$570B Mutual Fund Manager Moves into ETF Space

Wealth Management

JUNE 21, 2024

Allspring Global Investments plans to start offering actively managed ETFs.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 21, 2024

Allspring Global Investments plans to start offering actively managed ETFs.

Wealth Management

OCTOBER 5, 2023

Protecting the average retiree in a confusing landscape of investment planning vs. financial planning.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

Nerd's Eye View

MARCH 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a report from Cerulli Associates found that, amidst an industry-wide trend towards comprehensive financial planning and away from pure transaction-based investment management, asset-based fees currently represent 72.4%

Wealth Management

MARCH 28, 2023

Among other changes, the association will add a wealth management specialization, with additional content on client management, investment planning and the duty of care.

Wealth Management

JUNE 11, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Brett Brodeski Savant Wealth Management WealthTech The Future of Wealth Management: Transformation and Innovation The Future of Wealth Management: (..)

Abnormal Returns

FEBRUARY 12, 2024

Podcasts Brendan Frazier talks with Sten Morgan, the founder of Legacy Investment Planning, about better communicating with clients. kitces.com) Daniel Crosby reads another chapter from his forthcoming book "The Soul of Money." (riabiz.com) Does Citigroup ($C) have a path forward in wealth management?

Nerd's Eye View

MARCH 4, 2025

Sten is the owner of Legacy Investment Planning, a hybrid advisory firm based in Franklin, Tennessee, that oversees $220 million in assets under management for 90 client households. Welcome to the 427th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sten Morgan.

Abnormal Returns

OCTOBER 29, 2024

theverge.com) How social media can wreck your investing plan. blogs.cfainstitute.org) Investment success is about small advantages compounded over time. morningstar.com) Fund management Does the world need a leveraged Berkshire Hathaway ($BRK.B) Strategy Another sign that gambling is being normalized.

Nerd's Eye View

APRIL 11, 2025

Also in industry news this week: NASAA this week approved model rule amendments that would restrict the use of the titles "advisor" and "adviser" by broker-dealers (and their registered representatives) who are not also dually registered as investment advisers, which, if adopted by state regulators, would largely bring state rules on this issue in (..)

Nerd's Eye View

JUNE 12, 2025

Tax planning often fits the 'kind environment' model: The rules are relatively stable, outcomes repeat annually, and feedback is immediate (e.g., Investment planning falls into this camp; a client who makes a risky bet and sees strong returns might conclude the strategy is sound, even if it was more luck than skill.

Nerd's Eye View

MAY 17, 2024

Altogether, the study suggests that social media engagement is driven more by the quality (and originality) of the advisor's content, rather than the quantity of posts. Read More.

Nerd's Eye View

SEPTEMBER 29, 2023

Also in industry news this week: After experiencing a downturn over the past few quarters, RIA M&A activity ticked higher in the 3rd quarter amid continued interest from sellers and increasing costs for internal succession A recent study shows that housing-related costs are more likely than healthcare spending to cause unexpected spending shocks (..)

Wealth Management

DECEMBER 14, 2022

New survey sheds light on spending and investing plans.

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

Nerd's Eye View

MARCH 8, 2024

Also in industry news this week: A recent survey has found that a majority of prospective financial planning clients across all age brackets are open to working with a remote advisor, creating opportunities for advisors to grow their businesses and for clients to find the ‘best’ advisor for their needs, regardless of their location A federal (..)

Nerd's Eye View

SEPTEMBER 23, 2022

A survey shows that more RIAs are outsourcing investment management, and that those who do are largely happy with the decision. From there, we have several articles on insurance and investment planning: Why the chair of the Senate Finance Committee has taken an interest in the private placement life insurance market.

Nerd's Eye View

JUNE 28, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent study found that at a time when the number of SEC-registered broker-dealers and their registered representatives is declining, the number of SEC-registered RIAs, their assets under management, and the number of (..)

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Yardley Wealth Management

FEBRUARY 4, 2025

The post Tax Strategies for High-Income Earners 2025 appeared first on Yardley Wealth Management, LLC. From maximizing deductions to managing capital gains, we’ll cover everything you need to know about smart tax planning. Tax Strategies for High-Income Earners in 2025.

Yardley Wealth Management

AUGUST 20, 2024

The post Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility appeared first on Yardley Wealth Management, LLC. Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility Introduction: Market volatility is a fact of life for investors.

WiserAdvisor

AUGUST 26, 2022

When it comes to money management, there are a lot of different schools of thought. If yes, then DIY financial planning might be a good option for you. On the other hand, if you tend to struggle with budgeting or find financial planning overwhelming, then professional money management could be a better solution.

WiserAdvisor

JUNE 13, 2025

Keeping it safe, growing it wisely, and using it to support your future takes careful planning. Wealth management isn’t only for the ultra-rich. Yet even the best financial plans can stumble. To protect your wealth, it helps to create a clear investment plan. Earning money is just the beginning.

Brown Advisory

OCTOBER 16, 2017

Investment Planning Options achen Mon, 10/16/2017 - 10:24 The decision to sell or hold a concentrated position may sound simple, but these situations are often more complex than they appear. They require the investor to reconcile investment dynamics, tax considerations and a variety of subjective, emotional factors.

Brown Advisory

OCTOBER 16, 2017

Investment Planning Options. They require the investor to reconcile investment dynamics, tax considerations and a variety of subjective, emotional factors. However, there is no single correct answer for how to manage these positions—it all depends on the client’s situation and goals. . . Mon, 10/16/2017 - 10:24.

