Commonwealth Recruits $430M Phoenix Practice From Osaic

Wealth Management

JUNE 24, 2025

Phoenix-based Patrick Funke & Associates joins Commonwealth Financial Network, citing relationship focus as key factor amid pending LPL acquisition.

Wealth Management

JUNE 24, 2025

Phoenix-based Patrick Funke & Associates joins Commonwealth Financial Network, citing relationship focus as key factor amid pending LPL acquisition.

Nerd's Eye View

JUNE 24, 2025

Welcome everyone! Welcome to the 443rd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Griffin Kirsch. Griffin is the owner of GK Wealth Management, an RIA based in Reno, Nevada, that oversees $200 million in assets under management for 450 client households. What's unique about Griffin, though, is how he has grown his AUM to $200 million in five years (with a 70% margin in terms of earnings before owner compensation) by providing high-touch planning for busines

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 17, 2025

Zach Ivey, Savant Wealth Management's CIO, discusses evolving investment landscapes, alternative allocations and educating advisors on private market liquidity at Wealth Management EDGE.

Calculated Risk

JUNE 18, 2025

Statement here. Fed Chair Powell press conference video here or on YouTube here , starting at 2:30 PM ET. Here are the projections. The projections are pretty bearish. The BEA's advance estimate for Q1 GDP showed real growth at -0.2% annualized. There is a wide range of estimates for Q2 GDP, but it is forecast to be over 3.0% (as Q1 distortions reverse).

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Nerd's Eye View

JUNE 18, 2025

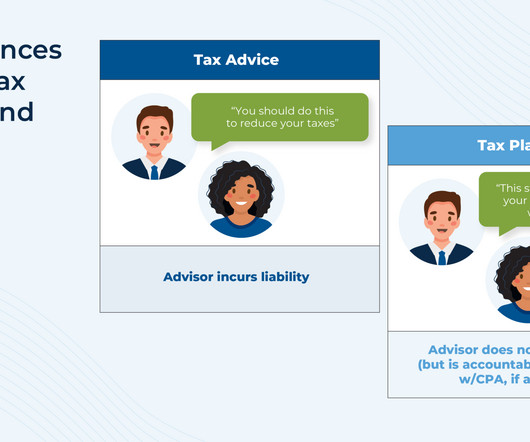

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. This shift reflects the reality that taxes permeate virtually every financial decision clients make – whether related to investing, retirement, business structure, or charitable giving – and often represent one of the largest expenses faced by clients over their lifetime.

Abnormal Returns

JUNE 18, 2025

Podcasts Chris Hutchins talks with Nick Maggiulli about his forthcoming book "The Wealth Ladder: Proven Strategies for Every Step of Your Financial Life." (chrishutchins.com) Jill Schlesinger talks with Barry Ritholtz about his new book "How Not To Invest: The ideas, numbers, and behaviors that destroy wealth - and how to avoid them." (ritholtz.com) Peter Lazaroff talks with Bob Pisani about lessons learned from his long career at CNBC.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Wealth Management

JUNE 17, 2025

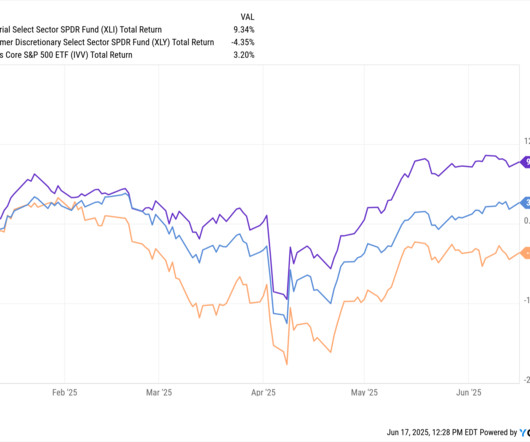

Third-party model portfolios had $646 billion in assets under management as of March 31—an increase of 62% since June 2023, according to Morningstar. While more than 60 asset managers have filed for dual-class share structures, many firms may never launch them, Ignites reports. These are among the investment must-reads we found this week for financial advisors.

