The WealthStack Podcast: Strengthening Financial Futures With Healthcare Planning

Wealth Management

JULY 12, 2024

Caribou's Christine Simone details how healthcare planning can differentiate advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 12, 2024

Caribou's Christine Simone details how healthcare planning can differentiate advisors.

Nerd's Eye View

FEBRUARY 5, 2025

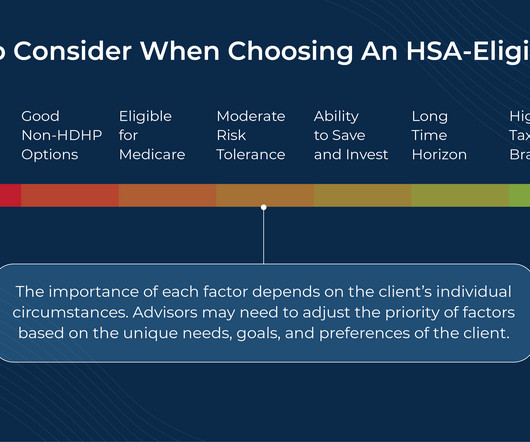

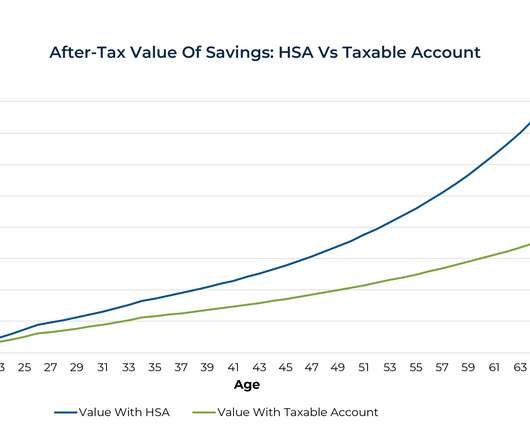

However, HSAs require individuals to be covered by a High Deductible Health Plan (HDHP), which has tradeoffs compared to traditional health insurance plans. While HDHPs are often expected to come with higher deductibles than traditional plans, these deductibles may be higher than they appear.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

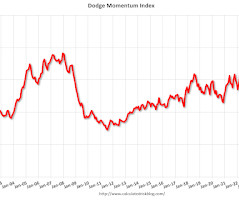

Calculated Risk

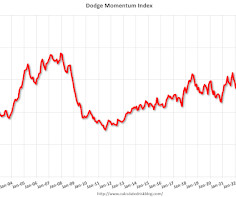

APRIL 8, 2025

Over the month, commercial planning declined 7.8% while institutional planning fell 5.0%. Increased uncertainty around material prices and fiscal policies may have begun to factor into planning decisions throughout March , stated Sarah Martin, associate director of forecasting at Dodge Construction Network.

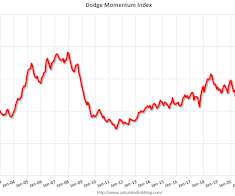

Calculated Risk

MAY 7, 2025

Over the month, commercial planning grew 3.3% while institutional planning fell 4.2%. Despite an uptick in April, the bulk of the DMIs growth was driven by a surge in data center planning, while momentum in other nonresidential sectors lagged behind , stated Sarah Martin, associate director of forecasting at Dodge Construction Network.

A Wealth of Common Sense

APRIL 27, 2025

The big ideas from the book revolve around the fact that there’s too much red tape when it comes to things like housing, energy, healthcare and technology development. I liked Abundance by Derek Thompson and Ezra Klein because the theme of the book is about doing stuff rather than scarcity. But there.

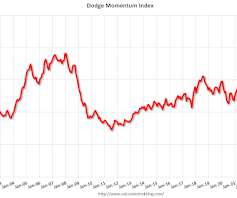

Calculated Risk

AUGUST 8, 2024

Over the month, commercial planning increased 6.8% and institutional planning expanded 11.1%. This is likely driving owners and developers to remain optimistic about 2025 market conditions and pushing more projects into the planning queue.” On the institutional side, healthcare was the primary driver of this month’s expansion.

Calculated Risk

AUGUST 9, 2022

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning. Commercial planning in July was led by an increase in data center, office and warehouse projects, while fewer education and healthcare projects drove the institutional component lower.

Calculated Risk

DECEMBER 9, 2022

Commercial planning experienced a healthy increase in hotel and data center projects and modest growth in stores and office projects. On a year-over-year basis, the DMI was 25% higher than in November 2021, the commercial component was up 28%, and institutional planning was 21% higher. emphasis added Click on graph for larger image.