Clever Girl Finance

JANUARY 22, 2024

10 steps to manage a financial windfall Expert tip: Keep living your life normally Factoring in taxes How do you deal with sudden financial windfall? Articles related to being wise with money Manage your large sum of money smartly! The key to success is to approach them with a clear plan. Manage your large sum of money smartly!

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. Zack is also skilled in presenting, emceeing, event planning, program management, and social media.

Dear Mr. Market

DECEMBER 31, 2024

Remember: investing isnt about timing the market, its about time in the market. Prioritize high-interest debt first (were looking at you, credit cards) while maintaining manageable payments on lower-interest loans like mortgages. Tackle Debt Strategically Not all debt is created equal. Consolidation might be a smart move too.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Trade Brains

JUNE 13, 2025

May 2025 marked a significant milestone in the country’s investing journey, as Systematic Investment Plans (SIPs) continued their record-breaking streak. What used to be a tool for the financially savvy urban elite has now become India’s favorite way to invest. lakh crore in May, up from ₹13.89 lakh crore in April.

WiserAdvisor

MAY 29, 2025

Automatic investment plans : One of the easiest ways to stay consistent is to set up automatic transfers from your bank account to your investment account, ensuring youre always saving first. Automation removes the temptation to skip or delay investing and turns it into a disciplined habit.

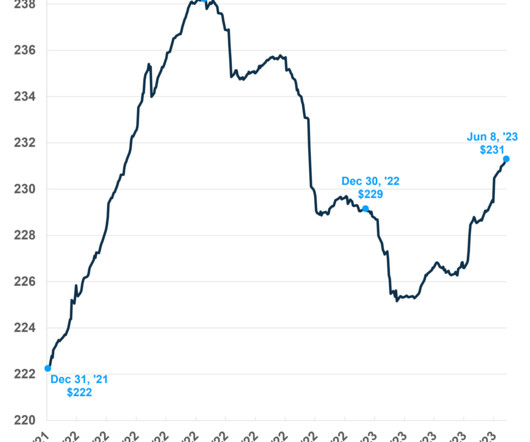

Abnormal Returns

JUNE 9, 2023

Strategy Periodic rebalancing is a part of any comprehensive investment plan. awealthofcommonsense.com) Thematic investing appeals to investors' worst instincts. semafor.com) Company managements just can't stop 'double-clicking' on things in conference calls. scheplick.com) Five mistakes to avoid in your pitch deck.

Nerd's Eye View

MAY 21, 2024

Dann is a Managing Partner of Sincerus Advisory, an RIA based in New York City, that oversees approximately $165 million in assets under management for nearly 150 client households. Welcome to the 386th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Dann Ryan.

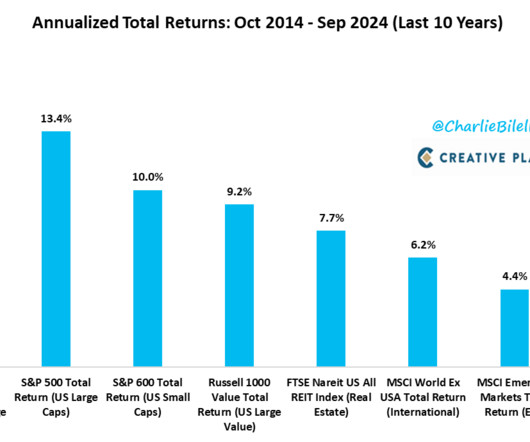

Financial Symmetry

SEPTEMBER 18, 2023

Investing is simple but not easy. To that end, what are the impacts if you do a poor job managing your investments? The numbers … Continued The post The Benefits of a Wealth Management Relationship – Part 2, Ep #199 appeared first on Financial Symmetry, Inc.

Darrow Wealth Management

AUGUST 30, 2022

As you consider what approach is right for your situation, consider these options for managing a large inheritance. Developing an asset allocation and investment plan that suits you , which may be different than who left you the inheritance. appeared first on Darrow Wealth Management. What to do with an inheritance.

Brown Advisory

SEPTEMBER 29, 2020

Endowment and Foundation Challenges: Managing Charitable Gift Annuities ajackson Tue, 09/29/2020 - 14:00 The charitable gift annuity is one of a number of donor-friendly solutions that nonprofit institutions can offer to donors. However, the management of underlying assets in a gift annuity pool is a different matter.

Brown Advisory

SEPTEMBER 29, 2020

Endowment and Foundation Challenges: Managing Charitable Gift Annuities. Because the CGA is a contract, and not an investment vehicle, nonprofits have flexibility in how they plan to fulfill their contractual CGA payment obligations over the long term. CHOOSING THE RIGHT INVESTMENT APPROACH. Tue, 09/29/2020 - 14:00.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. Here will discuss why CFP professionals are the first choice for millions of people worldwide regarding managing their finances. CFP services can help you grow your wealth and strengthen your investment strategies.

International College of Financial Planning

MAY 20, 2024

Opting for a job oriented course after graduation in wealth management can be particularly advantageous, offering a direct route into a vibrant and lucrative financial sector. Course Curriculum: The curriculum should be comprehensive, covering essential topics in demand in wealth management.

Trade Brains

JULY 4, 2024

Nuvama Wealth Management: Forget glowing wealth advisors and generic investment plans. In the hushed chambers of Nuvama Wealth Management Ltd, a different kind of wealth management unfolds. Nuvama are more than just asset managers. They’re the alchemists who transform vast wealth into strategic investments.

MarketWatch

APRIL 3, 2023

Canadian wealth and asset manager IGM Financial Inc. financial services advisory firm Rockefeller Capital Management for roughly $622 million — a move intended to expand into the U.S. IGM also said that it agreed to sell Investment Planning Counsel to the The Canada Life Assurance Co. stake in U.S.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content