Calculated Risk

JUNE 17, 2025

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 250 thousand, up from 248 thousand last week. • Also at 8:30 AM ET, Housing Starts for May.

Abnormal Returns

JUNE 23, 2025

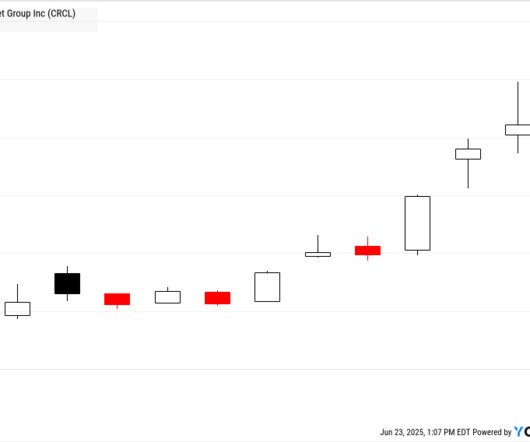

Strategy How geopolitical conflicts have played out for stocks. (optimisticallie.com) Just how volatile have the 2020s been for the stock market? (awealthofcommonsense.com) Don't mix politics and investing. (klementoninvesting.substack.com) Crypto Add ProCap Financial to the Bitcoin Treasury scene. (cnbc.com) If every major company issues their own stablecoin, chaos could ensue.

The Big Picture

JUNE 20, 2025

My end-of-week morning train beach reads: • Howard Marks on Tariffs: Repealing the Laws of Economics : Tariffs are, primarily, an effort to cause goods to be made domestically even when equivalent foreign goods are cheaper or better (or both). Governments can make that happen by erecting barriers that keep foreign goods out or make them more expensive.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Calculated Risk

JUNE 18, 2025

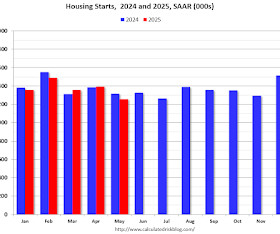

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts Decreased to 1.256 million Annual Rate in May A brief excerpt: Total housing starts in May were below expectations; however, starts in March and April were revised up, combined. The third graph shows the month-to-month comparison for total starts between 2024 (blue) and 2025 (red).

Nerd's Eye View

JUNE 23, 2025

Advisors have a relatively brief window of time to communicate their value to prospective clients. Many prospects ask friends and professionals for recommendations, browse a few firm websites, and typically interview only one or two advisors before deciding whom to hire. This means advisors must communicate both their services and values within a very limited – and not always synchronous – span of time.

Abnormal Returns

JUNE 18, 2025

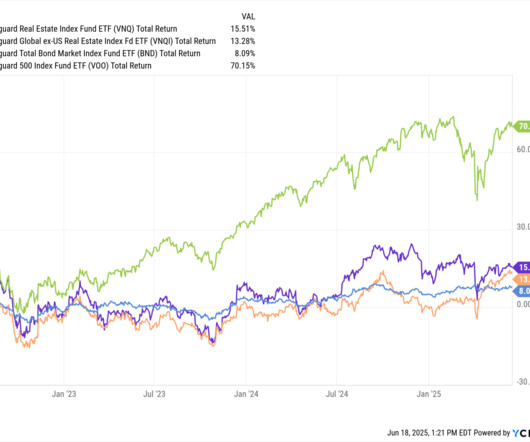

Markets The stock market doesn't care about you. (tonyisola.com) How long do dollar moves last? (larryswedroe.substack.com) Real estate REITs have struggled to keep up with the stock market. (morningstar.com) The supply of office space is set to actually contract in 2025. (wsj.com) Gold Why are central banks upping their holdings of gold? (mrzepczynski.blogspot.com) Individual Chinese investors love gold.

