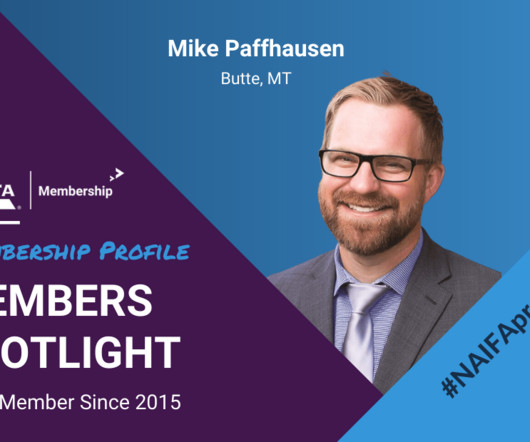

Mike Paffhausen's Journey From Civil Engineer to Financial Leader

NAIFA Advisor Today

APRIL 4, 2024

His transition into the insurance sector was largely influenced by his desire to help others navigate their financial lives, a passion ignited by a book on financial literacy he received upon graduating from Carroll College.

Let's personalize your content