The Chicago Financial Planner

OCTOBER 21, 2021

Increasing healthcare costs and longer life expectancies make the hill a bit steeper to climb each year. Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. The rising cost of healthcare in retirement . How the HSA works . Click To Tweet.

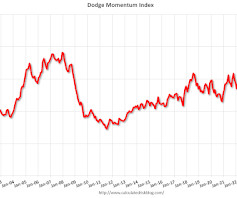

Calculated Risk

SEPTEMBER 10, 2024

Over the month, commercial planning expanded 1.9% and institutional planning improved 5.7%. Owners and developers continued to prime the planning queue in August, ahead of next year’s anticipated stronger market conditions,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. in August to 220.4

Nerd's Eye View

MAY 12, 2025

A common structure at many advisory firms is for the owner to handle most of the sales and prospecting, while employee advisors focus on delivering planning and analysis for existing clients. Once there's alignment on the niche, the next step is to support the advisor with a focused marketing plan.

Calculated Risk

JANUARY 9, 2023

“While some of that will likely erode in 2023 as economic growth wanes, increased demand for some building types like data centers, labs, and healthcare buildings will provide a solid floor for the construction sector.” Commercial planning in December was supported by broad-based increases across office, warehouse, retail and hotel planning.

Calculated Risk

NOVEMBER 8, 2022

Commercial planning was bolstered by a solid increase in office and hotel projects. The institutional component was varied, experiencing growth in recreational and education projects, countered by a decline in the number of healthcare and public planning projects. emphasis added Click on graph for larger image.

Calculated Risk

JULY 10, 2024

Over the month, commercial planning increased 14.5% and institutional planning ticked up 0.2%. Data centers continued to dominate planning projects in June – fueling another strong month for commercial planning,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network.

Calculated Risk

SEPTEMBER 11, 2023

“Overall activity remains above historical norms, but weaker market fundamentals continue to undermine planning growth,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. Also, planning in the sector continues to revert from the strong spike in activity back in May.

Nerd's Eye View

NOVEMBER 9, 2022

The passage of the Affordable Care Act in 2014 introduced many changes to the healthcare landscape in the United States. One of these changes was the ability for children to remain on their parents’ health insurance plan until they reach age 26.

Nerd's Eye View

MAY 3, 2024

Also in industry news this week: Large asset managers offering hybrid digital-human advice services are eating into the market share of purely human advisors, signaling that a smaller firm's ability to offer a differentiated value proposition could be a key to success in the coming years A recent study indicates that tech-forward advisory firms not (..)

Integrity Financial Planning

MAY 30, 2023

Healthcare insurance is a crucial aspect of managing one’s health and finances. 1] Each type of plan has different benefits and costs, and it’s important to choose one that suits your needs. 1] Each type of plan has different benefits and costs, and it’s important to choose one that suits your needs.

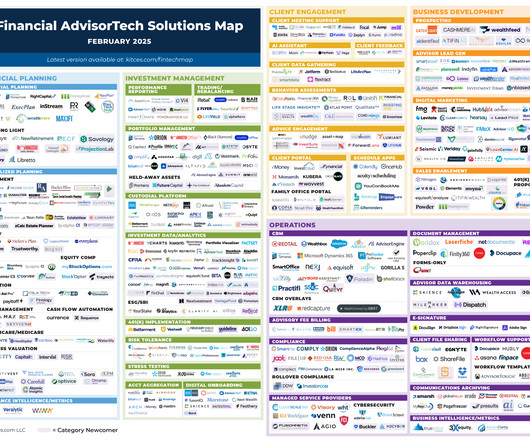

Nerd's Eye View

FEBRUARY 3, 2025

This month's edition kicks off with the news that FP Alpha has released its tax return extraction and analysis module as a standalone product, while RightCapital has separately launched its own tax return extraction tool bundled within its platform – with both announcements coming on the heels of Holistiplan implementing a significant price increase, (..)

Nerd's Eye View

JANUARY 8, 2024

These changes all have the potential to change the industry by shifting the current focus on selling financial products (including financial plans themselves) to providing a more in-depth and personalized experience that helps anticipate future issues in a client's life and better help them identify the goals that will help them thrive.

