How Many Bear Markets Have You Lived Through?

The Big Picture

MARCH 3, 2023

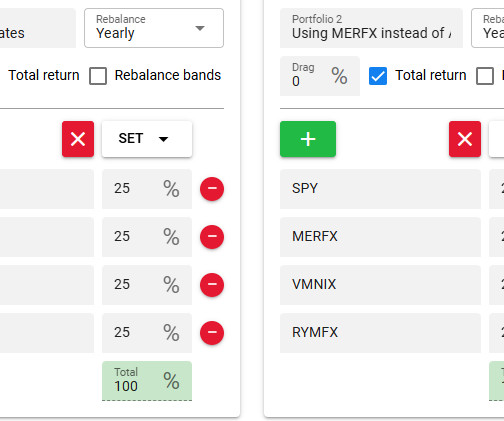

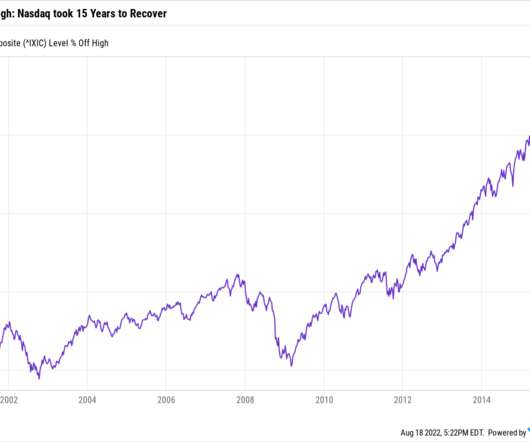

2000-13 : Secular bear market did not make new highs until March 2013 2018 : ~20% pullback as the economy slowed, FOMC hiked. The first bear I experienced was utterly meaningless economically but still felt bad. My economic future was uncertain, but I felt confident I could make a go of it. In fact, it felt horrible.

Let's personalize your content