Why Portfolio Diversification is for the Ignorant Investor

Risk Management Guru

APRIL 21, 2020

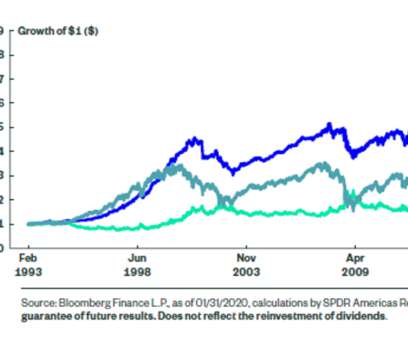

Why portfolio diversification is for the ignorant investor. This is often mentioned in the world of investing where clients trust their advisors to spread their money over a hundred stock funds among other asset classes such as bonds and commodities to protect their customers against risk. Harper, 2006. Works Cited.

Let's personalize your content