Introducing Advanced Life Insurance Case Designs in Times of Uncertainty

Wealth Management

MAY 14, 2025

Advanced life insurance case designs address the what-ifs to protect clients.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Insurance Related Topics

Insurance Related Topics

Wealth Management

MAY 14, 2025

Advanced life insurance case designs address the what-ifs to protect clients.

Calculated Risk

MARCH 5, 2025

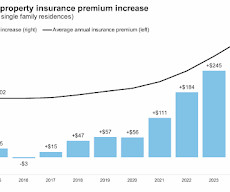

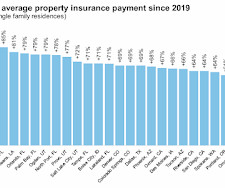

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Property Insurance Costs Rose at a Record Rate in 2024 Brief excerpt: Property Insurance Premiums Increased Sharply in 2024 Here is a chart from the Mortgage Monitor. These increases are largely being driven by losses due to natural disasters.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 16, 2024

The principles of life insurance policies aren’t that complicated.

Wealth Management

JUNE 20, 2023

Integrated is launching the new insurance business largely due to recent changes in tax and estate planning regulations. Peter Kaplan, a former First American Insurance Underwriters vice president, will lead it.

Wealth Management

JUNE 13, 2024

According to data from insurance brokerage firm Golsan Scruggs, premiums have dropped by about half over the past year.

Calculated Risk

OCTOBER 7, 2024

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Insurance Costs "Spike", Especially in Florida Brief excerpt: The largest insurance increases are in Florida (for obvious reasons - stay safe this week with Hurricane Milton).

Wealth Management

APRIL 4, 2024

The RIA platform partnered with Griffin Distribution to offer annuities, life, disability and long-term care insurance.

Wealth Management

SEPTEMBER 26, 2023

Life events or job changes can be a great client touchpoint around the need for review of client health insurance.

Wealth Management

APRIL 25, 2025

Howard Sharfman, Senior Managing Director at NFP Insurance Solutions joins Ryan Nauman to cover the different roles insurance can play in creating a comprehensive financial plan, the correct tax treatment of life insurance, the integration of annuities into investment portfolios and the overall impact of insurance products on financial security.

Wealth Management

JANUARY 8, 2025

Tactical refinements for a more productive year for life insurance agents and financial advisors.

Wealth Management

NOVEMBER 14, 2024

Morgan Christiansen, VP of Distribution at The Pinnacle Group, explores the evolving role of insurance in financial planning at Nitrogen's 2024 Fearless Investing Summit.

NAIFA Advisor Today

MAY 1, 2025

May is Disability Insurance Awareness Month (DIAM), an important time to highlight the critical role disability insurance plays in protecting the financial well-being of American workers and their families. NAIFA is committed to raising awareness and educating about necessity and value of disability insurance.

Wealth Management

JANUARY 3, 2024

Should company-owned life insurance used to redeem stock be included in valuing a decedent’s ownership interest?

Wealth Management

JANUARY 5, 2024

Several insurers are ramping up their participation in net asset value financing, an increasingly popular form of borrowing for private equity funds that need liquidity amid a tough market for cashing out holdings.

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Wealth Management

FEBRUARY 21, 2023

Demand for long term care is growing and advisors can differentiate themselves and deepen client relationships through modern approaches to long term care planning.

Wealth Management

JUNE 10, 2024

Corporation redemption obligation isn’t a liability that reduces the value of the decedent’s shares

Wealth Management

MARCH 18, 2025

How an agent should present the coverage choices to clients.

Wealth Management

OCTOBER 31, 2024

Meant for non-licensed advisors, the new platform generates carrier-agnostic quotes and provides a digital application process.

Abnormal Returns

OCTOBER 28, 2024

kitces.com) How long-term care insurance went away. (advisorperspectives.com) Advisers A plan for onboarding client service associates. kitces.com) Tax-loss harvesting is going long-short. bloomberg.com) How should consumers think about the cost of an adviser? barrons.com) We all make mistakes, including advisers. signaturefd-3437664.hs-sites.com)

Wealth Management

SEPTEMBER 11, 2024

With the election looming, it’s time to reach out to clients and start talking about the implications of sunset.

Wealth Management

DECEMBER 4, 2024

This time, it’s a different kind of conversation.

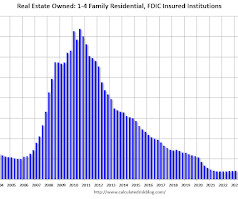

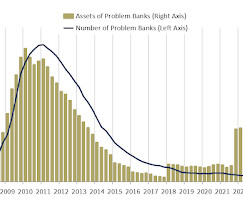

Calculated Risk

MARCH 14, 2025

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions based on the Q4 FDIC Quarterly Banking Profile released this week. Note: The FDIC reports the dollar value and not the total number of REOs.