Calculated Risk

OCTOBER 10, 2022

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. On the commercial side, the figure was primarily bolstered by an influx of data centers entering the planning queue. The index was at 183.2

Calculated Risk

MARCH 7, 2023

Owners and developers tend to put projects into planning until well after economic conditions weaken. Commercial planning in February was bolstered by almost 20% growth in office planning activity, as data centers continued to steadily enter the planning queue. emphasis added Click on graph for larger image.

Calculated Risk

SEPTEMBER 9, 2022

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. In August, the commercial component of the Momentum Index rose 1%, while the institutional component fell 5.6%.

Calculated Risk

MAY 8, 2024

Over the month, commercial planning improved 12.6% and institutional planning dropped 6.3%. The Dodge Momentum Index (DMI) saw positive progress in April, alongside a deluge of data center projects that entered the planning stage ,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network.

Calculated Risk

MAY 9, 2023

From Dodge Data Analytics: Dodge Momentum Index Declines In April After Pullback In Commercial Planning The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 5.1% Commercial planning in April was pushed down by sluggish office, hotel and retail activity. in April to 180.9

Ballast Advisors

SEPTEMBER 15, 2023

For those nearing age 65, it’s essential to understand the paths in and around Medicare regarding your financial plan. As a full-service financial planning firm, Ballast Advisors works closely with seasoned professionals in many areas of personal financial planning , like health insurance. You have choices.

Trade Brains

OCTOBER 21, 2023

Blue Jet Healthcare IPO Review : Blue Jet Healthcare Limited is coming up with the IPO which is set to be listed on the NSE and BSE. This article will provide a comprehensive review of the IPO, including an in-depth analysis of the company’s financials and the strengths and weaknesses of Blue Jet Healthcare.

Calculated Risk

APRIL 10, 2023

Commercial planning in March was driven down by less projects in the office and warehouse sectors, decreasing 29% and 11%, respectively. Institutional planning weakened more substantially, as healthcare fell 17%, education dipped 6%, and amusement planning activity dropped 14%.

Nerd's Eye View

DECEMBER 13, 2024

Also in industry news this week: While the SEC has had the power to restrict mandatory arbitration clauses in RIA client agreements for more than a decade, an advisory committee meeting this week suggests support for such a measure isn't unanimous CFP Board saw a record number of exam-takers during 2024, reflecting recognition of the professional and (..)

Calculated Risk

JULY 11, 2023

From Dodge Data Analytics: Decline in Institutional Planning Drops Dodge Momentum Index Down 3% in June The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 2.5% Commercial planning in June remained afloat alongside an uptick in data center and hotel planning projects. in June to 197.3

Nerd's Eye View

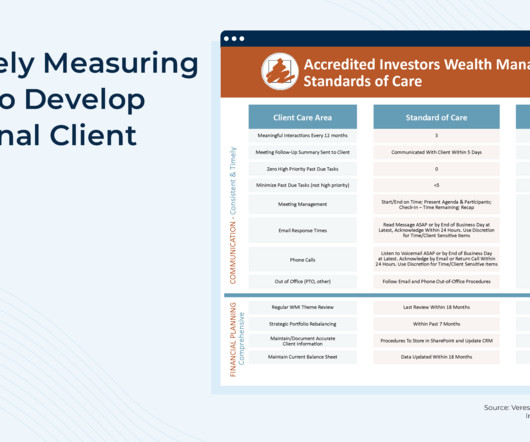

JULY 29, 2024

Ultimately, the key point is that striving for stellar client care is at the heart of many financial planning firms – and devising the right metrics that help a firm assess its areas of excellence and potential areas for growth can be instrumental in establishing a flourishing firm culture based on exceptional client service.

Nerd's Eye View

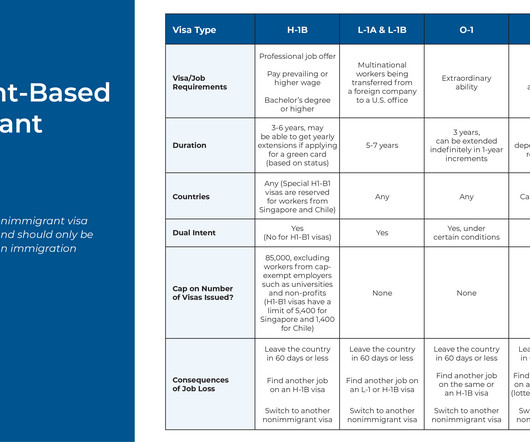

MAY 17, 2023

Like native-born workers, foreign workers need to think about saving for retirement, planning for their children’s college, managing healthcare costs, and all manner of other financial goals. on a work visa – maintaining enough flexibility to preserve their assets should those plans change.

