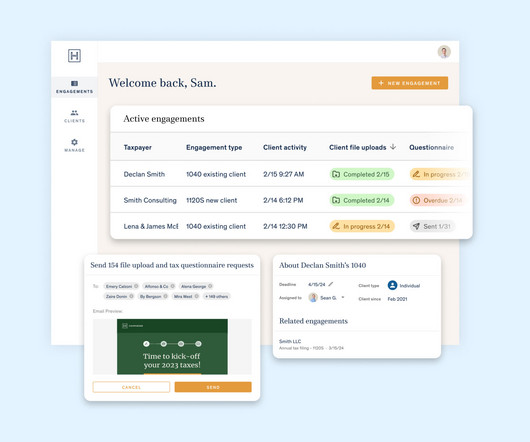

Harness Tools: Equity Tax Insights

Harness Wealth

MAY 31, 2022

Using Equity Tax Insights from Harness Wealth. Whether you’re making $50,000 or $5,000,000 of W-2 income, there are only so many actions you can take to dramatically change your tax burden. With company equity, the tax treatment of those profits can be radically different. Minimizing Regular Taxes.

Let's personalize your content