Wealth Management

NOVEMBER 20, 2024

A sensible move for both the firm and its clients?

Wealth Management

APRIL 10, 2024

Estate planners should have a role in the overall risk management aspect of a client’s planning.

Wealth Management

SEPTEMBER 8, 2023

The Jack Ma-backed fintech company will use its financial large language model to power two applications known as Zhixiaobao, which answers questions for customers, and Zhixiaozhu, an assistant for financial professionals.

NAIFA Advisor Today

DECEMBER 6, 2024

After earning a finance degree from Ball State University in Muncie, Indiana, Tyler Engelhaupt entered the insurance industry, initially seeking a case manager role with a focus on financial advising. Instead, he found himself in a sales position at Ash, where his career quickly flourished.

Wealth Management

NOVEMBER 6, 2024

A matter of critical importance to the merely well-to-do.

Wealth Management

MARCH 17, 2025

Tips on how to make posts on social media more effective in todays unsettled climate.

Wealth Management

NOVEMBER 11, 2024

Agents need to get clients’ advisors involved. Here’s how.

Wealth Management

NOVEMBER 19, 2024

Alter discusses the impact of the U.S. Supreme Court’s recent decision.

Wealth Management

SEPTEMBER 7, 2023

Also, GMO’s Nebo passes $1B in platform assets a year after launching, Finology Software’s website is now live and Focus Financial Partners is UPTIQ’s newest client.

NAIFA Advisor Today

MAY 13, 2025

He leads life insurance distribution strategies, focusing on expanding agent partnerships and enhancing customer experiences. Focusing on empowering independent financial professionals, he assists advisors in integrating life insurance into their practices as a vital component of comprehensive financial planning.

Wealth Management

NOVEMBER 19, 2024

Kaival Patel was previously convicted of charges stemming from a plan to collect commissions on falsely prescribed compound medications, according to the Justice Department.

Wealth Management

MARCH 20, 2024

Supporters and critics of the proposed rule are setting up discussions with the Office of Management and Budget, one of the last steps before the final rule will be revealed.

NAIFA Advisor Today

NOVEMBER 12, 2024

A recent study supported by the American Council of Life Insurers (ACLI), and conducted by economists Mark Warshawsky and Gaobo Pang, reveals that retirees could see better financial outcomes by incorporating annuities into their retirement income strategy, rather than relying solely on the traditional “4% rule.”

Wealth Management

MAY 28, 2024

The American Council of Life Insurers, the Insured Retirement Institute and Finseca are among the plaintiffs in the newest suit against the Labor Department’s rule. This is the second suit filed against the rule in Texas this month.

Wealth Management

MARCH 18, 2025

A life settlement may be an overlooked option.

Calculated Risk

FEBRUARY 28, 2023

The FDIC released the Quarterly Banking Profile for Q4 2022: Reports from 4,706 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $68.4 The number of FDIC-insured institutions declined from 4,746 in third quarter to 4,706 this quarter.

Wealth Management

JUNE 10, 2024

Former Fidelity Investments Life Insurance Company President Jerry Patterson will lead Cetera’s retirement, insurance and annuities segment.

Wealth Management

FEBRUARY 14, 2024

FP Alpha is transforming financial planning with AI-driven automation and scenario modeling, making advanced planning accessible and efficient for advisors and their clients.

Calculated Risk

JANUARY 15, 2025

Input costs also rose, with contacts highlighting higher insurance prices, particularly for health insurance. Contacts in most Districts reported modest increases in selling prices, though there were instances of flat or decreasing prices as well, particularly in the retail and manufacturing sectors. emphasis added

Nerd's Eye View

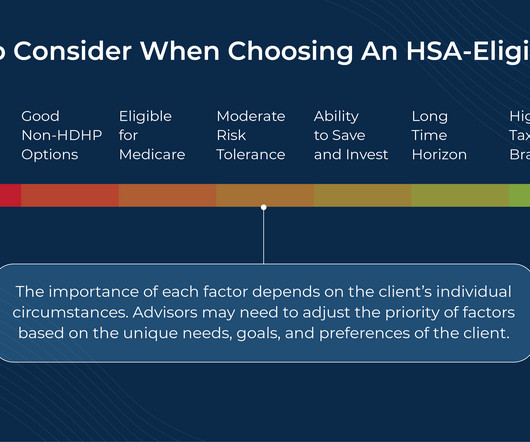

FEBRUARY 5, 2025

However, HSAs require individuals to be covered by a High Deductible Health Plan (HDHP), which has tradeoffs compared to traditional health insurance plans.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content