Carson Wealth

SEPTEMBER 5, 2024

Navigating Medicare can be a daunting task, especially with the numerous plans and options available. However, choosing the right Medicare plan is crucial to ensure that you have the coverage you need as you move into retirement. Different plans cater to different needs. It runs annually from October 15th to December 7th.

Abnormal Returns

AUGUST 4, 2023

qsrmagazine.com) Do you really want to get your healthcare from Dollar General ($DG)? abnormalreturns.com) Make a plan for your stuff, before someone else has to. (theverge.com) Companies Netflix ($NFLX) changed how content is made. Hence the Hollywood strikes. theatlantic.com) Cold drinks make up some 75% of Starbucks ($SBUX) sales.

Nerd's Eye View

OCTOBER 20, 2023

Also in industry news this week: The latest update on the status of the Department of Labor's proposed regulation related to fiduciary advice on retirement accounts and why the agency is referring to it as a "retirement security rule" rather than a "fiduciary rule" A report suggests that RIA M&A surged in the 3rd quarter, as large acquirers resumed (..)

Nerd's Eye View

SEPTEMBER 29, 2023

Also in industry news this week: After experiencing a downturn over the past few quarters, RIA M&A activity ticked higher in the 3rd quarter amid continued interest from sellers and increasing costs for internal succession A recent study shows that housing-related costs are more likely than healthcare spending to cause unexpected spending shocks (..)

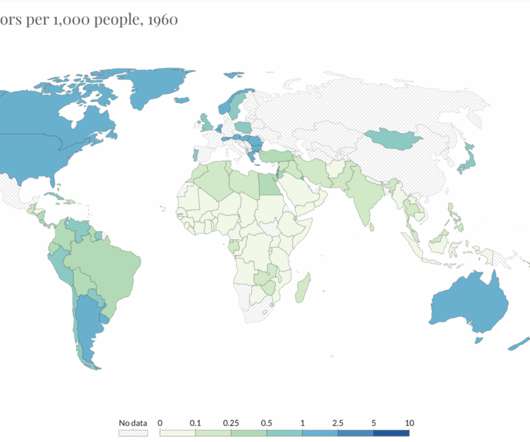

The Big Picture

OCTOBER 9, 2022

No surprise nobody talked about the bigger picture: Healthcare in the United States and why it is so expensive and so many people so underserved by the profession. The Planning of U.S. In 1960, the United States had more doctors per capita than any other country. What happened since then ?

Calculated Risk

NOVEMBER 7, 2023

Heightened momentum in warehouse planning activity supported the commercial side of the Index this month, while muted education planning activity slowed the institutional portion,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. Year over year, the DMI was 8% lower than in October 2022.

Harness Wealth

NOVEMBER 12, 2024

Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Checklist: Year-end Tax Planning Strategies Review the following tax strategies with your tax advisor and/or financial advisor before the end of the year. For 2024, the FSA contribution limit is $3,200.

Carson Wealth

OCTOBER 24, 2024

But moving to a new country involves significant financial planning. Healthcare Access to quality healthcare is another critical consideration. The availability and cost of healthcare can vary dramatically from country to country. However, if you plan on regularly accessing your U.S.

Integrity Financial Planning

OCTOBER 3, 2022

With market volatility and inflation affecting people’s finances, talk about investment strategies and portfolio longevity seems to dominate retirement planning conversations. But one of the most important aspects of retirement is often overlooked in these conversations: healthcare costs. But figuring that out is easier said than done.

Darrow Wealth Management

MARCH 31, 2023

There are many financial planning considerations before, during, and after a divorce. Here are some key considerations when financial planning for a divorce. Money and divorce This article solely focuses on some of the general financial planning aspects of divorce and is not personal legal, tax, accounting, or financial advice.

Nerd's Eye View

AUGUST 12, 2022

Also in industry news this week: FINRA has submitted a revised proposal to reform the process for broker-dealers to request expungement of client disputes from their public record, which allows state securities regulators to be informed of and involved in the arbitration hearings that decide whether the expungement is granted.

Advisor Perspectives

NOVEMBER 27, 2023

I'll share the impact healthcare costs have on financial plans, the critical healthcare information to include (such as medical tax deductions and IRMAA), how to budget for costs in a world of variables, and tangible strategies to implement during open enrollment and beyond to ensure clients are on the optimal coverage.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content