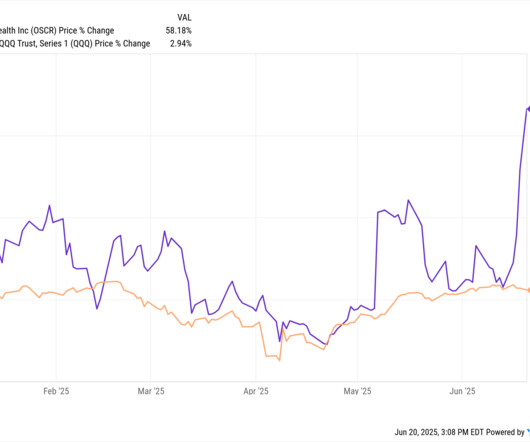

Trade Brains

JUNE 20, 2025

When seasoned investors put their money into a company, it often sparks curiosity—and for good reason. Consistent revenue growth over time is one of the clearest indicators of a company’s underlying strength. In this article, we have highlighted a few stocks backed by ace investors that have delivered an impressive 5-year revenue Compounded Annual Growth Rate (CAGR).

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Wealth Management

JUNE 20, 2025

F2 Strategy co-founder Doug Fritz offers a mini-masterclass on how the best advisory businesses utilize technology to create efficiencies and deliver a better client experience.

Calculated Risk

JUNE 23, 2025

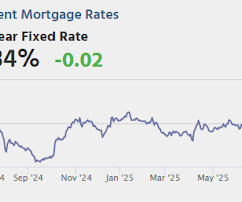

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lowest Since May 1st Mortgage rates ended the previous week roughly in line with the best levels since May 1st. Today's modest improvement made it official. Mortgage rates are primarily a function of trading levels in the bond market and bonds have had a few reasons to move at the start of the new week.

Nerd's Eye View

JUNE 17, 2025

Welcome everyone! Welcome to the 442nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is David Bahnsen. David is the founder of The Bahnsen Group, an RIA based in Newport Beach, California, that oversees approximately $7.5 billion in assets under management for 1,800 client households. What's unique about David, though, is how his firm has been able to attract $100 million in new client assets per month thanks in large part to his content creation and public comme

Abnormal Returns

JUNE 20, 2025

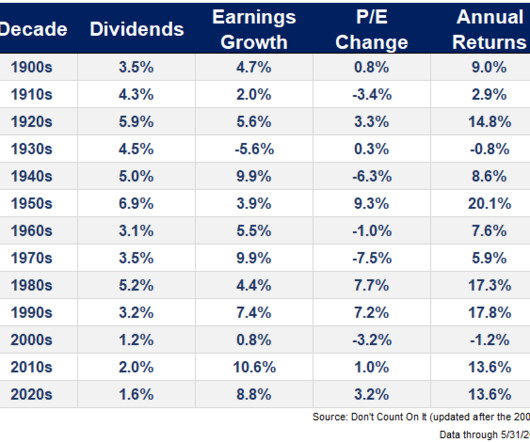

Markets Corporate bond spreads have come back down from their April peak. (mrzepczynski.blogspot.com) Silver prices are rising along with gold. (wsj.com) Strategy Good decade or bad for the stock market? Changes in valuation matter a lot. (awealthofcommonsense.com) What the consensus 60/40 portfolio looks like. (morningstar.com) Stablecoins Stablecoins are no longer niche.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Trade Brains

JUNE 20, 2025

A prominent financial services stock came under pressure on June 20, slipping nearly 9% amid heightened activity in the block deal window, triggering investor concerns over a potential large-scale stake offloading. With a market capitalisation of Rs 3,330 crore, shares of Northern Arc Capital Limited plunged nearly 9% on Friday, hitting an intraday low of Rs 195.55 compared to the previous close of Rs 214.50, amid heavy selling pressure in the block deal window.

Wealth Management

JUNE 18, 2025

Global financial advisors prioritize private equity and credit in alternative investments, but struggle with assessing liquidity and portfolio impact, survey finds.

