Avoid the Unforced Investment Errors Even Billionaires Make

The Big Picture

APRIL 17, 2025

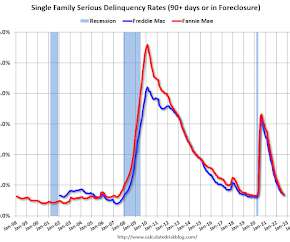

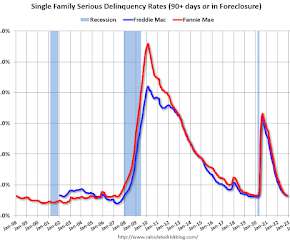

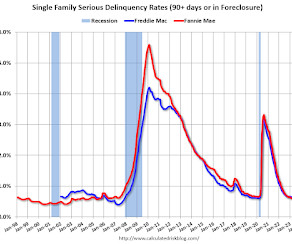

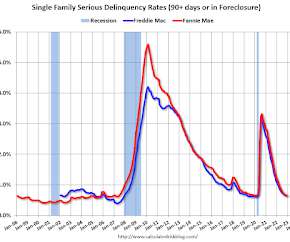

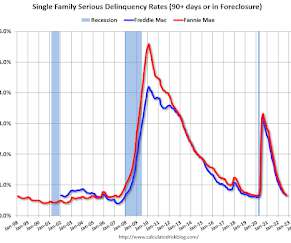

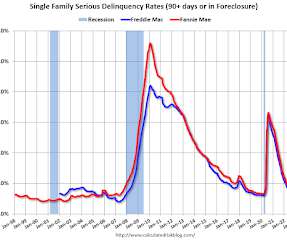

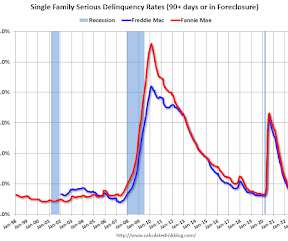

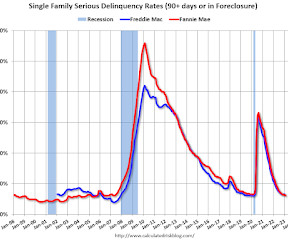

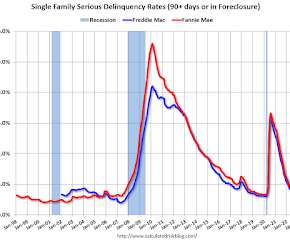

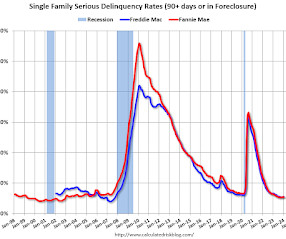

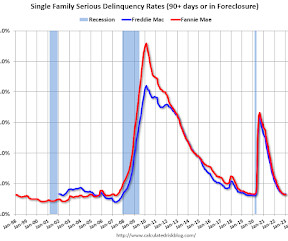

All costs impact your returns, but high or excessive fees have an enormous impact as they compound or, more accurately, lessen your portfolios compounding over time. ” Ask the folks who loaded up on MBS for the extra yield how they did. ~~~ There is an endless assortment of ways to make mistakes that hurt your portfolio.

Let's personalize your content