10 Tuesday AM Reads

The Big Picture

AUGUST 29, 2023

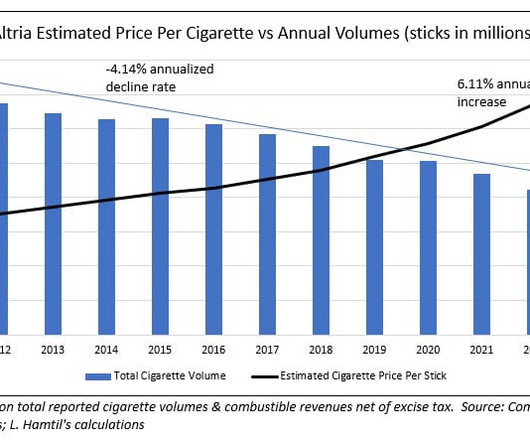

My Two-for-Tuesday morning train WFH reads: • Stock Pickers Never Had a Chance Against Hard Math of the Market : In years like this one, when just a few big companies outperform, it’s hard to assemble a winning portfolio. 2000-2003 Dotcom implosion 6. Businessweek ) but see With cash earning 5%, why risk money on the stock market?

Let's personalize your content