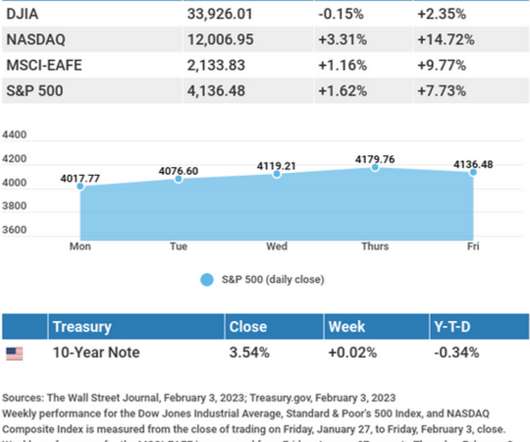

Weekly Market Insights – February 6, 2023

Cornerstone Financial Advisory

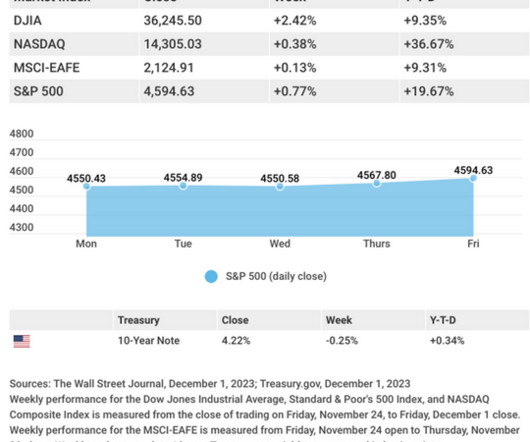

FEBRUARY 6, 2023

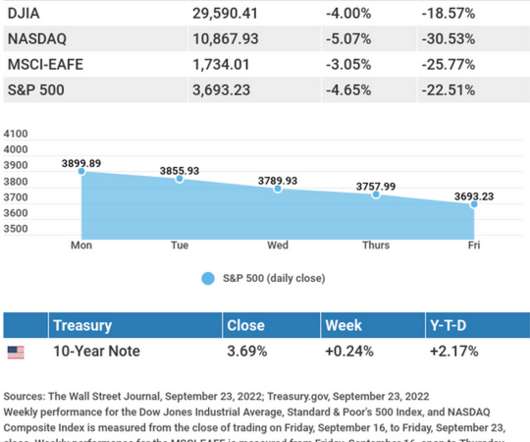

Another Rate Hike The Federal Reserve raised interest rates by 0.25%, signaling to the financial markets that it would likely hike rates by another 25 basis points at its next meeting in late March. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

Let's personalize your content