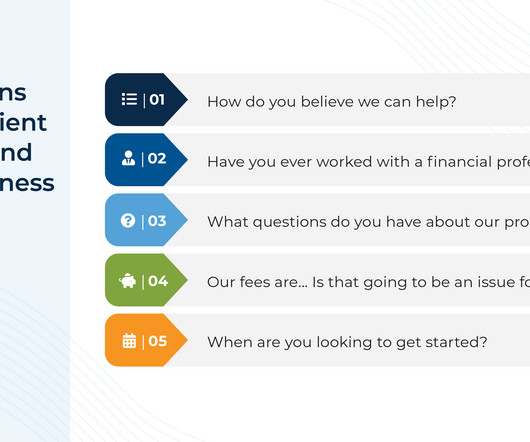

5 Screening Questions To Assess Client Readiness And Appropriateness (And Why It’s Especially Useful For Some Firms)

Nerd's Eye View

MAY 24, 2023

Screening calls are a common part of the prospecting process for financial advisory firms, particularly those that receive a large number of inquiries, and can help determine whether a prospective client might be a good fit. At the same time, these calls can be awkward for both the prospect and the advisor, as the prospect might be asked to discuss personal information about their finances with someone they have never met before, and the advisor has to ask potentially thorny questions, such as w

Let's personalize your content