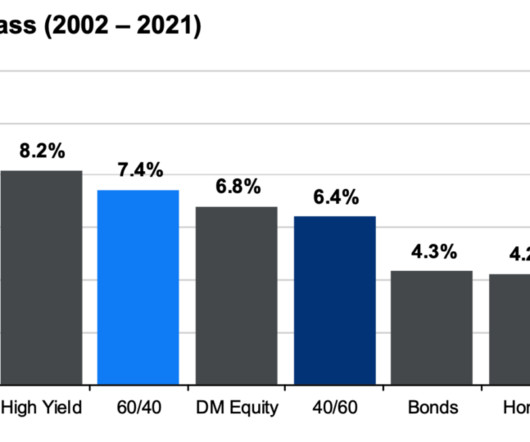

Pomp points out that: “I am, however, arguing that the total return percentage traditionally quoted is not what people actually achieve in their brokerage account because of taxes. I have addressed Tax Alpha before ( see this and this ); but Pomp indirectly raised a very different issue: Why do people underperform their own assets?

Abnormal Returns

AUGUST 5, 2022

rajivsethi.substack.com) What would a tax on stock buybacks mean? newsletter.abnormalreturns.com) Mixed media The best books of 2022, so far, including "True Story: What Reality TV Says About Us" by Danielle J. (techcrunch.com) Finance KKR ($KKR) wants to win more IPO business. sportico.com) Boatsetter is Airbnb ($ABNB) for boats.

The Big Picture

APRIL 3, 2023

The asset value peak was $33.6 trillion as of the end of 2022. Given the rough year markets had in 2022, including all of the held asset classes, it is an impressive, albeit curious showing. The group also names 2022’s Best of, including Fund, Asset Class, Region, and Industry of the Year (all found here ).

The Big Picture

AUGUST 17, 2022

What’s obvious is that cheaper is better than more expensive; that there are inherent costs in managing an active portfolio that include more than just trading and taxes but research, analysis, PMs, etc. But that is not the same as becoming one of the most dominant asset managers in the world.

Harness Wealth

APRIL 4, 2025

This weeks Tax Advisor Weekly covers key updates for financial professionals. We begin with guidance on navigating property tax considerations during business mergers and expansions. In this blog post, well cover key business events that impact property tax and business licenses, along with what you need to consider for each.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Random Roger's Retirement Planning

FEBRUARY 8, 2025

Barron's had a very quick look at the recent popularity of private assets to try to figure out whether investors should wade into the space. Consumer discretionary is another one that pretty reliably outperforms for ten year periods, not the last couple though after getting whacked pretty hard in 2022 though.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. The maximum for 2022 is $61,000, this has been increased to $66,000 for 2023. Employee contribution limits are $20,500 for 2022 and $22,500 for 2023. Eligibility.

The Big Picture

APRIL 19, 2023

( The Atlantic ) • How 2022 Became a Record Year for US Income Taxes : An asset-price boom, a progressive tax code and inflation interacted to drive effective rates higher than ever. Bloomberg ) • Tax season is getting longer. Now the process is working in reverse. Blame climate change.

Abnormal Returns

FEBRUARY 13, 2023

citywire.com) Taxes Five tax mistakes to avoid when it comes to stock options, RSUs, etc. tonyisola.com) Advisers RIAs continue to take share of IRA assets. riabiz.com) The number of CFPs grew some 5% in 2022. (fa-mag.com) (mattreiner.com) SEC The SEC is going to focus on the new marketing rule in 2023.

The Big Picture

JULY 27, 2022

Consider these columns going back to 2013 pointing out the foolishness of tax-payer subsidized corporate welfare queens (2013), and why median wages were rising ( 2016 , 2017 , 2018 , 2018 , 2019 ). The 2010s monetary rescue plan benefitted anybody who owned capital assets: Stocks, Bonds, and Real Estate. I wrote a book about this).

