Avoid the Unforced Investment Errors Even Billionaires Make

The Big Picture

APRIL 17, 2025

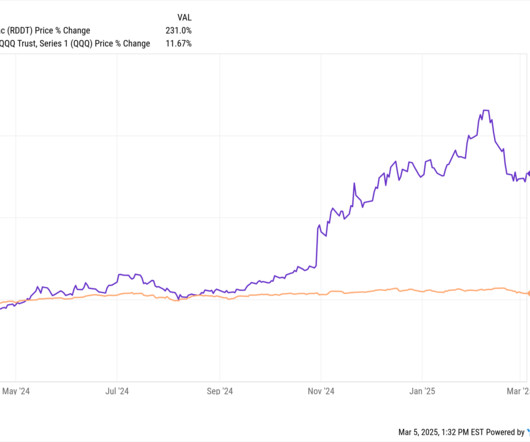

Two managers of a single-family office siphoned off so much money that each became a billionaire. Other than a handful of superstar managers (most of whose funds you cannot get into), the vast majority of these managers fail to justify their costs. Do you hang on every word whenever a famous fund manager shows up on TV?

Let's personalize your content