Market Commentary: Strong Jobs Report Gets the “Good News Is Bad News” Treatment

Carson Wealth

JANUARY 13, 2025

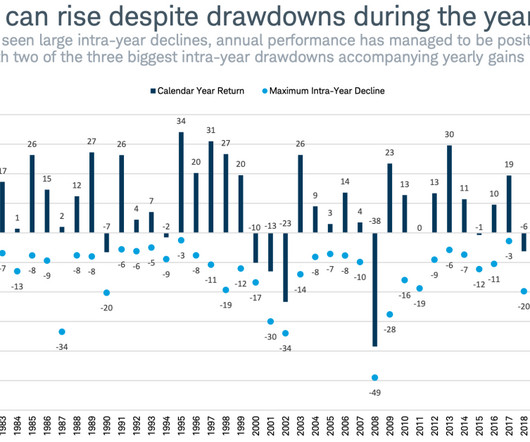

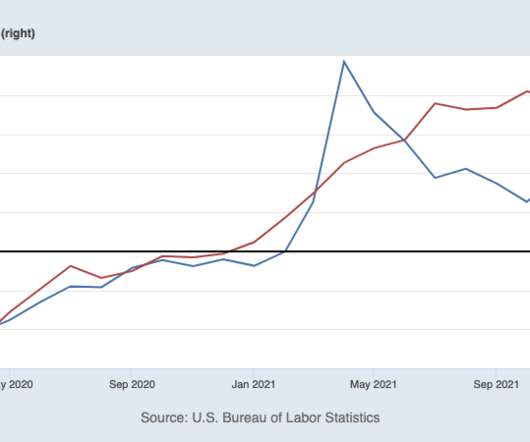

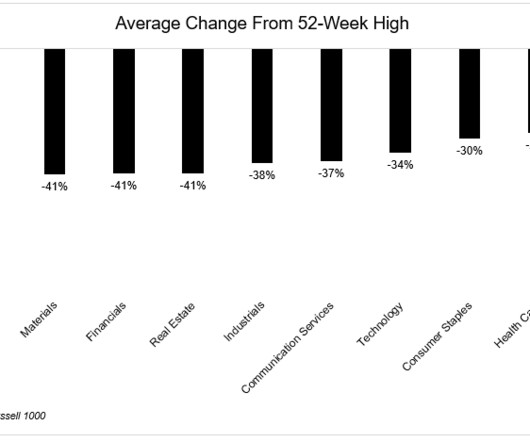

Good news can be bad news in the short run, but a solid economy usually becomes good news again once we get past the initial market reaction. If the underlying economy is sound, pullbacks like this can actually be a positive for the longer-term health of the market. Monthly numbers can be noisy and so a 3-month average is helpful.

Let's personalize your content