Nerd's Eye View

OCTOBER 4, 2023

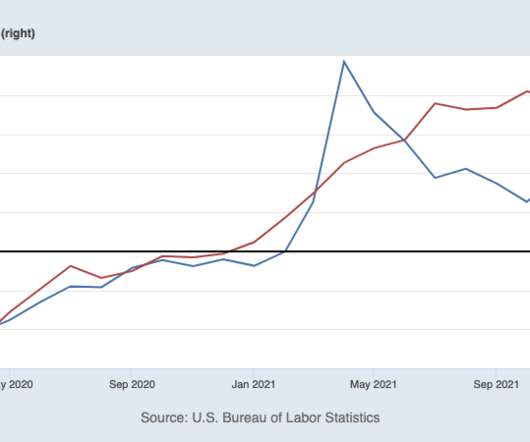

Furthermore, inflation, though down from its peak in early 2022, remains above the Federal Reserve's long-term target of 2% despite the bank's attempts to tamp it down. What's driving many of the economic conditions today are higher interest rates resulting from the Fed's efforts to fight inflation. And even though U.S.

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. As proposed, the new legislation would increase these tax rates to 9% and perhaps even 16% , respectively, starting in 2023.

WiserAdvisor

JUNE 13, 2025

Below are some of the mistakes you should avoid making to secure your wealth: Mistake #1: Not diversifying your investments Investing too much of your money into one sector, one type of asset, or one region can expose your wealth to unnecessary risk. Take the year 2022, for example. That’s why diversification matters. The good news?

MainStreet Financial Planning

MARCH 7, 2023

It is March…that means you have just about 5 weeks left to get organized and submit your tax return. The tax deadline is April 18, 2023 (some taxpayers in disaster areas in California, Georgia and Alabama have an extended deadline). Gathering all your documents is crucial to complete a tax return free of mistakes.

The Big Picture

NOVEMBER 27, 2023

This is before we get to the issue of capital gains taxes, which create a hurdle of (minimum) 20% on those pesky profits just to get to breakeven. Low Stakes : The most successful market timers are often those people who do not have actual assets at risk. It’s utterly laughable. 4 Newsletter writers are notorious for making big calls.

Nerd's Eye View

AUGUST 12, 2022

As RIA firms’ challenges in attracting and retaining talent have continued, firms have needed to reduce their business development activities to stay within their existing staff's capacity (compounding the challenges of growing firm revenue during a bear market that has reduced most firms’ assets under management).

Nationwide Financial

AUGUST 29, 2022

Key Takeaways: Even without new legislation, the prospect of higher taxes in the future is still looming. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital. But even without new legislation, the prospect of higher taxes in the future is still looming.

Good Financial Cents

SEPTEMBER 29, 2022

In this guide, we’re going to present the 10 best long-term investment strategies for 2022. The table below provides a quick summary of each of the 10 best long-term investment strategies for 2022, along with the main features and benefits of each. Below is our list of the 10 best long-term investment strategies for 2022.

The Big Picture

SEPTEMBER 19, 2023

The transcript from this week’s, MiB: Elizabeth Burton, Goldman Sachs Asset Management , is below. Elizabeth Burton is Goldman Sachs asset management’s client investment strategist. In fact, state revenues were often at all time highs from taxes when this happened. It depends on your asset allocation.

Random Roger's Retirement Planning

JUNE 27, 2024

If someone can build a portfolio robust enough to have at least a couple of things that go up in a terrible year like 2022, I could see a sort of mental accounting where someone thought they were lucky in a periods that was broadly unlucky.

Harness Wealth

APRIL 15, 2025

Data from the Federal Reserves 2022 Survey of Consumer Finances (SCF) (released in late 2023) offers the most recent comprehensive snapshot of American household wealth. Find Your Wealth Advisor at Harness How Net Worth Is Changing in America From 2016 to 2022, the median U.S.

Good Financial Cents

JANUARY 16, 2023

We all witnessed the stock market’s volatility in 2022, as soaring inflation led to aggressive rate hikes over the course of the year. Access to wide array of alternative asset classes Access to ultra-wealthy investments Can invest for income or growth Learn More Now. Unique Asset Classes. Key Features of Yieldstreet.

