Why You Should Buy Junk Bonds Now

Validea

AUGUST 5, 2022

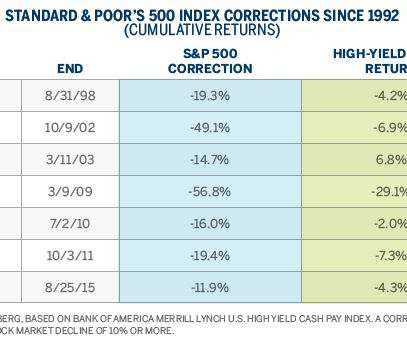

Rowe Price told MarketWatch , adding that “now is a very attractive time to enter the asset class.” But they shot back up 55% in 2009. With rising concerns over a recession, many believe that defaults are going to be high, but that isn’t necessarily true, Kevin Loome of T.

Let's personalize your content