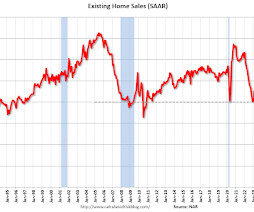

Calculated Risk

JUNE 21, 2025

The key reports this week are May New and Existing Home sales, the third estimate of Q1 GDP, Personal Income and Outlays for May and the April Case-Shiller house price index. For manufacturing, the June Richmond and Kansas City Fed manufacturing surveys will be released. Fed Chair Powell testifies on the Semiannual Monetary Policy Report to Congress. -- Monday, June 23rd -- 10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR).

A Wealth of Common Sense

JUNE 17, 2025

I was talking with a friend a few months ago about money. Let’s call him Daryl. Daryl and I were waxing philosophically about careers, incomes and the never-ending comparison battle that exists among friends and peers. He admitted to me that it wears on him constantly seeing other people’s big houses, big incomes, big vacations and big lives on display all the time.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

JUNE 22, 2025

Newsletters Make sure you stay on top of everything on Abnormal Returns. Sign up for our (free) daily e-mail newsletter. (abnormalreturns.com) Are you a financial advisor? Sign up for our (free) weekly advisor-focused newsletter. (newsletter.abnormalreturns.com) Top clicks this week How long do dollar moves last? (larryswedroe.substack.com) The stock market doesn't care about you.

Meb Faber Research

JUNE 20, 2025

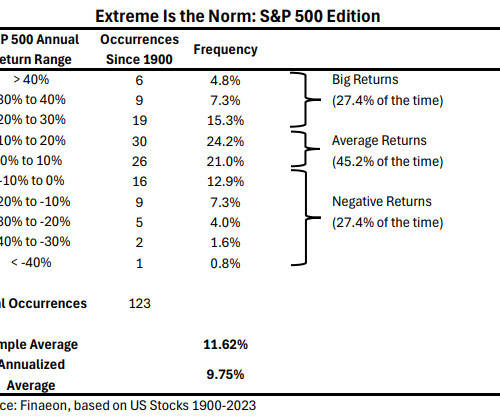

We’re starting a new series here that will eventually be a short paper, but thought we’d drip these articles out every week over the course of the summer… enjoy! #1 – Normal stock market returns are extreme Most investors understand that stocks return about 10% per year over time. However, many investors may not appreciate the […] The post 20 Things You May Not Know About Markets (or That Might Surprise You). #1 – Normal Stock Market Returns are Extreme appear

Wealth Management

JUNE 18, 2025

Andy Kalbaugh will lead The Wealth Consulting Group into its next phase of growth, which will include a new partners channel to help advisors with succession issues.

Calculated Risk

JUNE 18, 2025

Fed Chair Powell press conference video here or on YouTube here , starting at 2:30 PM ET. FOMC Statement: Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

A Wealth of Common Sense

JUNE 19, 2025

A reader asks: I was reading your post “3% Market Returns For The Next Decade” and it got me thinking about something you wrote about a few years ago — the John Bogle Expected Return Formula. I don’t remember how you were able to get the numbers to calculate the formula, but I’d love to see an update about what the formula says today.

Abnormal Returns

JUNE 17, 2025

Strategy You can't eliminate the noise, but you can manage around it. (ritholtz.com) Should you exclude Chinese stocks from your international allocation? (morningstar.com) History only tells us so much about investment returns. (whitecoatinvestor.com) Companies Advertising is a big (and growing) business for the delivery companies. (platformaeronaut.com) OpenAI and Microsoft ($MSFT) are beefing.

Trade Brains

JUNE 24, 2025

Sambhv Steel Tubes Limited is launching its Initial Public Offering (IPO) to raise capital. The IPO comprises a fresh issue of 5.37 crore shares totaling Rs. 440 crore and an offer for sale of 1.22 crore shares worth Rs. 100 crore. The total IPO size aggregates to Rs. 540 crore. The IPO opens on June 25, 2025, and closes on June 27, 2025. The shares will be listed on NSE and BSE on Wednesday, July 2, 2025.

Wealth Management

JUNE 18, 2025

Explore three mega-trends in private market investing, including big partnerships, semi-liquid structures and retirement plan integration.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content