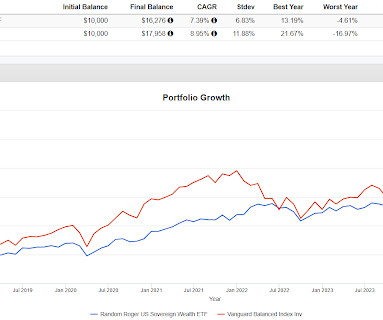

Random Roger's Retirement Planning

MARCH 5, 2025

We have an oil reserve already as well as a gold reserve which are sort of "break glass in case of emergency" assets while a SWF is more of a pool of capital that is typically derived from some sort of byproduct, like oil in the case of Norway, where that byproduct creates a surplus for the country. but it was low in 2022 when it mattered.

Abnormal Returns

NOVEMBER 21, 2022

riabiz.com) Retirement Why retirees should include Social Security into their asset allocation. morningstar.com) Delaying taxes in retirement isn't always the best strategy. thinkadvisor.com) How Notice 2022-53 has affected the tax code. (riabiz.com) CI Financial ($CIXX) is planning to spin-off its U.S.

The Big Picture

NOVEMBER 20, 2023

Previously : Tax Alpha (April 14, 2022) Accessing Losses via Direct Indexing (April 14, 2021) The Cutting Edge (September 30, 2021) USA Is Smashing Its Clean Energy Targets (October 17, 2017) Sources : Wall Street’s ESG Craze Is Fading By Shane Shifflett WSJ, Nov. This is true whether you are pro-life or pro-environment.

Random Roger's Retirement Planning

JUNE 2, 2025

The Invenomic Fund (BIVIX) that we've looked at a few times is seriously skewed by two phenomenal years in 2021 and 2022 when it was up 61% and then 50%. If I had gotten a real answer I would have asked the same for 2022. Risk parity generally leverages up on bonds to even out the risk allocation of a multi asset portfolio.

Abnormal Returns

SEPTEMBER 26, 2022

Podcasts Christine Benz and Jeff Ptak talk with Tim Steffen, director of tax planning for Baird. riabiz.com) Three positives, and three negatives, from the 2022 Future Proof festival. linkedin.com) Fintech Most people don't need asset management, they need paycheck management. Budge looks to solve this.

Nerd's Eye View

AUGUST 12, 2022

As RIA firms’ challenges in attracting and retaining talent have continued, firms have needed to reduce their business development activities to stay within their existing staff's capacity (compounding the challenges of growing firm revenue during a bear market that has reduced most firms’ assets under management).

Carson Wealth

MAY 7, 2025

According to a report from the consultancy Altrata , charitable contributions from ultra-high net worth individuals increased by almost 25% between 2018 and 2022 , illustrating a growing trend of philanthropic engagement. There are overall limits on charitable donation tax deductions, however.

WiserAdvisor

OCTOBER 11, 2022

While these can be avoided, there is another cash outflow that can considerably lower your savings and returns and is also hard to avoid – tax. Tax planning is essential. Tax is charged on every penny you earn. Tax evasion is a crime, and missing tax payments can lead to legal hassles that can be hard to get out of.

Nationwide Financial

JANUARY 25, 2023

Review risk tolerance and current asset allocation strategy It’s important to ensure your clients’ portfolios align with their risk tolerance because taking too much risk can negatively impact their ability to navigate market fluctuations. Suppose they made emotional investment decisions during the market volatility of 2022.

Darrow Wealth Management

DECEMBER 5, 2022

Donating appreciated stock to charity can be a great way to give back and reduce your tax bill. Taxpayers who itemize get a tax deduction for the market value of the stock. If you want to make a gift for the 2022 tax year – act now. These two steps don’t need to happen in the same tax year. Give wisely.

