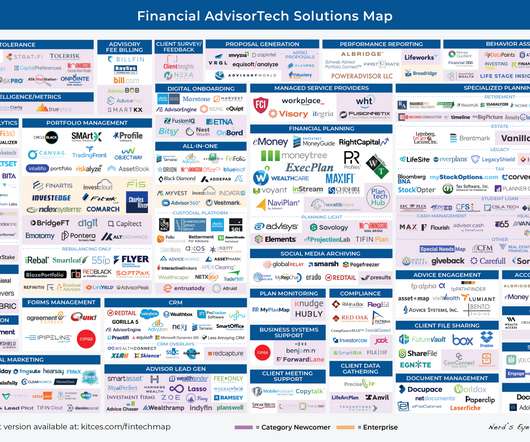

The Latest In Financial #AdvisorTech (January 2023)

Nerd's Eye View

JANUARY 2, 2023

Welcome to the January 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Envestnet has decided to enter the RIA custodial business through a partnership with Australian bank FNZ to white-label what was once the State Street RIA custodial platform of many years ago –

Let's personalize your content