Abnormal Returns

FEBRUARY 16, 2023

bloomberg.com) Bitcoin is at its highest level since June 2022. howardlindzon.com) Private assets Why private equity needs much better valuations. axios.com) Funds Tax efficiency is the secret sauce of ETFs. Markets The FTSE 100 Index has risen above 8,000 points for the first time ever. pragcap.com) Fidelity is hiring!

Harness Wealth

FEBRUARY 5, 2025

The rise of remote work and digital nomadism has made FEIE a common tax minimization strategy for Americans living abroad. What is the Foreign Tax Credit (FTC)? Financial and lifestyle considerations of living abroad The importance of professional tax advice for expats FAQs about the FEIE What is the Foreign Earned Income Exclusion?

Random Roger's Retirement Planning

FEBRUARY 6, 2025

Most of the fund will be in exchange traded products so it will be targeting some holdings it believes can serve as proxies for private assets along with up to 15% in actual private assets. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

Random Roger's Retirement Planning

MARCH 2, 2025

Barron's wrote about the difficulty of spending down accumulated assets in retirement. Generically, dividends are not tax efficient. They are taxed at ordinary income. SCHD has historically paid "qualified" dividends which are taxed more favorably as capital gains but this is something to continuously track.

Walkner Condon Financial Advisors

NOVEMBER 11, 2022

2022 has been a difficult and trying year for stock and bond indexes in both emerging and developed markets. Bear in mind that IRA accounts do have income restrictions so it is important to work with your financial advisor or tax preparer to determine if you are eligible to contribute in 2022. The gift limit for 2022 is $16,000.

Random Roger's Retirement Planning

JANUARY 26, 2025

The article was thin but there was a reference to his "holy grail" of 10-15 uncorrelated assets in portfolio construction. We've looked at this a couple of times, it is interesting of course and actually having 10-15 uncorrelated assets in a portfolio would hit the mark for diversifying your diversifiers.

Integrity Financial Planning

OCTOBER 17, 2022

There are rules and regulations that can help you avoid higher taxes and penalty fees and help you structure your income to minimize taxes. In 2022, you can contribute up to $6,000 to an IRA if you are under 50 and an additional $1,000 if you are 50 or older. 1] Smart Asset. Take Catch-up Contributions at 50. 3] IRS.gov.

Random Roger's Retirement Planning

FEBRUARY 12, 2025

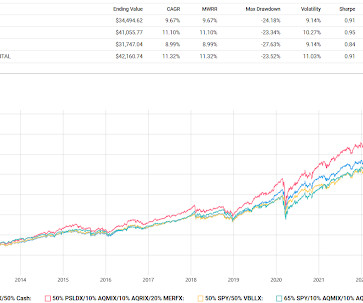

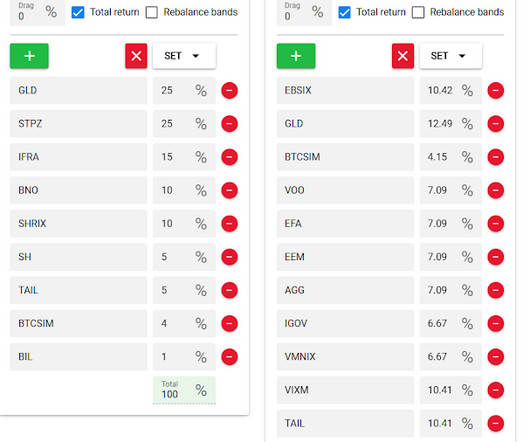

The starting point for the Man article is that defined contribution investors need exposure to risk assets for more years and portable alpha to add alternatives, they say, is a better way to do it. Also PSLDX is capable of some huge drawdowns, dropping 43% in 2022 and 33% in 2008. PSLDX is the PIMCO StocksPLUS Long Duration Fund.

Random Roger's Retirement Planning

MARCH 12, 2025

AQR Multi-Asset (AQRIX) used to be called Risk Parity and it also does some quadranty stuff. The max drawdowns of the backtested portfolios bottomed out in late 2022 as follows To the extent quadrant style might intersect with all-weather, you can decide for yourself whether any of them were all weather enough.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content